Gold prices have surged past $3,300 per ounce while silver remains undervalued with analysts predicting a rise to $50 per ounce by the end of 2025.

As we move into the second half of 2025, investors are closely watching the dynamics of gold and silver, two assets that have traditionally offered protection and growth during turbulent times.

Amid rising geopolitical tensions, potential central bank rate cuts, and growing industrial demand, both metals present compelling but distinct opportunities.

This analysis explores gold and silver’s investment prospects by examining technical trends, underlying fundamentals, and forward-looking predictions.

Gold: Safe-Haven Appeal Amidst Economic Uncertainty

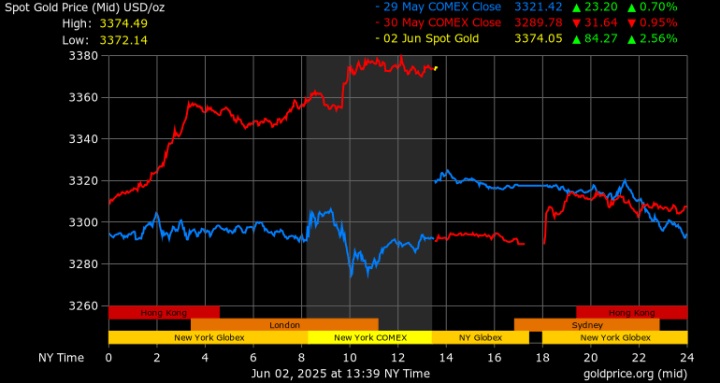

Gold prices have surged past $3,300 per ounce, bolstered by geopolitical tensions, trade disputes, and expectations of interest rate cuts by major central banks.

Notably, countries like China have been increasing gold reserves, reinforcing the metal’s role as a safe-haven asset. Many gold miners are avoiding hedging strategies, signaling confidence in sustained price strength.

On the technical side, gold has seen strong upward momentum, with analysts predicting a potential climb to $3,700 per ounce by year-end, and some forecasts even suggesting $4,000.

This optimism is supported by gold’s resilience against inflationary pressures and its role as a non-yielding asset in a low-rate environment. However, investors should remain mindful of price volatility, especially if central banks delay rate cuts or geopolitical tensions ease.

Silver: Industrial Demand and Undervaluation

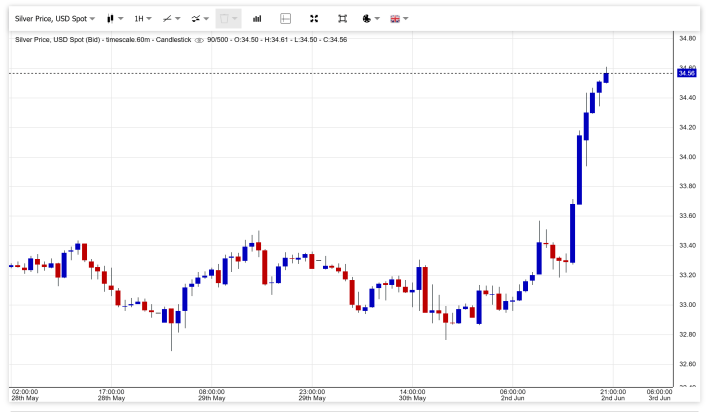

Silver, currently trading around $34 per ounce, presents a contrasting story. With a gold-to-silver ratio near 100:1, silver appears undervalued relative to gold.

This undervaluation is further highlighted by the metal’s dual role as both an investment and an industrial commodity. Demand from renewable energy projects, electronics, and electric vehicles is expected to drive significant growth.

Silver’s fundamentals are compelling. A projected global supply deficit of approximately 149 million ounces in 2025, coupled with tightening mine supply, suggests upward pressure on prices.

Analysts forecast silver could reach $40 to $50 per ounce by the end of the year, driven by industrial demand and constrained supply. However, silver remains more volatile than gold, and investor sentiment has been mixed due to economic headwinds.

Conclusion

Gold remains a robust option for those seeking stability amid global economic uncertainty, while silver offers significant growth potential due to its industrial applications and current undervaluation. For investors, a diversified approach—balancing gold’s stability with silver’s upside potential—may offer an optimal strategy in mid-2025.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27)