Gold trades at strong levels, central banks added about 200 tonnes this year, and major banks see a clear path to $5,000 if key conditions line up.

Gold holds around $4,200/oz after a solid year of gains.

Big banks, including BofA, HSBC and JPM, model scenarios that reach $5,000 when real rates fall and demand stays healthy.

Growing ETF interest and steady central-bank buying provide real-world support, giving these Gold price forecasts more weight than simple speculation.

But can gold really hit $5,000?

RECOMMENDED: Gold Eyes $4,000–$5,000: Momentum Fueled by Fed Outlook

Can Gold Reach $5,000?: Current Price, Flows And Central-Bank Demand

Recent price strength matches what we see in market flows. ETF holdings show fresh inflows, and retail investors continue to buy bars and coins.

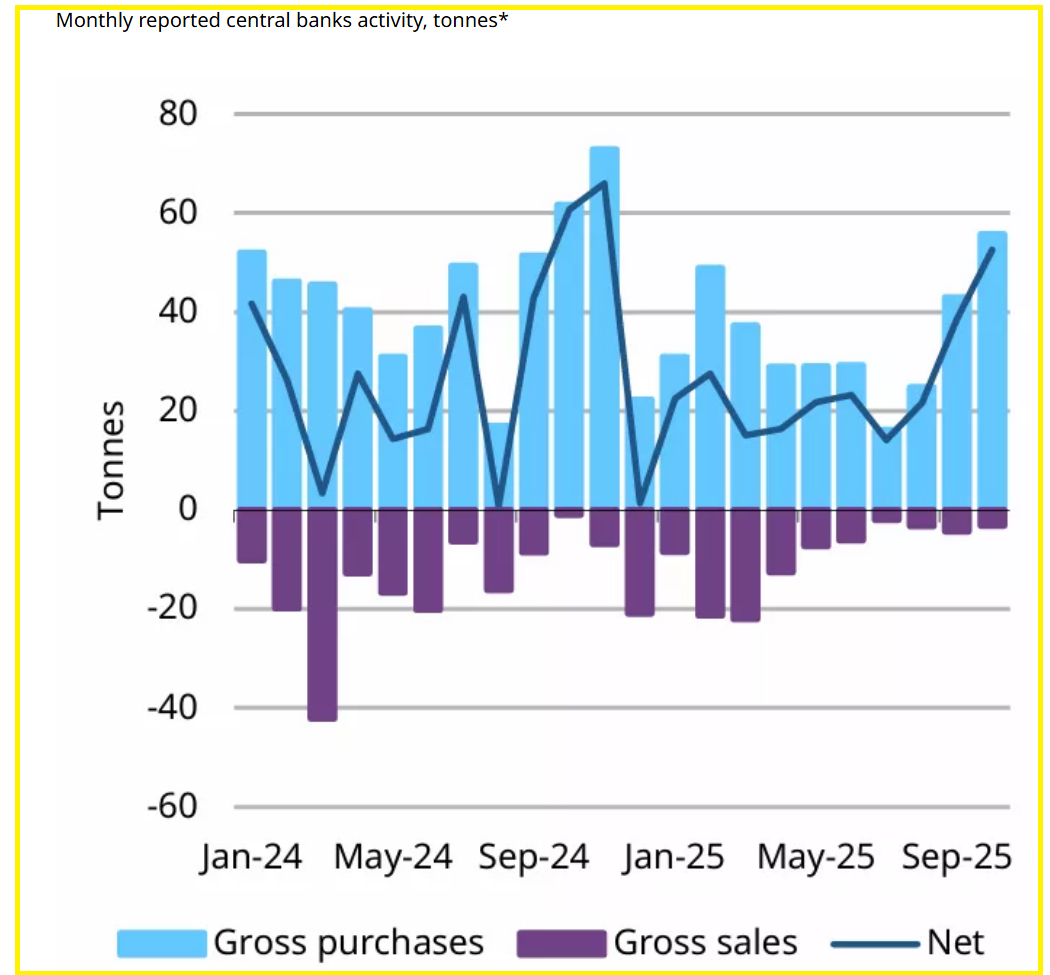

Jewellery demand remains softer, but heavy official-sector buying, about 200 tonnes so far, keeps the market tight.

These steady purchases shrink available supply and help anchor the price at higher levels.

With demand concentrated in investment and reserves, gold has built a firm base above $4,000.

RECOMMENDED: Week Ahead: How Powell’s Decision Could Move Bitcoin and Gold

Why $5,000 Is Possible: Catalysts That Can Push Gold Higher

For gold to reach $5,000, several measurable factors must align.

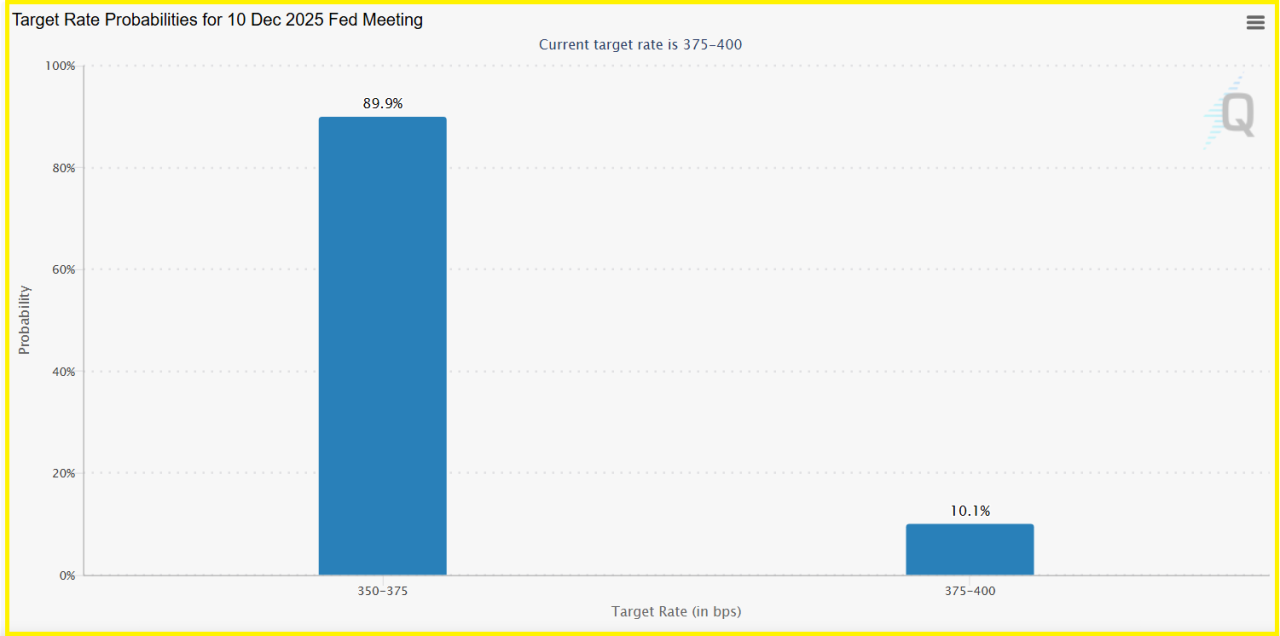

The first is lower real rates. Markets currently price an 80%–90% chance of a 25bp Fed cut, which would reduce the appeal of interest-bearing assets and support gold.

The second is ongoing central-bank buying at similar pace, which removes large volumes of metal from the market.

The third is consistent investor inflows into ETFs and physical products.

The final factor is slow mine supply growth, which limits how quickly the market can respond to rising demand.

Banks build their $5,000 scenarios using this combination of lower real yields, continued reserve accumulation and steady investment flows.

When these conditions strengthen together, the move from $4,200 to $5,000 becomes realistic.

ALSO READ: Italy’s Gold Politics: Central-Bank Independence Versus Fiscal Pressure

When Will Gold Reach $5,00?: Key Risks And Realistic Timeline

Gold could struggle if economic growth picks up, real rates rise or investor flows pull back.

Sharp pullbacks often appear after strong rallies, and technical levels can trigger quick selling.

A fast move to higher prices fits a 2026 timeline, but a slower multi-quarter climb is just as likely if any of the major catalysts weaken along the way.

YOU MIGHT LIKE: How BRICS Gold Buying and Global Reserve Shifts Could Trigger a Major Repricing

Conclusion

Gold can reach $5,000, but it depends on lower real rates, steady reserve buying and firm investment demand.

These factors will show whether the market has the momentum to extend this rally. If they stay aligned, the price path to $5,000 remains open.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- Weekly & Monthly Precious Metals Price Charts In The Absence Of COMEX Data(Dec 7th)

- A Strong Monthly Close for Silver. Is Silver Up & Away?(Nov 30th)

- This Is Why Precious Metals Investors Should Be Watching The USD (Nov 23rd)

- Precious Metals – The Candles Are Clear (Nov 15th)

- Gold, Silver, Miners – The Message of the Charts (Nov 8th)

What Our Members Say

“I have to say — your gold and market analysis is INCREDIBLE. The timing of your pullback forecasts has been spot on. People forget that even the strongest trends need healthy corrections!”

“The way you distinguish between accumulation moments and profit-taking moments has helped me tremendously. You've been right so many times — it’s honestly impressive.”

— Premium Newsletter Member

“Your team puts an extraordinary amount of work into the Gold Alerts and premium market updates. After all these years, the passion and consistency are still there. Respect.”

“Thanks to your research, I’ve become a much more patient investor. My decision-making is calmer, clearer, and more strategic — and the results show it.”

“Looking at gold, silver, and the S&P 500 from a long-term perspective has reduced so much stress. Your approach consistently outperforms short-term trading — the difference is night and day.”

— Gold Alert Subscriber

“I really appreciate the clarity and wisdom in your gold and market commentaries. The way you simplify complex trends has helped me understand the big picture like never before.”

— Long-Time Member