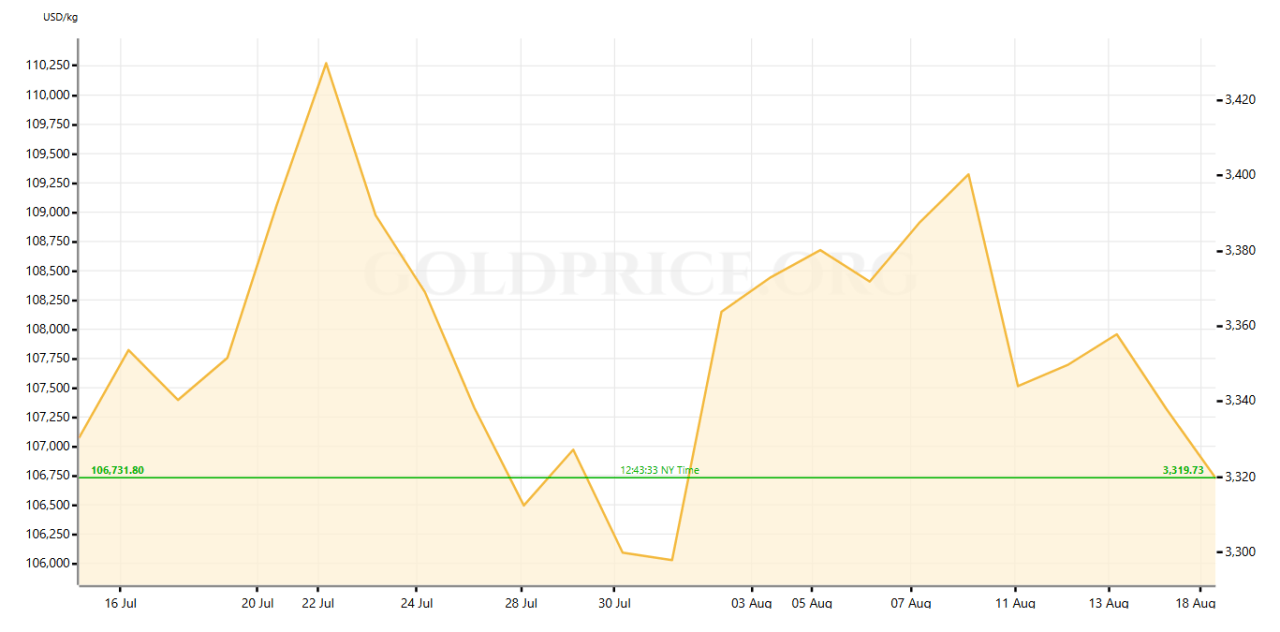

A 26–28% gain in gold’s price so far in 2025 largely reflects purchases by global reserve managers and long-term funds. Their sustained, deliberate buying supports gold’s strength.

Gold has climbed more than 25% in 2025, trading near $3,300–3,400 per ounce. That rise responds not to speculative shifts but to central bank gold purchases and long-term investors adding gold to reserves and portfolios for financial security and diversification.

RECOMMENDED: Gold Price Predictions in 2025-2030

Conviction Buyers Shape the Trend

Gold rose about 27% already this year, with prices hovering around $3,320 per ounce, as central banks and institutions continued purchasing steadily. Every 100 tonnes they add tends to lift gold by approximately 1.7%.

A survey by the World Gold Council finds that 95% of central bank reserve managers plan to add gold over the next 12 months, up from 81% a year earlier.

Over the past three years, central banks have bought more than 1,000 tonnes annually, up from previous averages of 400–500 tonnes. Goldman Sachs expects prices to reach $3,700 by end-2025 and $4,000 by mid-2026 if demand holds.

RECOMMENDED: Want to Make $1M with Gold? Here’s How in 10 Years or Less

Reserves Trends and ETF Flows

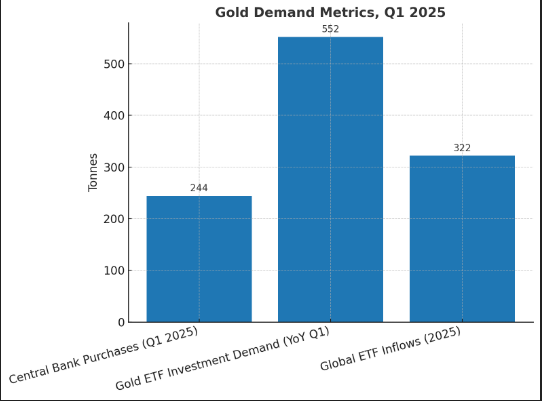

In Q1 2025, central banks added 244 tonnes of gold, while gold ETF investment demand more than doubled year-on-year to 552 tonnes. Global ETF inflows totaled about $30 billion so far in 2025, adding 322 tonnes to holdings.

UBS projects demand will reach nearly 600 tonnes in 2025, the highest since 2011. Survey data also shows that 76% of central banks expect to hold less U.S. dollars in reserves over the next five years, signaling further shift toward gold.

RECOMMENDED: 5 Reasons to Buy Gold in 2025

Conclusion

Gold’s upward trajectory reflects deliberate accumulation by institutions that value long-term preservation and diversification, not short-term sentiment.

With central banks and strategic investors committing steadily, gold’s bullish case remains compelling, even if markets face volatility or changing interest-rate expectations.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service — delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean?(Aug 16)

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)