Central banks added hundreds of tonnes of gold in 2025 while prices hit record highs.

Their steady buying is reshaping the market and raising expectations for 2026 demand.

Official gold purchases reached 45 tonnes in November 2025, lifting total buying for the first 11 months of the year to about 297 tonnes.

At the same time, gold pushed to new all-time highs in January 2026, showing how official demand and market momentum are moving together.

RELATED: Central Banks and Long-Term Investors Fuel Gold’s Surge

Why Central Banks Want More Gold

Many central banks prefer gold because it carries no counterparty risk and cannot be frozen or sanctioned.

As real interest rates trend lower, holding gold becomes more attractive compared with bonds that lose value when rates fall.

Officials are also trying to reduce dependence on the US dollar in their reserves, which makes physical gold a natural alternative.

The fact that buying continued even as prices climbed shows this is a long-term strategy, not a short-term trade.

RECOMMENDED: Gold And Silver Explode To Record Highs After Greenland Tariff Shock

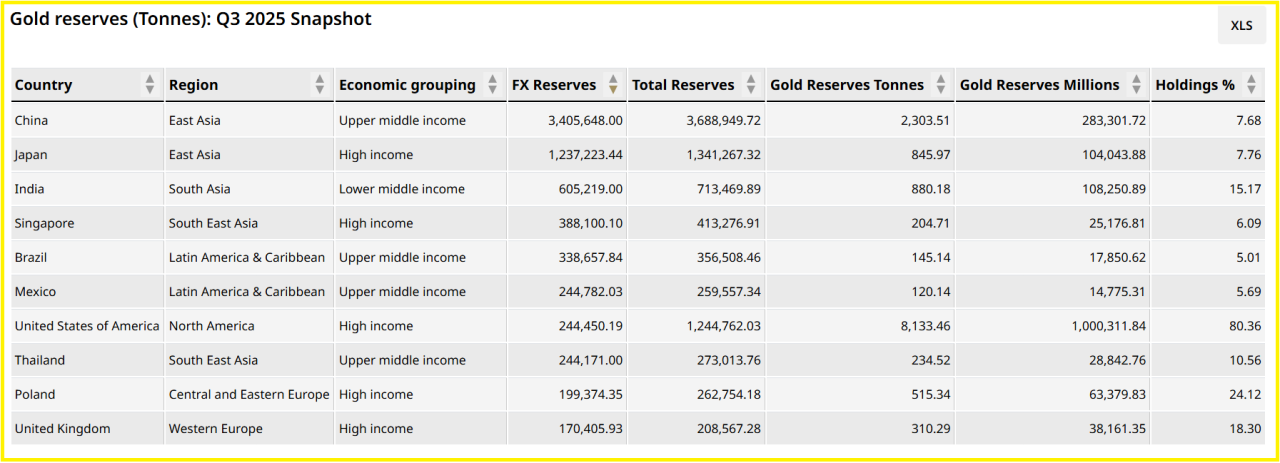

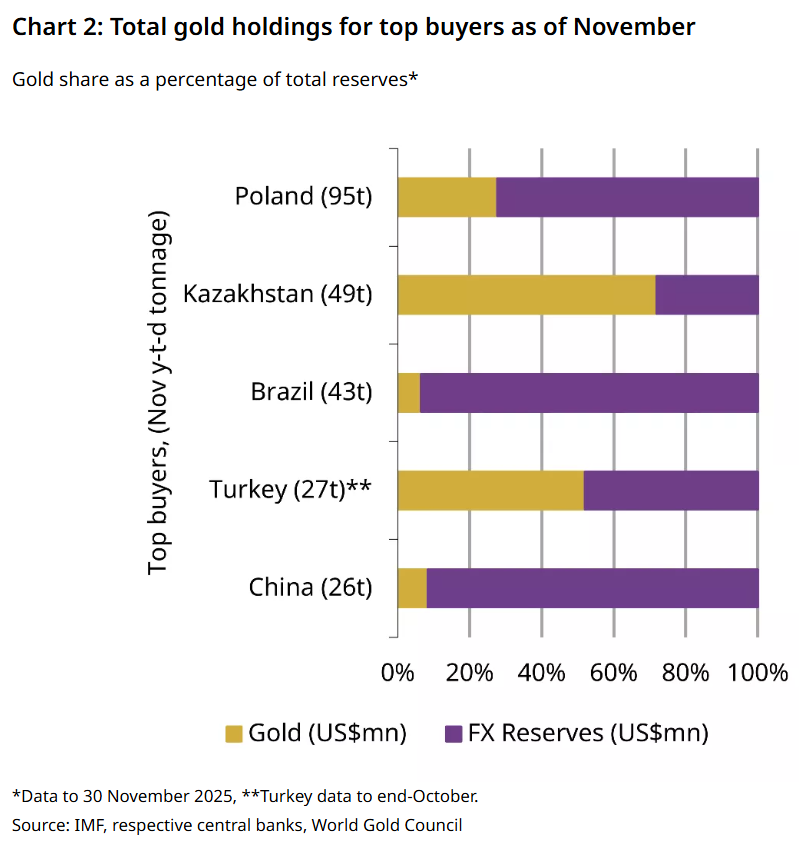

Who Is Buying The Most Gold

China extended its buying streak into a 14th straight month, steadily increasing its holdings rather than making one-off purchases.

Poland re-emerged as a top buyer in November, while several emerging-market nations also raised their allocations.

When these moves are combined, official buyers now account for a significant share of total annual gold demand, shifting how and where physical bullion flows around the world.

RECOMMENDED: China Is Stockpiling Gold at Record Levels – What This Means for Global Gold Prices

What This Means For Gold Prices

Strong official buying helped push spot gold to fresh records in mid-January 2026, and ETF inflows picked up at the same time.

More central-bank demand tightens physical supply, which increases the chance of further price gains if investment demand stays firm.

Major market houses have already lifted their upside targets, reflecting this tighter balance between supply and demand.

Conclusion

Central-bank buying has become the quiet backbone of the gold market in 2026, and their monthly purchase data now carry as much weight as traditional macro signals.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.