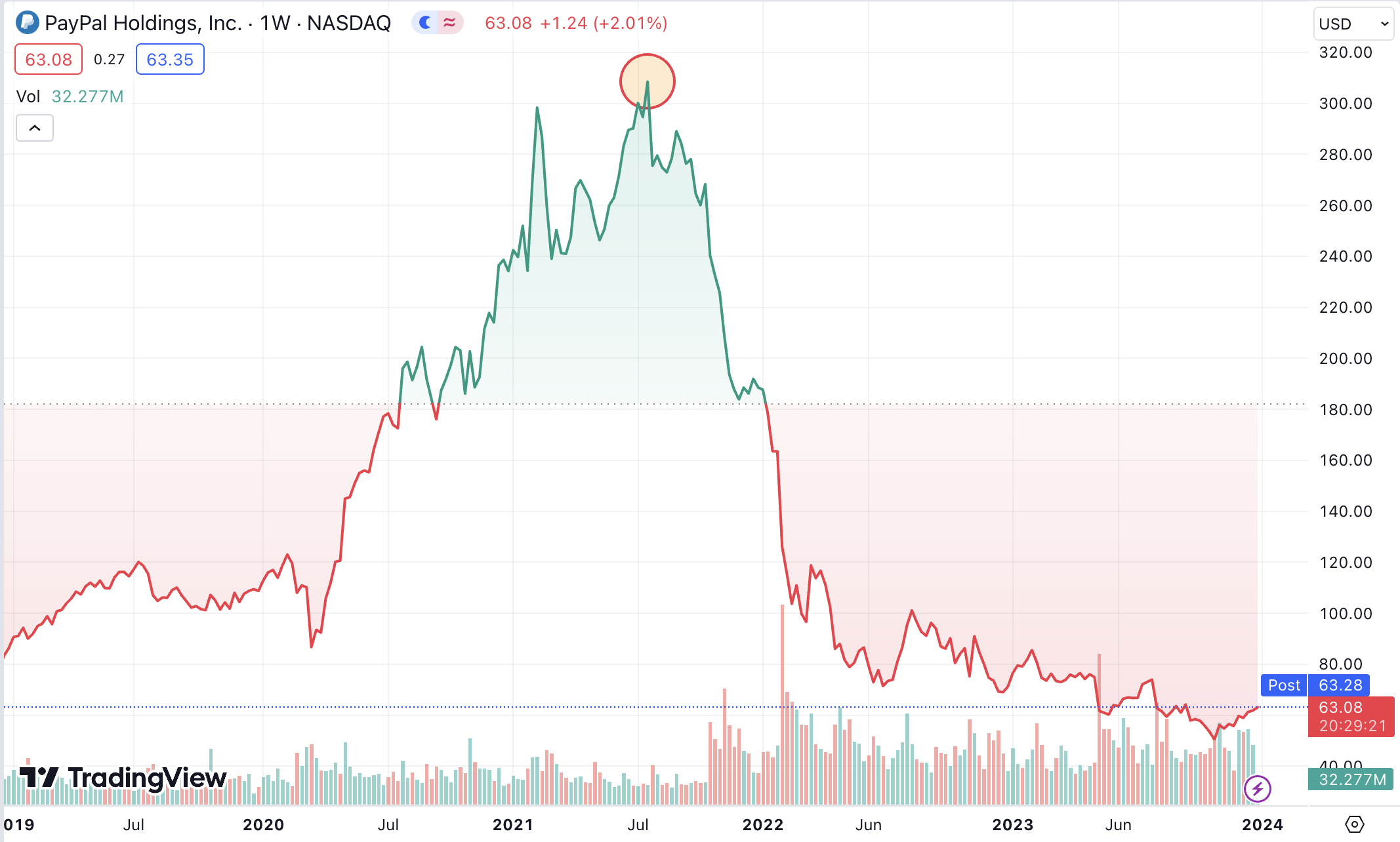

PayPal ($PYPL) stock has flown under the radar in 2023 after being down roughly 15% over the span.

This has caused investor sentiment to shift to towards neutral. Especially after it once traded upwards of $309 in July of 2021.

Now, $PYPL’s technicals look prime for a potential long entry. Let’s dive into our PayPal stock forecast for 2024 and see if it’s worth a flier.

See related stock forecasts for: $META | $COIN | $MU | $ONON | $SE

PayPal stock forecast: overview

First let’s touch on the meteoric rise and fall of PayPal stock and what caused it to plummet post 2021.

Remember when we were all stuck at home in 2021? Some people became stock and crypto traders with their extra spare time.

Others chose to spend their time shopping digitally — causing the e-commerce sector to boom.

When global restrictions lifted, e-commerce experienced a ‘healthy’ correction, leading to slower growth in annual revenue.

After increasing their annual revenue 20.72% from 2019 to 2020, they blew out expectations by growing an additional 18.26% in 2021.

That’s when things went south.

Wall street cooled off on $PYPL stock after achieving only 8.46% growth in 2022.

So, why would we be intrigued by what’s seemingly a declining company and space?

PayPal’s bull case

Let’s start with our first catalyst: the company is a cash cow.

TOP STOCKS FOR 2024

1. $PYPL: P/FCF = 13

2. $DQ: P/FCF = 0.8

3. $BABA: P/FCF = 7

4. $ENPH: P/FCF = 20

5. $CROX: P/FCF = 6What are your favorite stocks going into 2024?

— Friso Alenus (@FrisoAlenus) December 28, 2023

Typically, the lower the P/FCF ratio indicates that the company could be undervalued.

Now it does appear that $PYPL is struggling to break past key resistance levels around $63 to close out 2023.

$PYPL trending higher – looks like it’s trying to break out of this multi-year downtrend this week – BIG spot.

Might be time to jump in here.. Watching 👀 https://t.co/D4HEjnACUg pic.twitter.com/tYB6fv1FOq

— Urkel (@SteveUrkelDude) December 28, 2023

Once broken, it could signal a run north of $70 by the Spring of 2024.

The company has also been eager to buy back shares while they’ve been ‘undervalued’.

This alone could cause its EPS (earnings per share) to rise 5.3% annually — and that’s if their revenue remains stagnant.

What will be the most obvious 100% gain over the next 12 months?

I’ll start:$PYPL

— The Long Investor (@TheLongInvest) December 28, 2023

Now we are not as bullish on $PYPL as TheLongInvest on X, who thinks it could gain 100% in 2024.

But there’s other positives to note.

PayPal also quietly ventured into the realm of crypto in 2023, creating their own stablecoin.

PayPal USD (PYUSD) lives on the Ethereum chain and is 100% backed by US dollar deposits.

The platform also allows users to transfer ETH and BTC — showing their gradual shift toward DeFi.

PayPal Stock Forecast for 2024

PYPL – Has a monster potential by CheelooTrader on TradingView.com

Given the positive catalysts mentioned above, we see PayPal having a strong year ahead with a price target of $82 per share.

This would give $PYPL roughly 26% upside in the calendar year. Of course, this is just an estimate.

On the contrary, a ‘black swan’ type of event could bring down the markets as a whole.

Please note, this is merely an opinion and not financial advice. Please consult with a licensed financial advisor prior to making investments.