Silver will move higher in 2023 because we expect the top in the US Dollar to be confirmed. Moreover, our silver price forecast 2023 is supported by leading indicators like inflation expectations and the silver CoT report (silver futures market positions). They all suggest a strongly bullish 2023 for silver. That’s why our silver price forecast for 2023 is 34.70 USD. Note that this is our first bullish target, also a longstanding target that we expected to be hit in 2022. Once silver trades near 36 USD it will be a matter of time until it will attack ATH. In our gold forecast 2023 we mentioned that our preference goes to silver investments in 2023 and beyond. We also tipped silver as the precious metal to buy for 2023.

Ed. note: This silver price prediction was originally published on October 8th, 2022. We make frequent adjustments to this article to keep it current, any change is prefaced with the date on which the change was published. Most recent chart updates: Oct 8th, Dec 4th, Jan 23d, May 21st, August 4th, 2023.

Nowadays, the web is full of fake silver price forecasts. Many sites publish large tables, generated by AI, with price calculations for the next years, positioning those endless series of numbers as silver price forecasts.

We have a very different view on how to predict the price of silver. If you are looking to understand the true dynamics driving the silver price, you will love our silver price prediction rationale and methodology.

Silver prediction: summary (update: August 4th, 2023)

We re-iterate our bullish stance about the silver market. Our silver price target stands strong.

This is what we wrote back in February:

For 2023, we continue to predict that silver will rise to 28 USD/oz which is a secular breakout level. Whether it will succeed in clearing secular resistance will depend on how high rates and the USD will rise in March of 2023. Stated differently, if the upside in both TNX and the USD are limited, both setting lower highs, then we are convinced that silver will clear 28 USD/oz in 2023. In that scenario, we see a quick run to the 32-36 area.

At the start of H2/2023, we firmly believe that silver has everything that it needs to stage a secular breakout still in 2023, maybe even short term. We define short term as 3 weeks to 3 months out. We do expect silver to confirm its breakout in the period August/October of 2023. We eagerly wait for silver to clear 26 USD/oz which will open the door to surpass 28 and go in one straight line to 34 USD/oz.

Another Silver Price Prediction: Why?

The internet has no shortage of silver price predictions. In fact, InvestingHaven was the first back in 2014 to publish a silver price prediction and repeat it every year. Since then, the number of silver price predictions has exploded. Most of them are absolutely worthless.

We pride ourselves not only being the first one to publish a silver price prediction but also do it in a very diligent way, backed by thorough research.

But there is more.

What we are really interested in is catching the next really big move in silver that might bring it back to 50 USD/oz or even higher. That’s the reason why silver has a top spot in our watchlist.

We write a lot about silver both in the public domain (silver tag) but also in our premium services. Silver has a track record of running very hard and fast, in both directions. There is a very good reason why silver is called the restless metal.

Silver came very close to a secular breakout in 2022, however the breakout was stopped cold by very aggressive (read: historic) monetary policy interventions in Q2/2022. Once the wave of monetary policy interventions will be over, which we ultimately expect as 2023 kicks off, we see the USD come down. This will make the silver market explosive!

Our silver price prediction 2023

We turn to the silver charts to support our silver price forecast 2023.

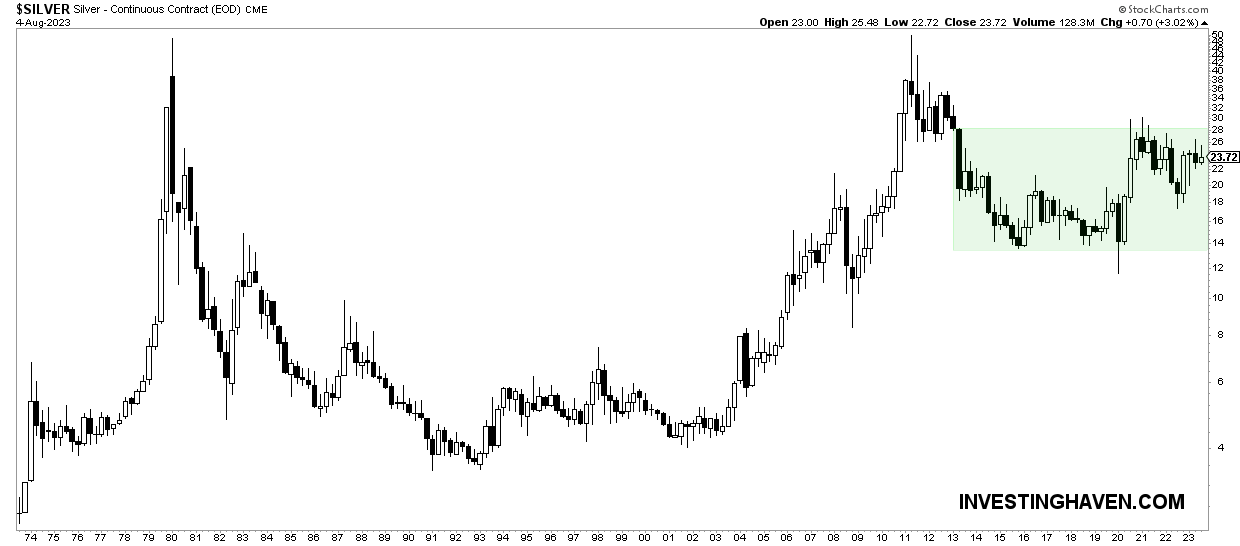

As seen on the longest timeframe, the silver price chart over 50 years, there is a giant cup and handle in the making. This is a strongly bullish pattern, one that might take two more years to truly explode.

The area in green is the ‘handle’, it took some 6 years to create the first part of the structure. The consolidation is taking some 3 years now. We find it challenging to estimate the exact time required for this formation to complete. We can reasonably expect silver to move to the top of this formation (between 32 and 36 USD) in the 2nd half of 2023.

Silver charts that support our forecast

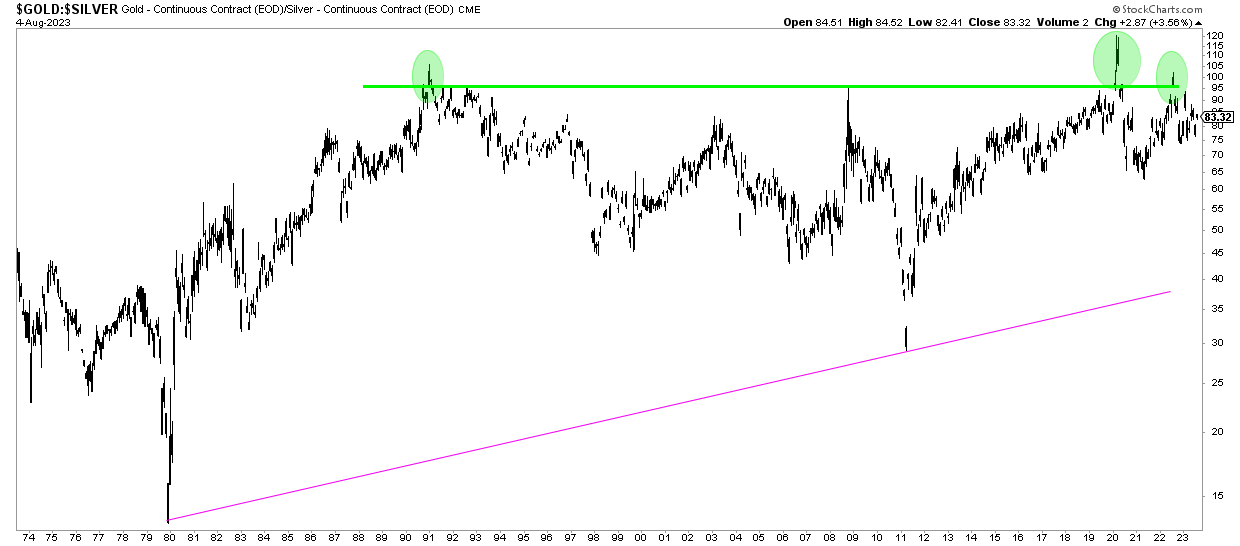

We start with the weekly gold to silver ratio over 50 years.

We explained the importance and the meaning of the gold to silver ratio, in great detail, in this article: Gold-to-Silver Ratio and Historic Silver Rallies.

Back in September of 2022, when the investor community was extremely bearish, particularly but not only on silver, we came with a contrarian bullish silver call which is available as a public blog post One Silver Chart Justifies ‘Buy The Dip’ For Long Term Positions:

The gold to silver ratio says that silver is a screaming buy: the gold to silver ratio over 50 years! Take a look at the green line: any time, in history, silver achieved a ratio of 92:1 when compared to the price of gold, it started an epic turnaround. In some cases it took a few years, in other cases a few months, for silver to become explosive!

The gold to silver ratio chart over 50 years:

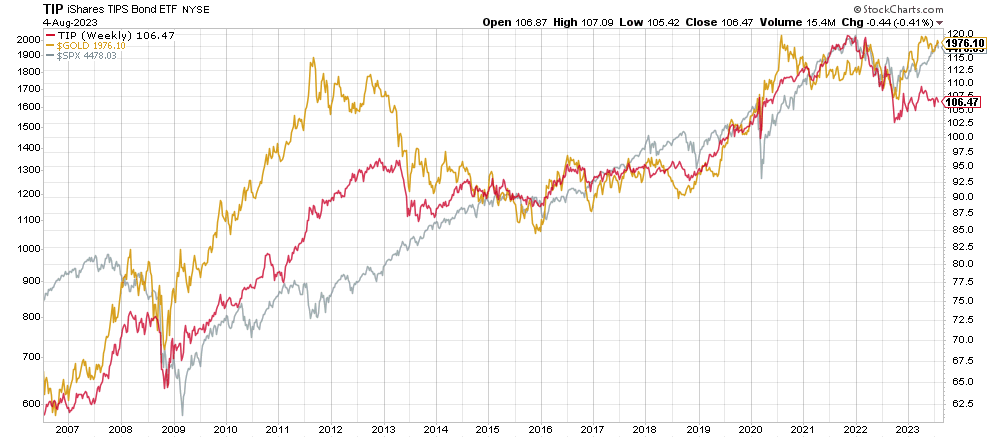

The 2nd chart that supports a higher silver price in 2023 is the correlation between inflation expectations (TIP), gold and SPX.

The decline in 2022 in all 3 of them is telling. We expect that all 3 of them will stop declining and turn up in 2023, and it should happen not later than March of 2023 (presumably much sooner). We explained this in: Why Markets Should Resume Their Uptrend The Latest In March of 2023.

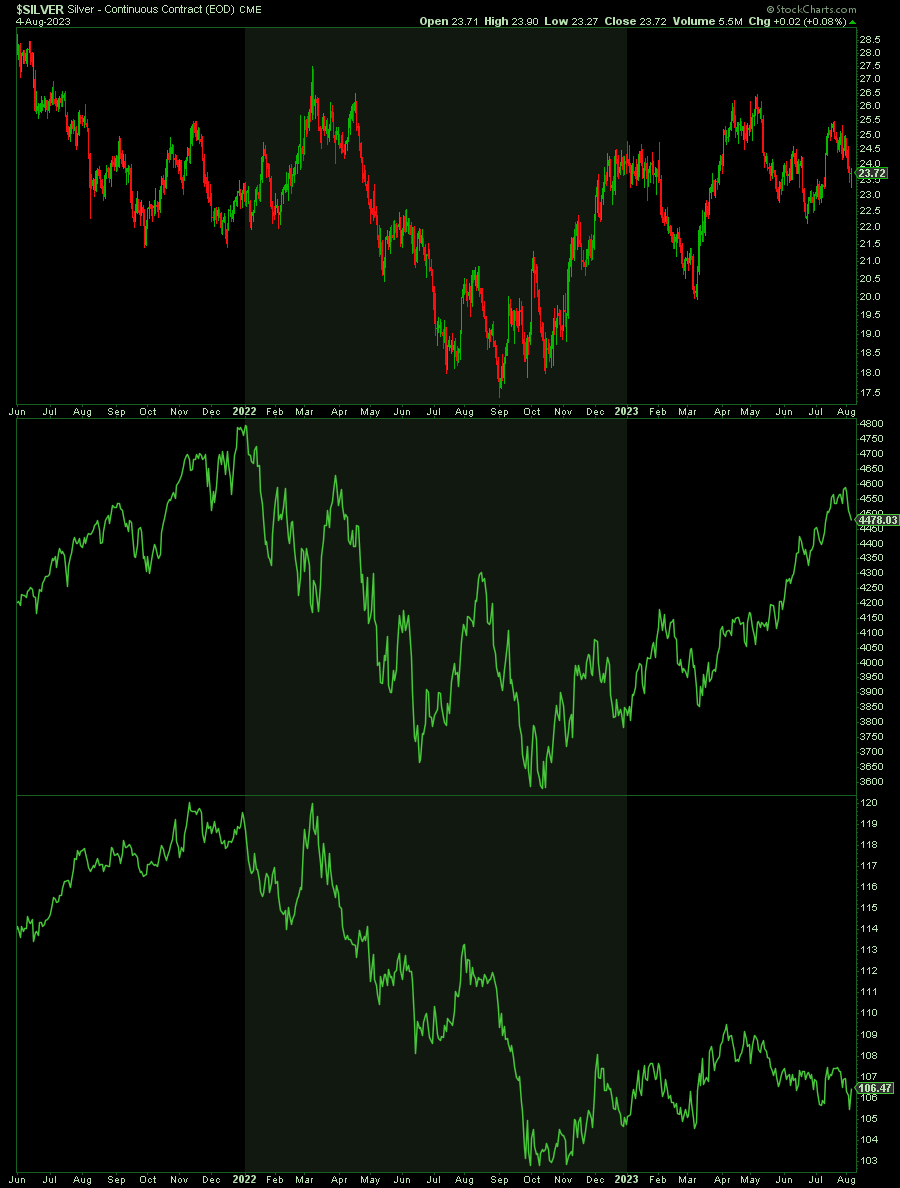

With the correlation between those 3 markets in mind, we look at the current setups in silver / TIP / SPX.

Silver is setting a very strong inverted head & shoulders pattern, stocks are setting a double bottom (pending validation though), TIP looks to be consolidating.

We believe all 3 instruments will move higher in 2023.

Silver’s leading indicator #1: Gold

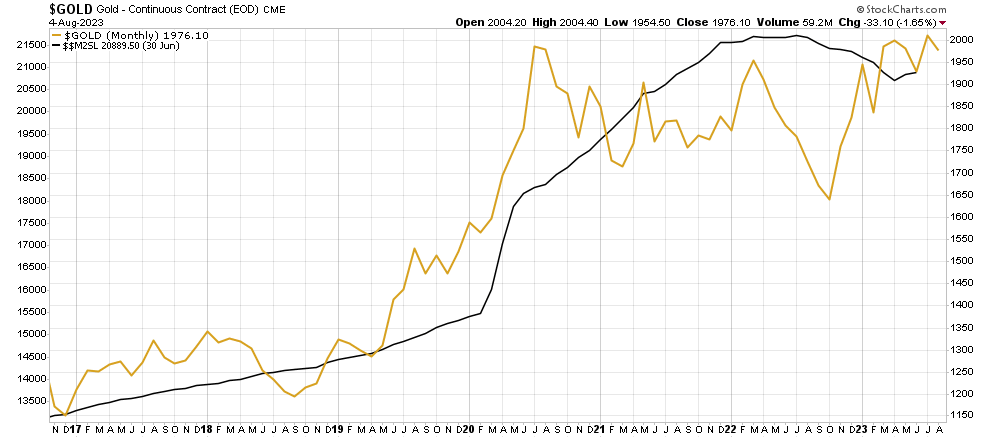

We expect gold to eventually move higher in 2023 because of the divergence between its leading indicator M2 (the monetary base).

We gave much more detail about the expected path of gold in 2023 in our gold forecast (link in the intro of this article).

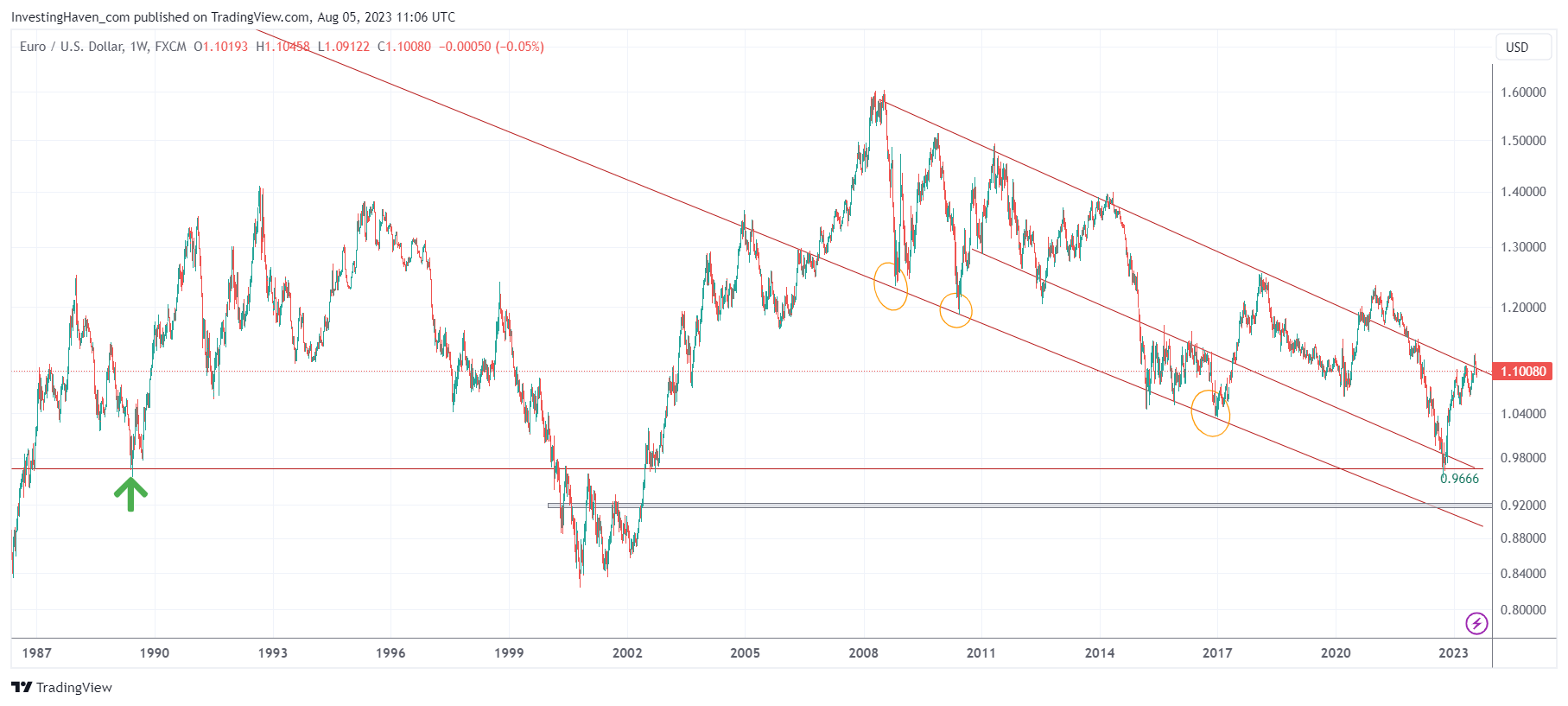

Silver’s leading indicator #2: Euro (USD)

Precious metals need a rising Euro (falling or flat USD) in order to shine.

If we look at the Euro chart on the longest timeframe we find 2 bearish targets: 0.9666 and ultimately 0.91-0.92. The first one was hit, the second one might be hit (or not).

Stated differently, even though it might be that the U.S. Dollar has more upside (more downside in the Euro), we believe that there is more downside risk in the USD than upside potential. Pending validation and an important pre-requisite for our bullish silver price forecast 2023 to materialize.

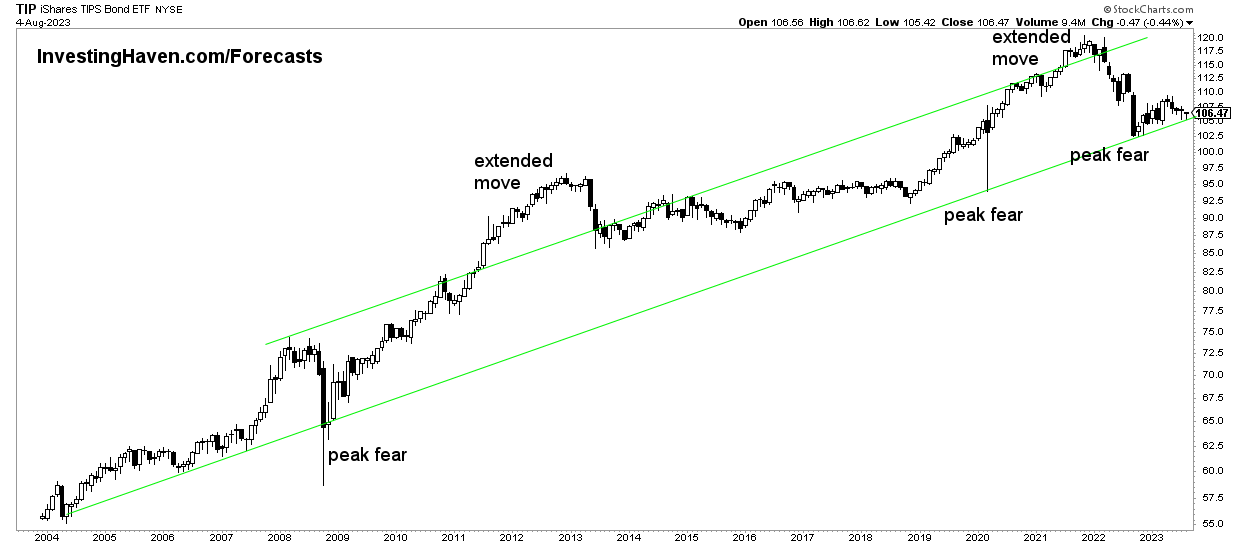

Silver’s leading indicator #3: Inflation expectations

Inflation expectations are positively correlated to precious metals. They are a very strong a leading indicator, certainly when combined with the USD/ Euro effect.

The long term setup in TIP seems to be hitting a multi-decade low in the context of its rising channel. Can TIP move lower? While everything is possible, we see that the recent decline was equally large as the previous ones in 2008 and 2020. That’s why we believe TIP is about to start a consolidation and move higher in 2023.

The medium term chart of silver / SPX / TIP, shown below, makes the point: a turning point in all three markets is not far away. All three should resolve higher in 2023, even if they decide to continue their downtrend before 2023 starts.

Physical silver market: physical shortage in 2023

Editorial note: This section added on November 27th, 2022.

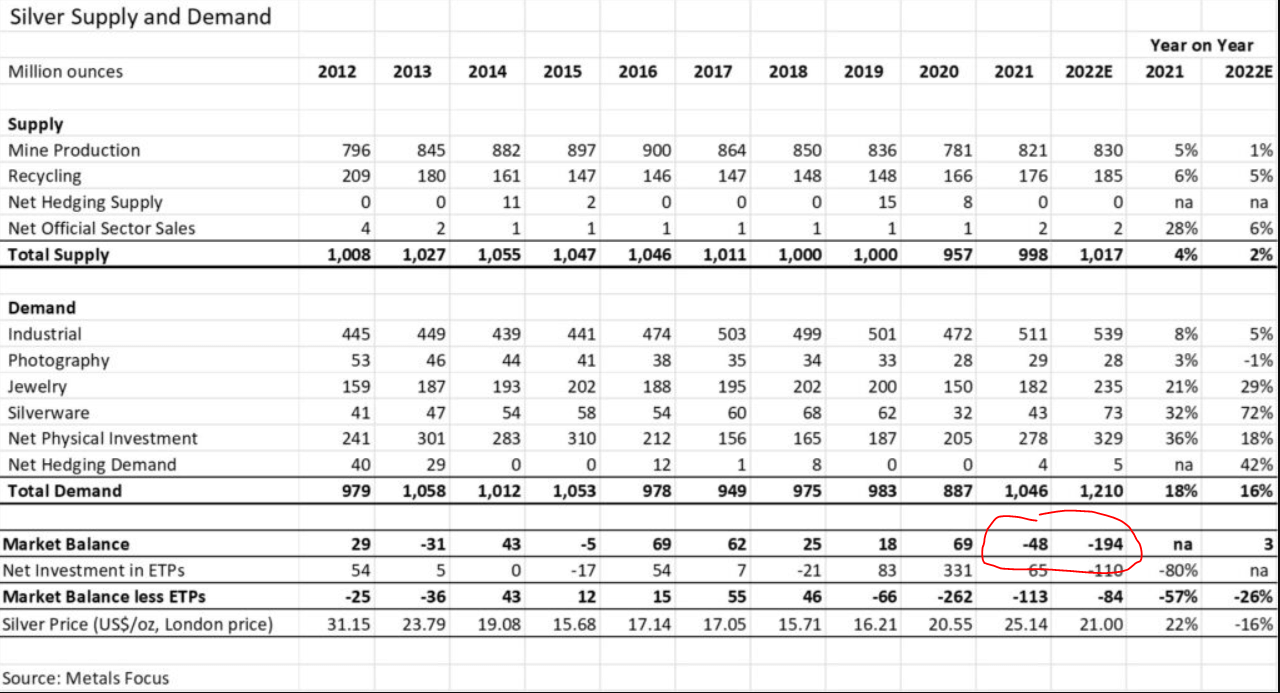

As discussed in Silver: A Divergence Of Epic And Historic Proportions there is a shortage developing in the physical silver market. Source: Global Silver Demand Forecast to Reach a Record High in 2022.

According to The Silver Institute) the global silver market should record a deficit in 2022. “At 194 Moz, this will be a multi-decade high and four times the level seen in 2021.”

As seen on the table which depicts the supply/demand situation in the last 10 years, it becomes clear that 2022 will be year with an epic physical market shortage. The strength of the physical shortage is the one conclusion that stands out, see red annotation.

As said, “this physical market imbalance (supply shortage) is historic, it’s not just a big supply shortage jump of 4x against last year.”

Silver price chart: a bullish reversal is almost complete

Editorial note: This section added on November 27th, 2022.

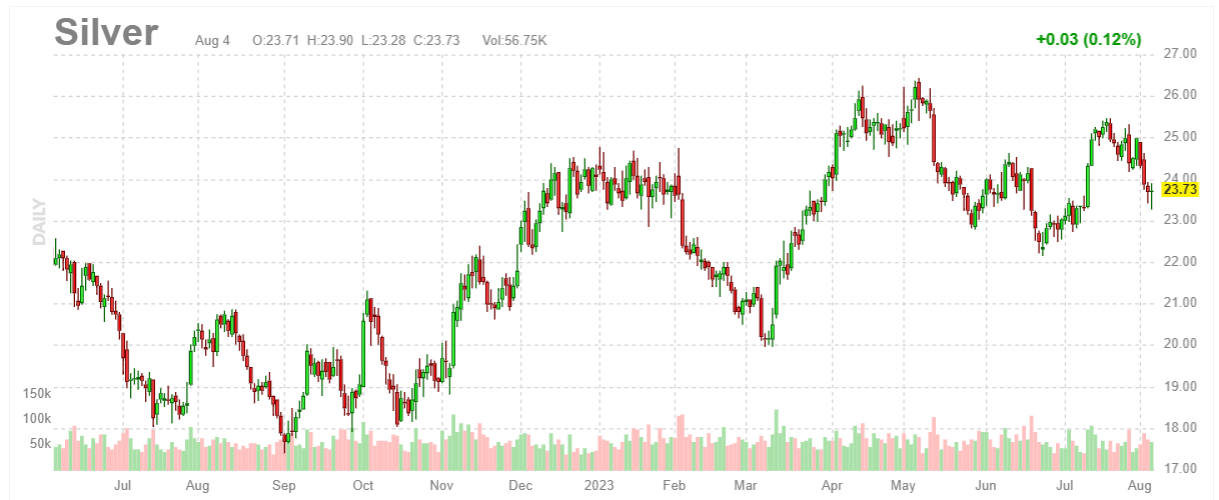

We use the daily silver price chart from Finviz, not a logarithmic chart, without annotations.

What do you see?

A very, very bullish reversal setup. The 21.50 to 22.00 USD level comes with resistance, the 19.00 to 20.00 USD level is support. But, more importantly, the entire structure between 18 and 22 is one giant bullish chart structure!

Silver price forecast 2023: conclusion

That was a lot information to take in, so let’s ensure we get to a very clear and simple conclusion:

- Leading indicators Euro and inflation expectations turned bearish in Q2/2022, pushing silver lower.

- The silver CoT turned extremely, historically bullish as we head into 2023.

- Once the Euro and inflation expectations start rising, we silver see taking off.

That’s why we see silver easily moving to 28 USD in 2023 and moving to our first and longstanding bullish target of 34.70 USD. Our silver price forecast 2023 is 34.70 USD. Whatever happens at that price point will inform us about the intention of silver to attack ATH, presumably beyond 2023.

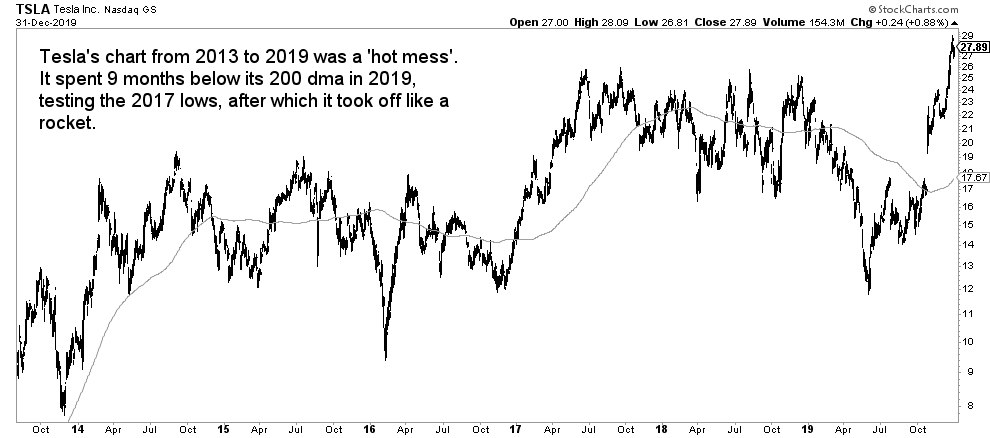

Bonus chart: Silver and Tesla comparison

Every investor talks about the big Tesla opportunity of recent years. If you would have invested in Tesla back in 2017 or 2018, had done nothing for a few years, your position would have exploded.

Here is the problem: Tesla first sold off before taking off. Most investors sold on fears that Tesla would start crashing.

Interestingly, there are similarities between the Tesla setup back in 2019 (before it exploded) and the silver price as we head into 2023.

Tesla’s daily chart between 2013 and 2019 was a ‘hot mess’. It spent 9 months below its 200 day moving average before it tested the support area. In doing so, the price of Tesla went from 25 to 12 in some 6 months. Not a lot of investors were holding those shares.

Technical analysts would have told you to run for the hills.

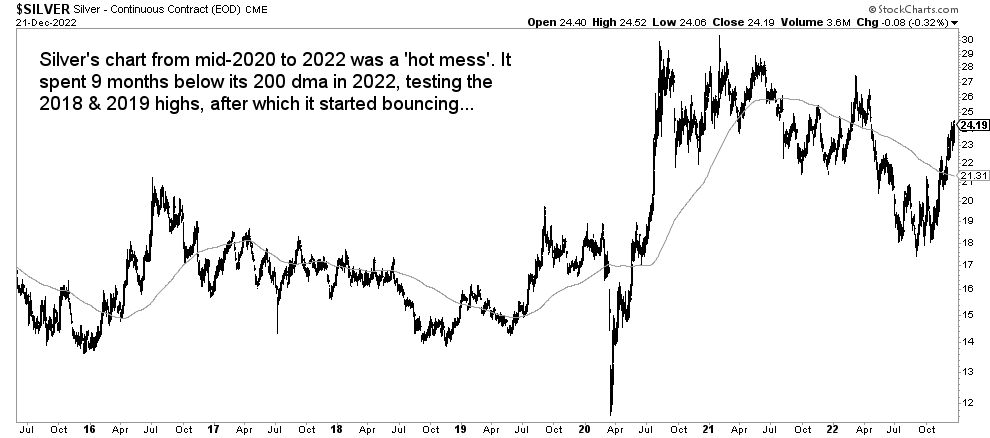

Fast forward to today and look at the silver price chart.

Well, silver concluded 9 months below its 200 day moving average after it came down from 27 to 17 USD/oz. It spent several months right at its 2017/2018/2019 highs and it looks like it successfully confirmed it as key support.

Now, here is the point: if you ask any investor today if they would have held their Tesla shares even if they would have sold off but got in return a 10x ride, the answer unanimously would have been ‘yes’.

The reality is different: most sold their Tesla shares back in 2018 & 2019.

If you ask any investor today to consider silver, they would tell you it’s only a fool that is investing silver because, among other reasons, (a) rates are too high (b) the USD is too high (c) the world does not care about silver (d) silver has gone anywhere in recent years (e) silver is too volatile (f) silver came down so much. Note that this list is not exhaustive.

You got our point: if the big silver move is about to start in 2023, which we firmly believe is the case, you MUST be in an environment characterized by disbelief in the investment. Because if there were too much belief in silver as an investment, there would be no opportunity.

You got our point?

Please read this a few times, it’s crucial, timely insights, we explained more of these principles in 7 Secrets of Successful Investing.

Silver price prediction – 2023 log

This is a log of our silver price prediction that we’ll update multiple times throughout 2023, ideally twice per month:

- 2023 kicked off in a modest way. The silver price chart looks good as a long term reversal. However, short term, silver is getting vulnerable to a pullback. There are also 2 conflicting forces at work: 10 year yields seem to be topping (good for silver) while the USD seems to be bottoming (not good for silver).

- We believe silver needs a consolidation period of a few months before it can really attack the 28 area (with sufficient power to break through it).

- Silver it taking a short break. It is prone to a pullback to the 21-22 area. We don’t think silver should be shorted, nor sold. We expect a healthy pullback which should make the long term reversal even more constructive. It is a ‘buy the dip’ pullback. As explained in this article Silver: Here Is Why February 15th, 2023 Really Matters we identified 02/15/2023 as a date which might come with decisive price action.

- Now, suddenly, the world is waking up to the potential of silver. Even in mainstream financial media we start seeing bullish silver price headlines like this one on CNBC Silver could touch a 9-year high in 2023 — with a bigger upside than gold.

- Silver’s decline in February of 2023 is not concerning, not yet. It is about to end the month at key support. Note that the price of silver in the area 20-21 USD/oz qualifies as a regular retracement in the context of a wide bullish reversal. Moreover, on March 1st, 2023, a new cycle starts for silver. That’s when silver will be testing key support. We are not concerned about the price drop of silver in February for both reasons.

- In our May update we look back to what we wrote in February, in the previous point, appeared to be spot-on. The support level we indicated did hold, the subsequent rally was strong. After silver touched 26 USD/oz, in May of 2023, it became clear that it was too much resistance. That’s fine, it only means, to us, that a breakout is postponed. On the other hand, as said in Silver Testing Its Secular Breakout Level, there is a case to be made that silver’s pullback in May of 2023 is a secular breakout back-test. So, we should not be concerned about some selling, certainly not if the 23.50 USD/oz will hold on a 3 to 5 day closing basis!

- Throughout June, we observed an improvement in literally all leading indicators: silver CoT positioning was outstanding, gold pulled back but only slightly, rates pulled back. Silver had everything to stage a secular breakout in July. Towards the end of July, though, rates started rising and the silver CoT report registered a sudden jump in net short positions of commercials. That’s a combination that does not allow the secular breakout in silver to continue. We got a pause in July, a tiny pullback to the 50% retracement level of the consolidation since its 2020 highs. Silver remains unusually bullish on the long term timeframe, we are simply waiting for the start of the big run to start which can happen at any given point in H2/2023.

Follow our silver forecasts

We recommend subscribing to our free newsletter which will feature all our silver updates throughout 2023. It will follow up throughout the year on our silver forecast 2023.

The only way to track the pulse of markets and stay tuned with how our forecasts are evolving is to subscribe to our free newsletter >>