Gold’s record-breaking rally in 2025 is fueled by robust central-bank reserves, surging ETF inflows, and rising retail interest. With inflation risks and geopolitical tensions, allocating 5–10% to gold provides strategic protection and growth potential this year.

In 2025, gold has emerged as one of the year’s most impressive performers, delivering close to a 40 % year-to-date gain and touching highs above $3,900 per ounce by October.

This rally hasn’t happened in isolation: it’s driven by a powerful mix of central-bank accumulation, record ETF inflows, inflation pressures, geopolitical tensions, and a surge of interest from younger investors.

Below are nine reasons why now could be a strategic moment to consider adding gold to your portfolio.

1. Blistering Price Momentum Is a Key Reason To Invest in Gold

Gold’s meteoric rise of approximately 25–30 % in early 2025 has not only set new all-time highs but also reinforced its upward momentum .

Starting the year near $2,658 and climbing above $3,900 by October, gold has enjoyed one of its strongest starts in decades.

Such a sustained rally often builds investor confidence, attracting further inflows and reinforcing the trend.

2. Central‑Bank Accumulation Surge In Gold

In the first quarter, central banks added 244 tonnes of gold—about 24 % more than their five-year quarterly average—and have now amassed over 1,000 tonnes annually for three consecutive years.

According to the World Gold Council, 95 % of reserve managers plan to expand their gold reserves over the next year. This heightened institutional demand signals confidence in gold as a stable, long-term anchor asset.

3. Explosive ETF Inflows For Gold

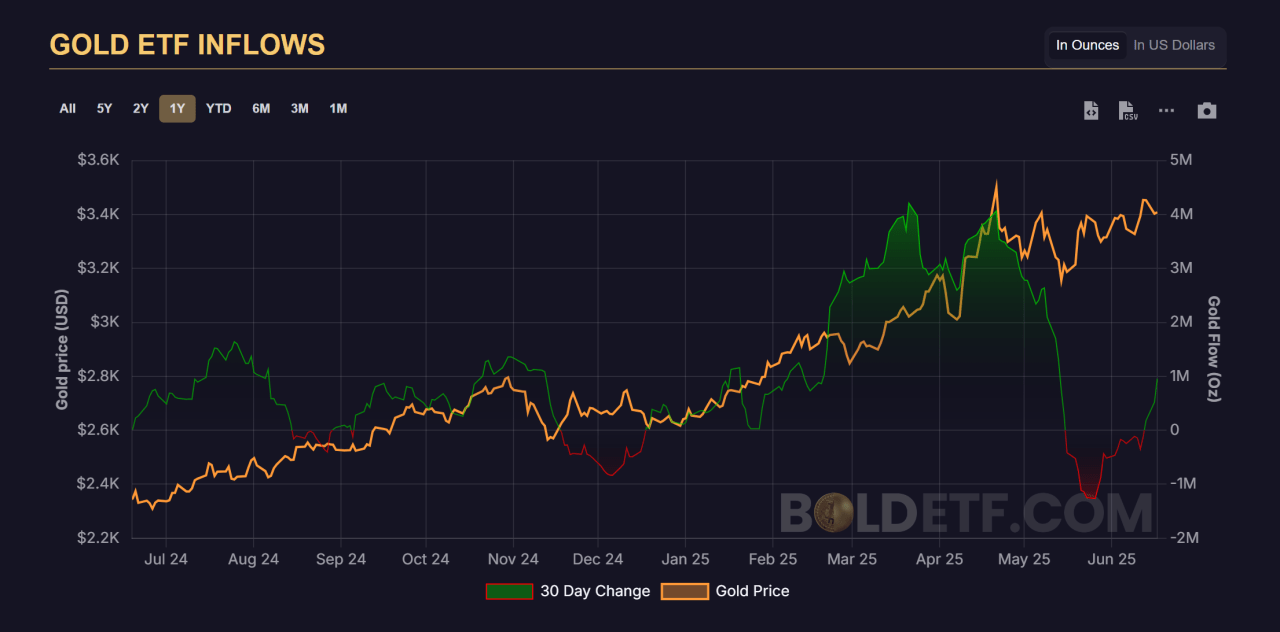

One of the key reasons invest in gold is due to Investment products driving the current gold boom: Q1 2025 saw ETF inflows of a staggering 552 tonnes, or around US $21 billion, marking the highest quarter since 2022.

These inflows maintained pace YTD and added meaningful physical demand pressure. The SPDR Gold Trust alone added nearly 0.43 % more gold, bringing its holdings to approximately 946 tonnes.

4. Inflation Hedge & Falling Opportunity Costs

A Great reason to invest in gold is due to it’s hedge against inflation, even as inflation begins to cool, it remains elevated at around 3–4 % in the U.S., and central banks—including the Fed—are expected to pivot toward rate cuts during the year.

This environment diminishes the opportunity cost of holding non-yielding assets like gold. In other words, with real yields declining, gold becomes more cost-effective to hold and more attractive to investors hedging against inflation.

5. Geopolitical Safe‑Haven Demand

Gold remains a good investment due to global uncertainty—from the Israel–Iran crisis to U.S.–China trade tensions and broader Middle East instability—has fueled demand for gold as a safe haven.

During periods of geopolitical upheaval, gold’s reliability as a crisis-hedge tends to draw increased investment, reinforcing demand.

6. Diversification Strength in Volatile Markets

Another reason to invest in Gold is because it has shown its worth as a portfolio stabilizer: it outperformed the S&P 500 in 3 of the past 5 years, and historically performs well during equity market downturns .

With traditional assets now showing elevated correlation, adding gold helps reduce overall portfolio risk and provides a valuable buffer.

7. Bullish Analyst Forecasts

Major investment banks are bullish on gold’s trajectory, which is another good reason to invest in Gold. Goldman Sachs expects gold to reach $3,700 per ounce by year-end, potentially climbing to $4,000 by mid-2026 if central-bank buying remains strong.

Conversely, Citigroup offers a more tempered view—predicting gold may stabilize around $3,100–3,500 mid‑year, with a possible dip below $3,000 in late 2025 . This spread of forecasts suggests upside potential with limited downside risk near current levels.

8. Retail & Young Investor Surge

Retail investors—especially Gen Z and Millennials—are increasingly incorporating gold into their portfolios. A global survey of 10,000 individual investors found 58 % have added or plan to add gold, even as they diversify away from U.S. equities.

This growing demand among younger demographics adds resilience to gold’s popularity and could bolster future prices and gives us another good reason to invest in gold.

9. Resilient Physical & Industrial Demand

One reason to invest in gold that will never disappear is that the physical gold demand remains robust, even at lofty price levels. Q1 saw 325 tonnes of bar and coin purchases, a healthy 15 % above the five‑year quarterly average, driven largely by China.

While jewelry demand has softened—from roughly 538 to 434 tonnes—investment demand is offsetting the drop, keeping physical supply tight.

Conclusion

Gold’s stellar early‑2025 performance is no accident—it’s backed by a potent combination of price momentum, institutional and retail demand, inflation protection, geopolitical cover, and strategic forecasts.

While estimates range from $3,100–4,000 by year-end, with bullish cases pushing toward $4,200, the consensus sees gold as a stable, strategic asset. For investors seeking to manage risk, preserve wealth, and maintain portfolio balance, dedicating 5–10 % to gold offers real potential for both protection and growth.

When is The Best Time To Buy Gold & Silver?

To receive key alerts and analysis on the best times to buy Gold and Silver, you should consider Joining the original market-timing research service — delivering premium insights since 2017.

InvestingHaven alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience.

This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Will Silver Set a Major Top at $50/oz? Our Deepest Analysis Yet. (Sept 27)

- Silver Rally Fueled by Absent Speculators (Sept 20)

- What Happens When Silver Hits 50 USD/oz? (Sept 13)

- Monster Basing Patterns in Precious Metals Resolving Higher (Sept 6th)

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean? (Aug 16)