Gold demand remains strong and prices may rise further. We discuss the key reasons to consider adding gold to your portfolio now.

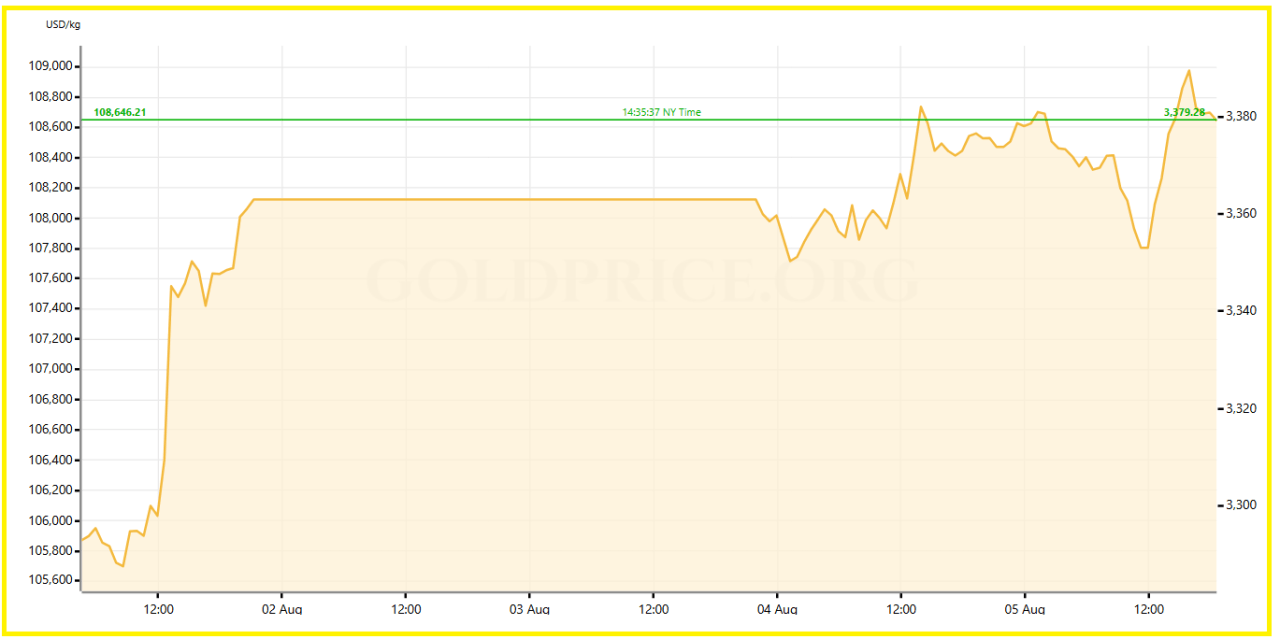

Gold prices reached about $3,377 per ounce by early August 2025. Investors drove total Q2 demand to 1,248.8 tonnes, a 3 % rise year-on-year and record-high value of $132 billion, according to data from the World Gold Council.

This means now is the right time to invest in gold.

In this article, we explain 5 reasons to buy gold in 2025 and why gold still offers value now, despite high prices.

RELATED: 9 Reasons To Invest In Gold In 2025

1. Safe‑Haven Protection & Economic Uncertainty

Weak U.S. jobs data in July 2025 pushed expectations of Fed rate cuts to 92 % by September. The result is a weakening U.S. dollar and gold becoming more attractive as a safe haven.

Geopolitical tensions, especially U.S.-India trade frictions, also heightened investor risk perception. Usually, during such turbulence, gold acts as a reliable safe haven.

In fact, investment demand surged 78 % year-on-year in Q2 with gold ETFs and physical bar and coin purchases dominating flows, especially in Asia and the U.S.

That said, if you are looking to buffer economic shocks, now is a great time to buy gold.

2. Inflation & Currency‑Debasement Hedge

U.S. inflation remains near 2.7 %. With expected deficits adding trillions to national debt, concerns about currency debasement have intensified.

As a result, Citi raised its short-term gold forecast to $3,500/oz, owing to weakened U.S. growth outlook and inflation risk.

Longer-term forecasts from J.P. Morgan and Goldman Sachs see prices reaching $4,000 by mid‑2026.

Generally, gold price forecasts for 2025‑2026 remain compelling and we might see promising growth by the end of the year. This makes gold the perfect inflation hedge.

3. Diversification & Portfolio Resilience

Gold offers low correlation with stocks and bonds meaning it can reduce portfolio volatility.

Most investors seem to be aware of this because total investment in gold ETFs soared in H1 2025, with inflows of about 170 tonnes in Q2 alone.

This rotation of capital into gold signals broad investor belief in its diversification role. Over the past year, retail and institutional flows into gold show rising appetite.

So, if you want diversification benefits, adding gold could strengthen portfolio resilience. You gain non‑correlated exposure that cushions downturns in risk assets.

READ MORE: Why Gold Makes Sense for Long-Term Investors

4. Structural Demand from Central Banks & Emerging Markets

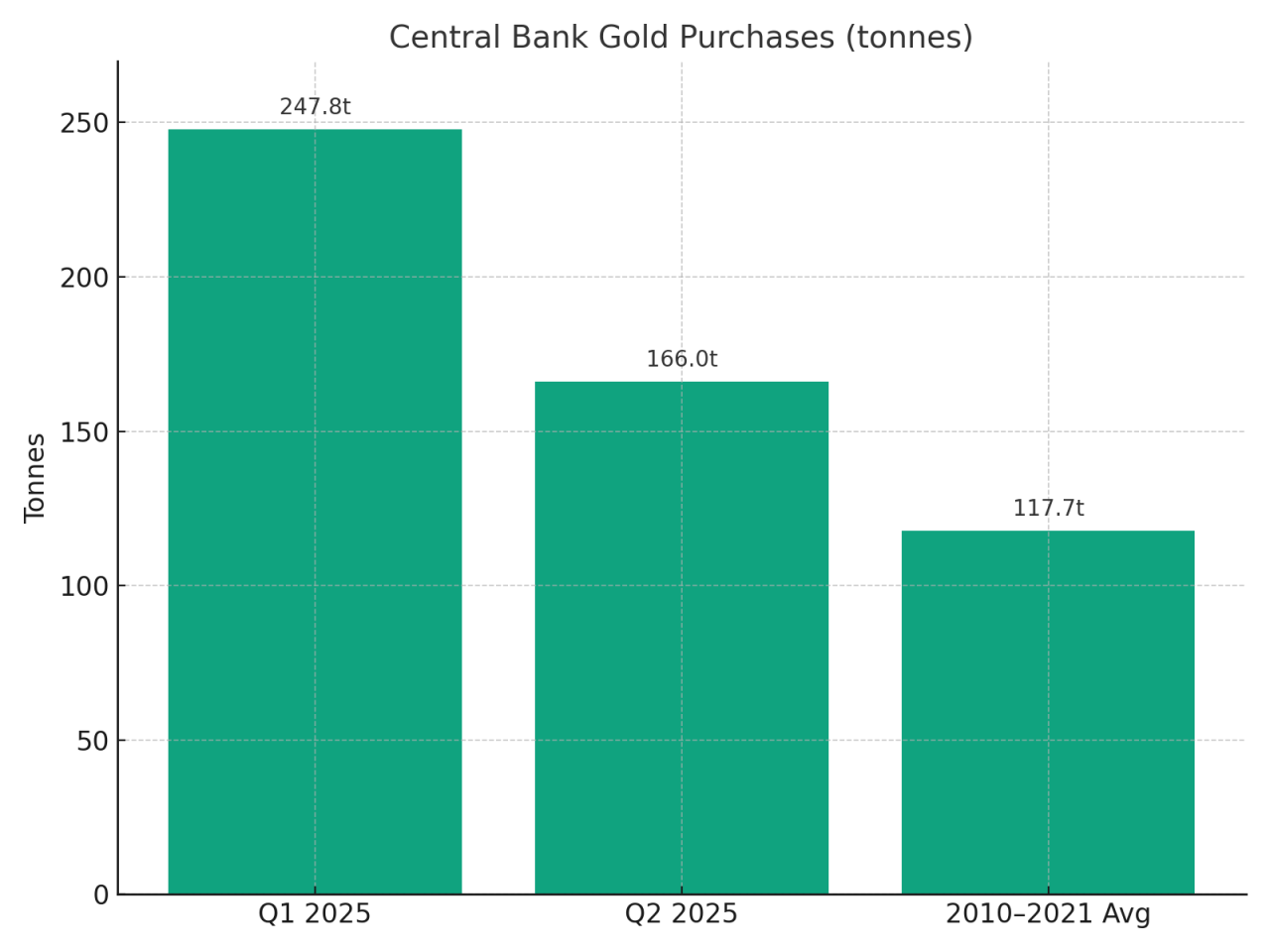

Central banks purchased 166 tonnes of gold in Q2. Although that was 33 % lower than Q1, it is still 41 % above the 2010–2021 quarterly average.

China added 6 tonnes in Q2, bringing its total to about 2,299 tonnes. Turkey, Poland, and Kazakhstan also increased reserves.

Emerging markets, especially China and India, saw bar and coin demand rise strongly. In China, bar purchases increased by 44 %, while India also posted large gains.

This official sector demand adds a stable gold demand in 2025 and supports long-term price stability.

RELATED: How Shifting Debt Levels Are Driving Gold and Silver Prices

5. Liquidity, Tangibility & No Counterparty Risk

Physical gold gives you ownership without relying on any institution meaning you avoid counterparty risk.

Gold also trades easily around the globe. You can buy or sell bullion, coins, or ETFs in most markets.

You can choose between gold coins vs gold ETFs based on your needs. Coins let you hold physical metal while ETFs offer digital exposure and liquidity.

What’s more, you control your holdings directly or via regulated custodians, adding trust and transparency. This means you can hold an asset with no credit risk at all.

Conclusion

Gold delivers safe-haven protection, hedges inflation, enhances diversification, benefits from structural official demand, and offers liquid, tangible ownership. The precious metal remains a resilient, long-term asset for your portfolio since it protects value when uncertainty rises.

Analysts expect prices to rise further toward $3,500–$4,000 in coming months. If you want to buy gold in 2025, consider a mix of physical and ETF exposure. We also recommend using dollar-cost averaging to reduce timing risk.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)