META stock has been on a continuous rise since November 2022 and has appreciated about +280% in price.

This year, META has seen +180% gains, which makes this year the best performance year for Meta Stock.

Until now, 2013, with +105% gains, has been the best year for this stock, which triggered a surge after Facebook’s IPO.

This year’s performance has been impressive after experiencing a decline of over -76% last year.

Furthermore, the company’s market cap has even reached above +900 Billion this December.

Facebook $META is back over a $900 Billion market cap pic.twitter.com/2b8eVI3mhC

— Evan (@StockMKTNewz) December 20, 2023

This turnaround is attributed to the confidence of CEO Mark Zuckerberg, who, in February, provided a Meta stock forecast and price prediction by way of declaring their business direction.

He declared that this year would be the year of efficiency for META stock.

META Stock Analysis: Successes, Challenges, and Future Outlook

The main reason behind this excellent price appreciation was the hefty cost cuts and around 20,000 job cuts. Furthermore, the shift of focus to advertisement and huge investments in Metaverse helped META stock surge this year.

Challenges, however, persist for META stock’s continued upward momentum.

The potential impact of the Israel-Hamas war looms large, exerting pressure on the digital ad market.

Moreover, the escalating competition resulting from Apple’s recent strategies, which played a pivotal role in undermining Facebook’s advertising business last year, poses an additional threat that needs attention.

The recent investment from Meta in Artificial Intelligence within the digital market section has proven to be efficient.

This is evident from the improved performance of the company as highlighted in the last quarterly report. It means Meta is on the right track for addressing the threats its competitors pose.

At Meta, AI has long been at the heart of our technology. Now we’re putting the power to create, express, and produce with AI in everybody’s hands. Here’s to the road so far — and all the magic to come ✨ pic.twitter.com/Jbuecx1k6k

— Meta (@Meta) December 19, 2023

Meanwhile, another risk associated with Meta stock is the multitude of lawsuits filed against the company.

Over the years, Meta Company has faced numerous lawsuits, with claims asserting that its products are harmful and addictive to children.

These risks pose a threat to the ongoing positive trend followed by the prices of Meta stock.

Additionally, the technical indicators are also offering a somewhat negative Meta Price Prediction for the initial times of 2024. Let us have a look at it in detail.

See related: $COIN stock prediction for 2024

META Stock Forecast 2024 – A Possible Trend Reversal or a New All-Time High?

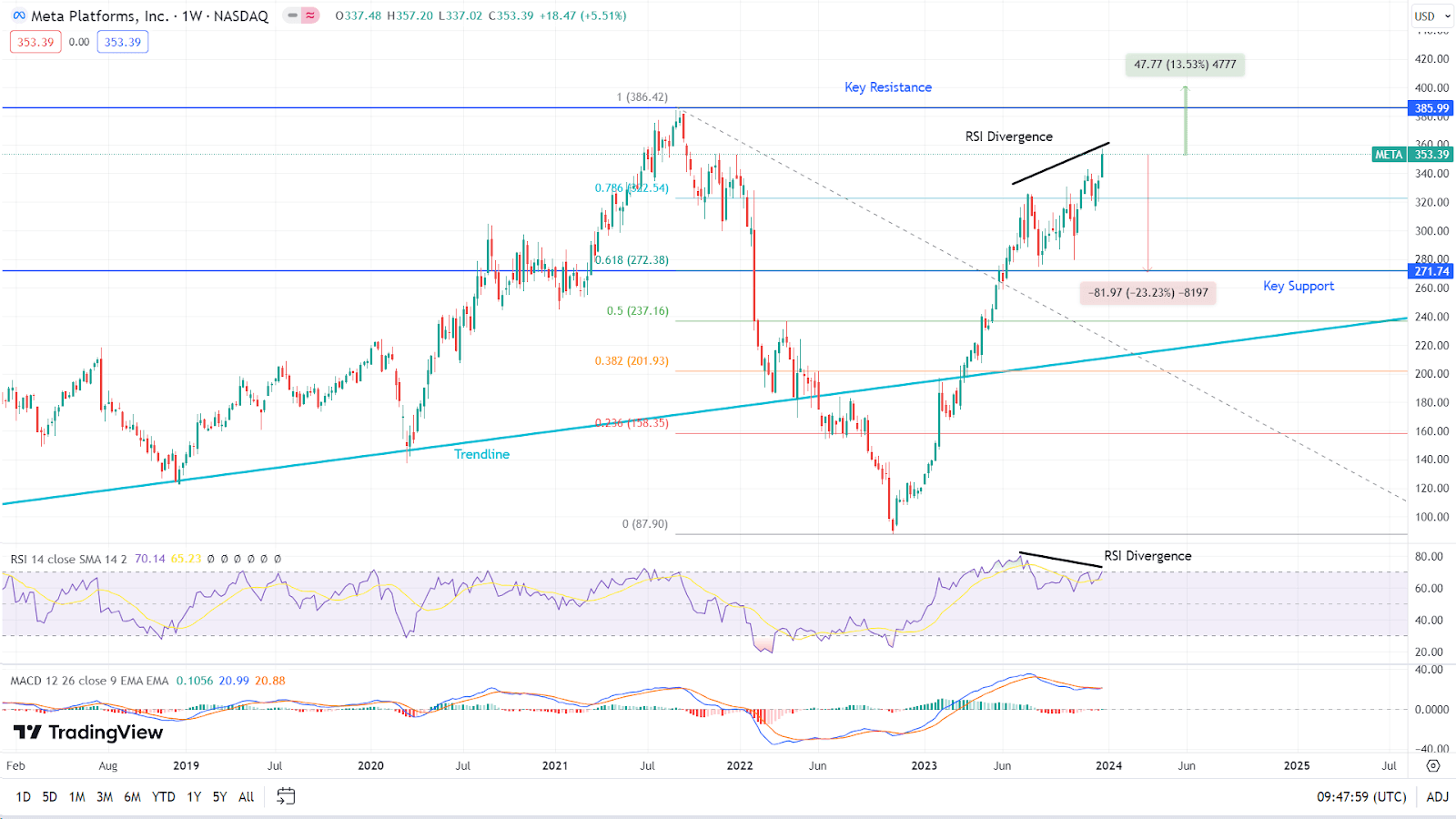

According to the weekly chart analysis of META stock, the prices have been moving above the ascending trendline since April 2023.

However, the recent appearance of a bearish RSI divergence indicates the possibility of a trend reversal in the coming weeks.

Meanwhile, the MACD histograms with no bodies above or below the zero line suggest indecisive behavior from investors.

It further supports the signal of possible trend reversal given by the RSI divergence.

The prices are currently moving close to the key resistance level of $385, which is an all-time high level of META stock, last seen in August 2021.

However, the technical indicators suggest that the prices might retreat back towards the initial support of $322.

This level is equal to the 78% Fibonacci Retracement level calculated from the high of $365 in August 2021 to the lowest of $88 in October 2022.

While the technicals look like this stock could have some headwinds in 2024, it’s also worth noting that X (formerly Twitter) is seeing higher organic traffic than Instagram.

— Elon Musk (@elonmusk) December 15, 2023

Summary

In conclusion, META looks like it may face some headwinds in the future. However, if key support levels are hit, look for some potentially large upswings throughout 2024.

Still, we’d rather watch to see if X is taken public again instead of banking on Meta continuing to grow.

Disclaimer: This is not financial advice. We use charting, fundamental and technical analysis to forecast stock and crypto trends.

See also: 5 Cryptocurrency Predictions for 2024