Will markets print new all-time highs in 2024? We believe that the S&P 500 and the Nasdaq will print new all-time highs soon, followed by the Dow Jones. However, the Russell 2000 is lagging a lot. In fact, it is in the small cap space that the best opportunities will arise in the first months of 2024. We illustrate this with these 7 must-see charts.

Forget a 2024 market crash. New all-time highs are underway in leading indexes. Not only in stocks, but also metals will do well (new all-time highs in gold and maybe even silver).

2024 will be an intense year, characterized by mini-cycles and a few strong secular cycles, mark our words.

Evidently, if several markets have hit all-time highs, the probability of a strong pullback is high. That’s because the market has to shrug off bulls, if not how is it otherwise going to make money?

2024 will be an eventful year

In our 2024 forecasts we have predominantly bullish stance, certainly for markets and metals, for sure in the first months of 2024.

Based on cycle analysis, we believe that ‘sell in May of 2024 and get back after September of 2024‘ will apply. It might be in September, late September, or mid November, we are not clear on the details of the cycles in the latter part of 2024. But the first months, until May approximately, will be very rich and vivid, characterized by mini-cycles and momentum in both directions across sectors.

We also pointed out that August of 2024 might come with volatility (maybe even sooner). We asked the question whether the widely expected recession will finally hit markets in 2024. The answers:

- Short answer: The recession is almost over. It was a rolling recession which is why sector rotation was so unusually intense in recent years.

- Longer answer: We are going to be blunt – we are not afraid of the market nor the economy, we are concerned about tunnel vision of policy makers at the Fed and ECB. We have no trust in their work, simply because their decisions are lagging. Their decisions are lagging because the data sets they use and their way of working/thinking/operating is lagging.

- Longest answer: please read the article mentioned above.

That said, we believe that we will first see some really good price action. There will be plenty of evidence of a potential turning point somewhere around summer of 2024.

New all-time highs for markets in 2024

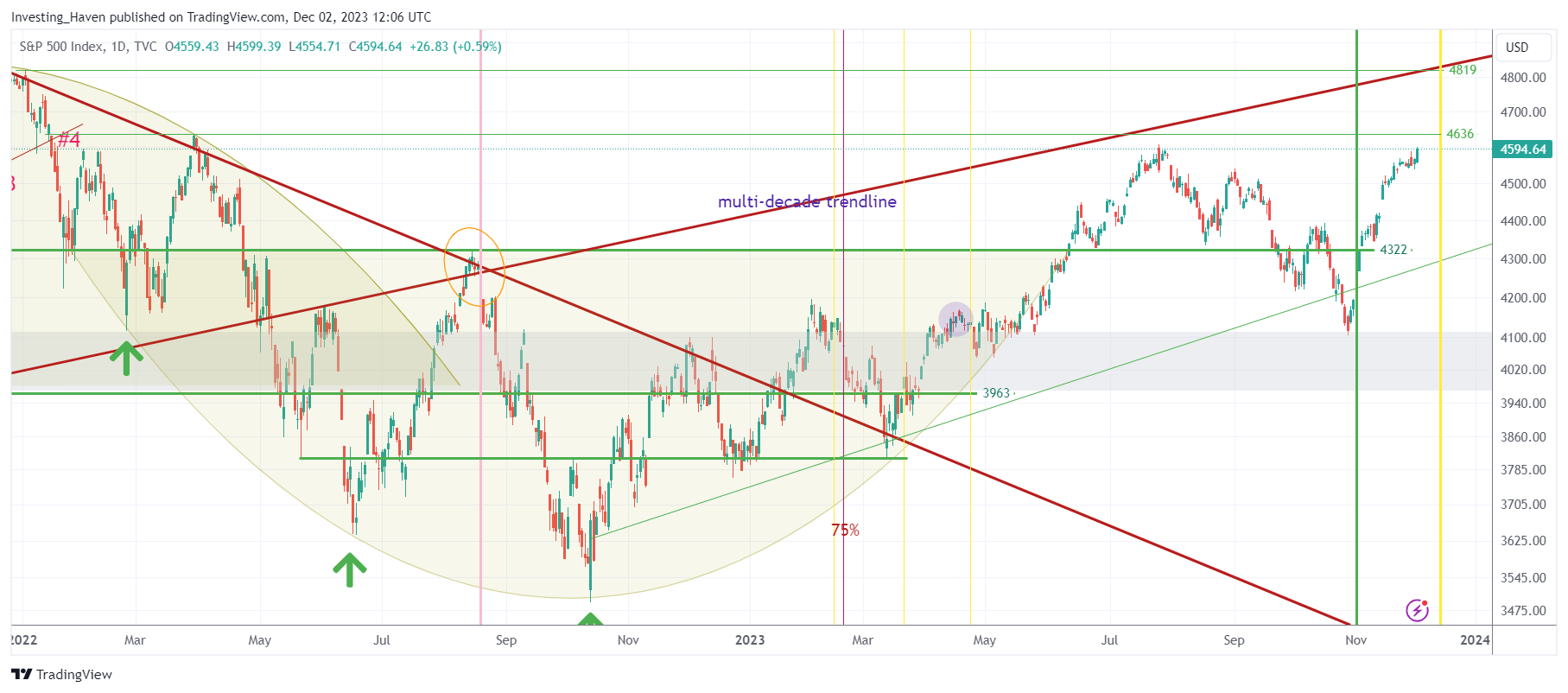

First of all, we clearly can see how the S&P 500 (SPX) is pointing to new all-time highs.

Will markets print new all-time highs in 2024? Yes, says the S&P 500.

In chart terms, note that the multi-decade trendline is rising and will cross levels that coincide with all-time high levels in Q1/2024. If the market will be hitting that multi-decade trendline in Q1 or Q2 of 2024, we will know it will be resistance (turning point).

For now, higher for longer.

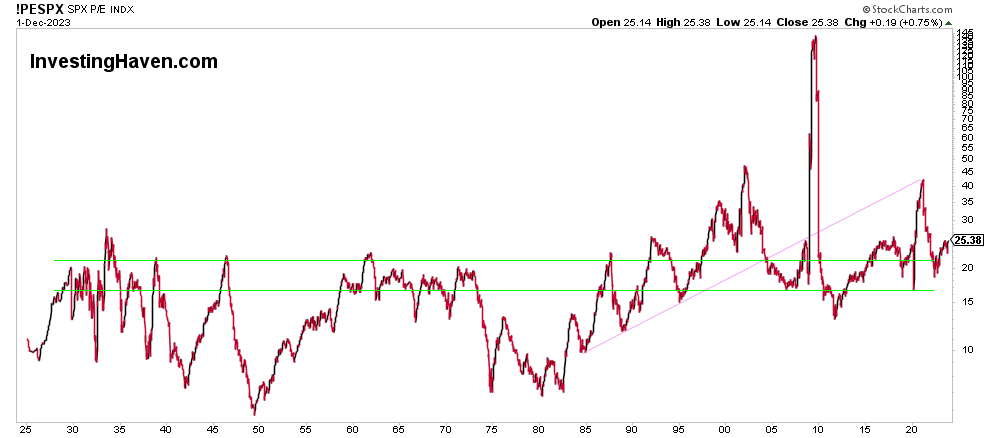

In historical terms, we see that the P/E ratio of the S&P 500 has bounced from the 18 points area. It is on the rise again, great news for stock market investors. In the last 3 decades there have been several periods in which the P/E ratio has moved for a longer period of time above the critical level of 20 points.

This chart confirms that markets will print new all-time highs in 2024.

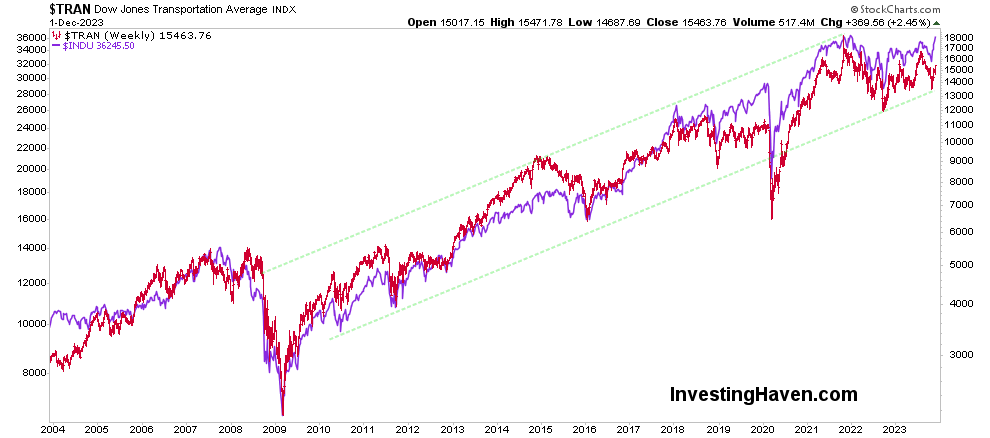

Even the Dow Theory is confirming that the market will print new all-time highs in 2024.

Broader participation as the market moves to all-time highs in 2024

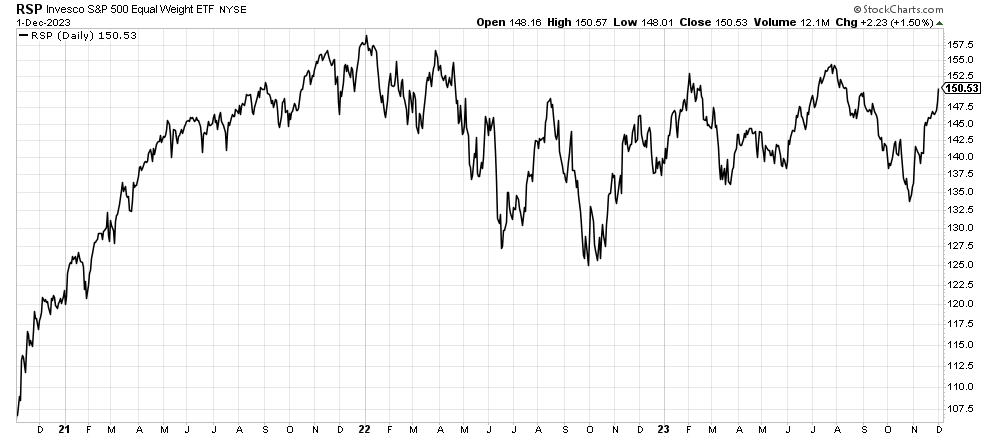

One chart we really like a lot is the equal weight version of the S&P 500. This is representative of a broader set of stocks, beyond the top 7 (think Apple, Microsoft, Tesla, Nvidia, Meta).

As seen, a wide and wild reversal in the equal weight version of the S&P 500 is nearly complete. This structure is bullish, with a series of higher lows, and a wide period in which this consolidation is occurring (the longer, the better).

Broad participation is a recipe for sustained success in markets. Will markets print new all-time highs in 2024? The answer is more confidently YES if there is a broader participation.

Value stocks are getting hot again in 2024

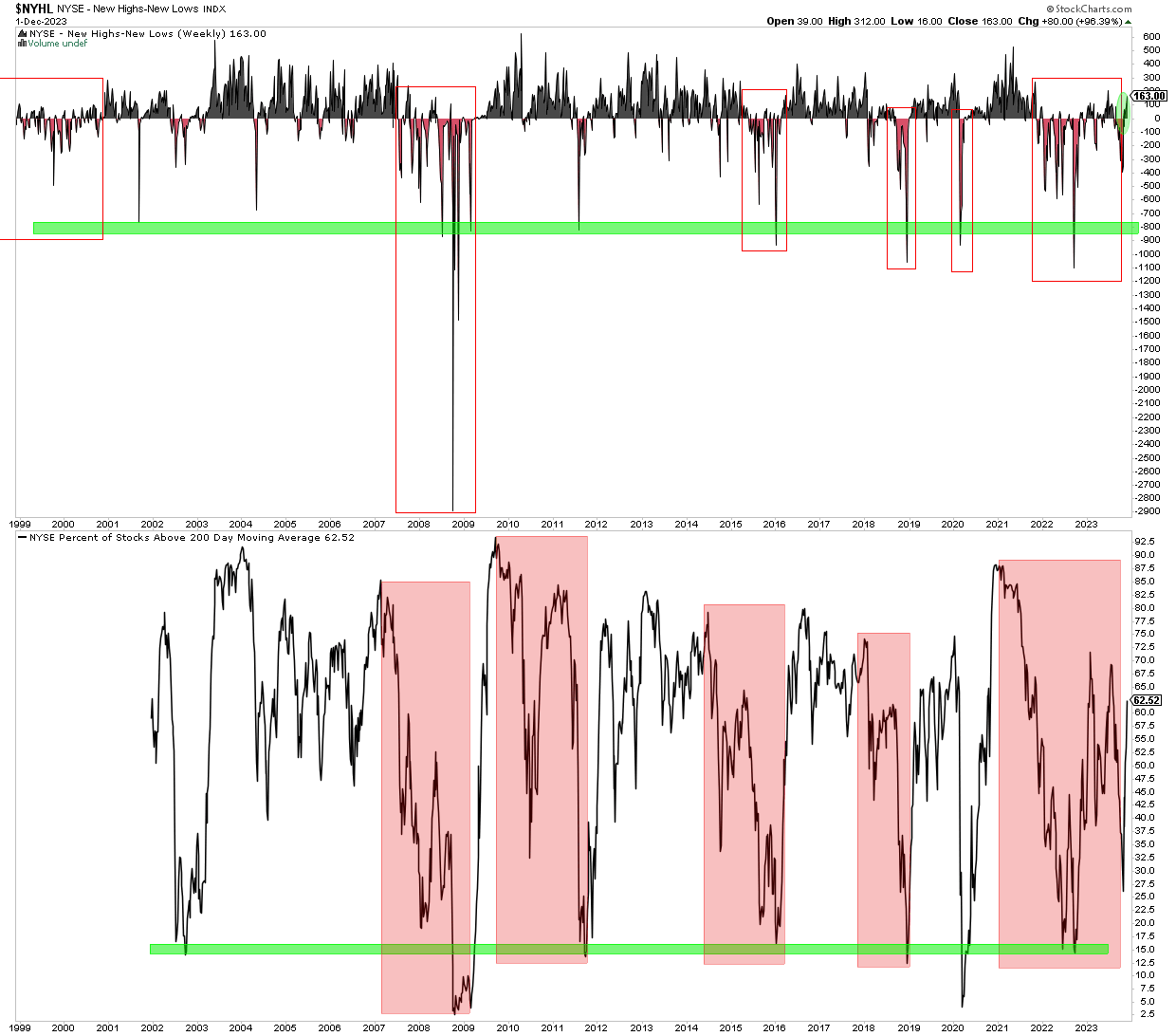

The NYSE index, representing value stocks, is hot again. More importantly, market breadth is significantly improving in the NYSE.

Market breadth must improve in order for the market to reach all-time highs, and stay there for a considerable amount of time (say months to quarters). As per the chart shown below, stocks trading on the NYSE reaching new highs minus new lows, as seen in the upper pane, breadth is improving significantly.

The lower pane of the chart shows NYSE stocks trading above their 200day moving average. This metric shows improvement as well. Great!

Will markets print new all-time highs in 2024? We can confidently say that the probability is very high as breadth is improving in the NYSE Composite index, an index representative of ‘the average stock’ especially in the ‘value’ segment.

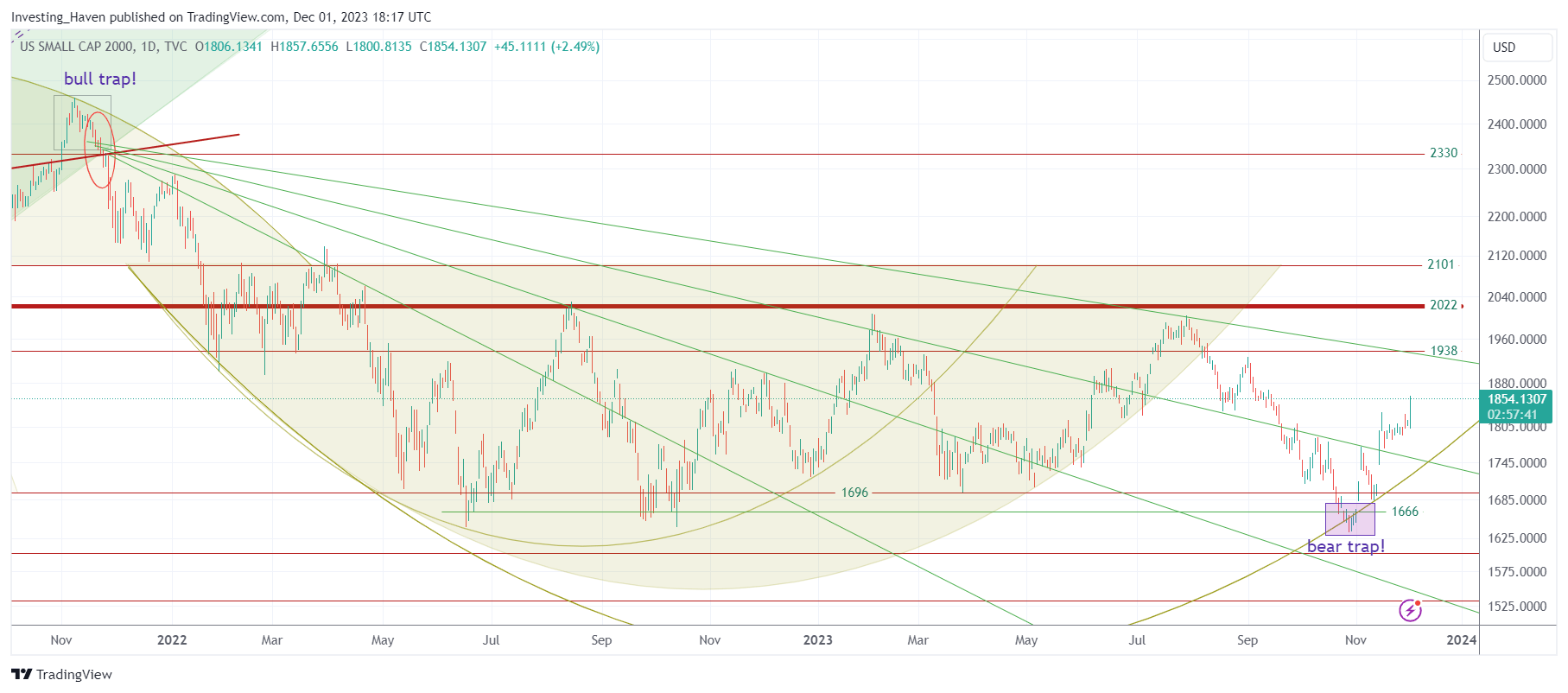

Small caps, as laggards, might be the outliers in 2024

Small caps, as per the Russell 2000, have been lagging. In fact, they are more than 20% below all-time highs while the S&P 500 is only some 5% removed from its former highs.

In a way, it is clear that the Russell 2000 has the best opportunities. We have selected one of the top 10 stocks in the Russell 2000 as a stock that has a high probability to move 50% higher in 2024, it is a position in in our Momentum Investing portfolio.