Investor buying surged worldwide as gold prices hit historic highs and changed demand across markets.

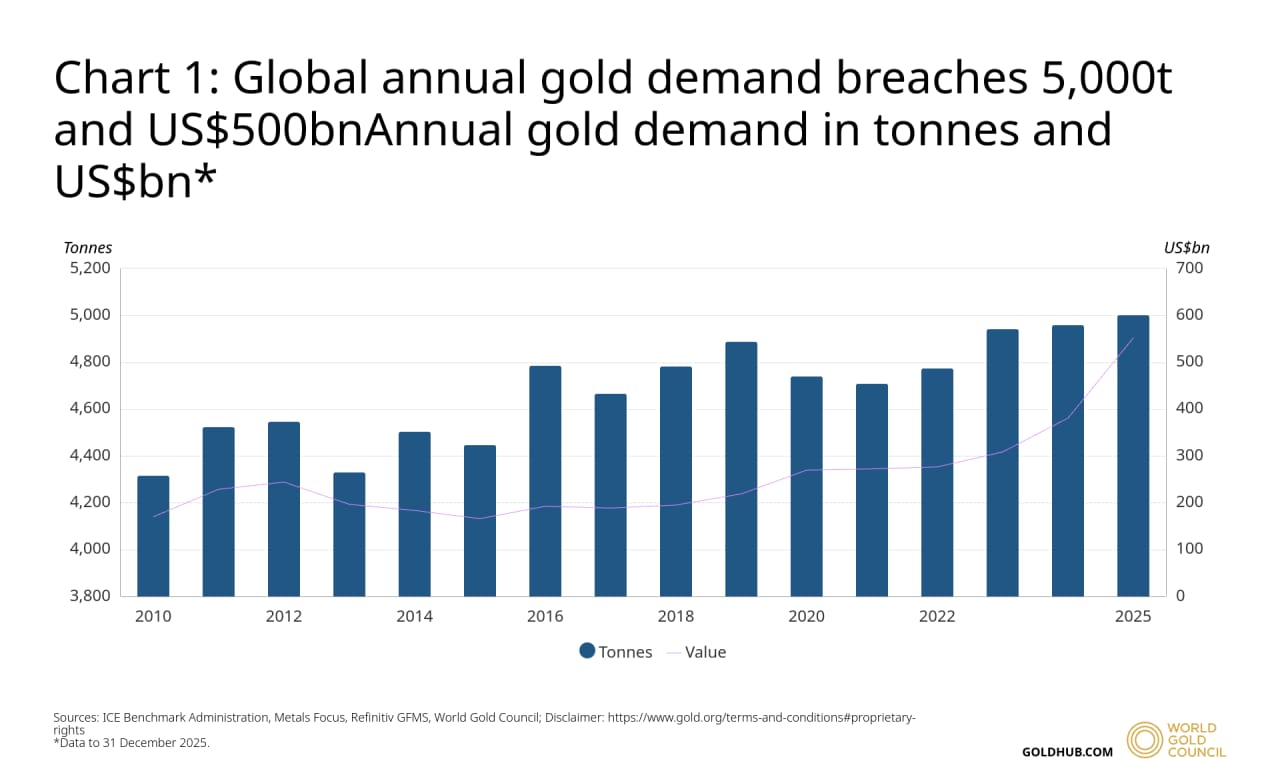

Global gold demand climbed to a record 5,002 metric tonnes in 2025, according to a recently released report by the World Gold Council. Investment demand jumped 84% from the prior year, while ETF inflows totaled about $89bn.

Prices broke above $5,000 per ounce and briefly touched $5,602/oz, influencing buying behavior across investors, central banks, and consumers.

RECOMMENDED: Gold Jumps After Goldman Raises Target – Is $5,400 Possible?

Investors Flood The Gold Market

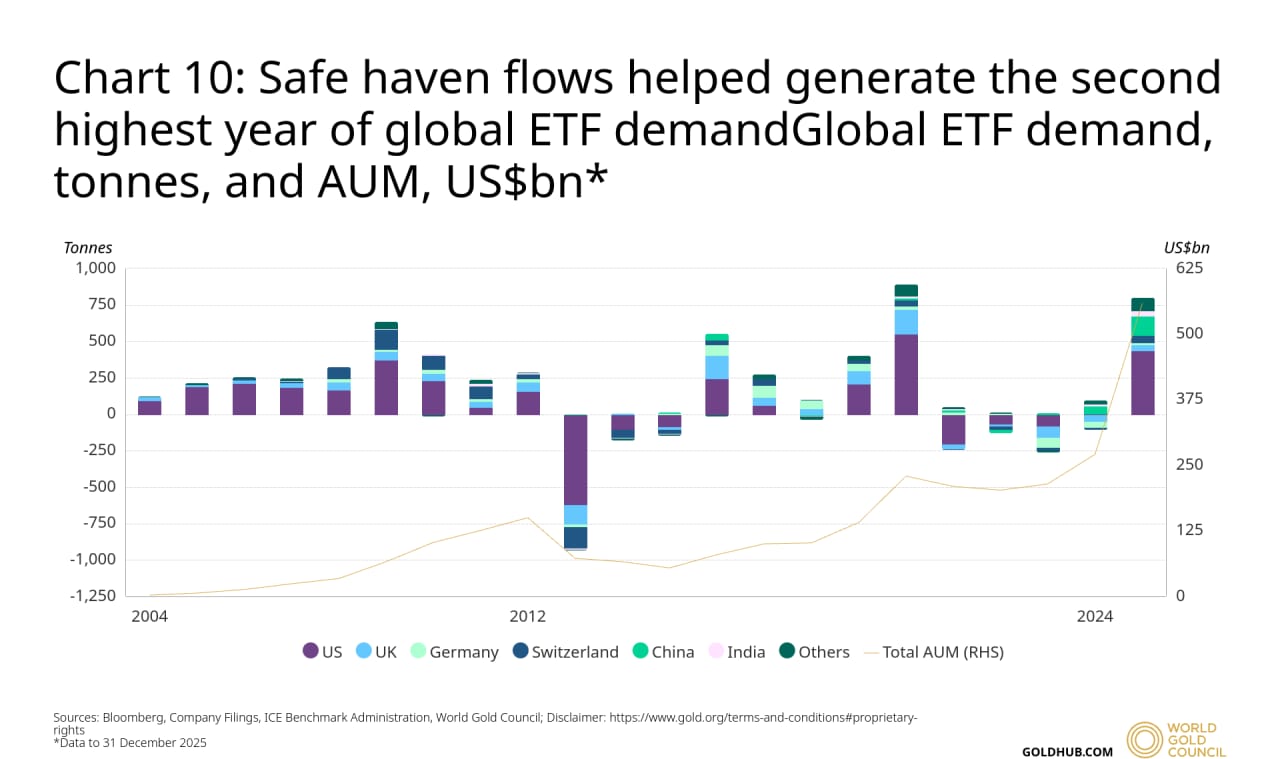

Investment demand expanded faster than any other category in 2025. Exchange traded funds recorded their strongest inflows on record, while retail buyers increased purchases of bars and coins.

Total investment demand rose 84% year on year, making it the single largest source of growth. ETF inflows alone reached about $89bn, indicating strong institutional interest.

Investors focused on currency risk, rising government borrowing, and lower inflation adjusted yields as reasons to increase exposure.

ALSO READ: Wall Street Strategist Dumps Bitcoin, Goes All-In on Gold

Gold Prices Break Records

Gold prices surged past $5,000 per ounce and briefly peaked at $5,602/oz. The rally lifted gold into a new price range, changing buying patterns across the market.

Jewellery demand declined in China and India as consumers delayed purchases or reduced volumes. Manufacturers also faced higher input costs, while retail buyers became more selective.

Analysts noted that strong investor demand combined with limited supply flexibility added to short term price swings.

RECOMMENDED: Gold Heading Towards $6,000/oz? Deutsche Bank Believes It Is

Central Banks And Regional Demand Shifts

Central banks remained net buyers of gold in 2025, although purchases slowed compared with earlier peak years. Mine supply increased only modestly, and recycled gold did not rise enough to offset demand growth.

Regional trends also diverged. Western markets recorded stronger investment flows, while Asian jewellery demand softened due to higher prices and weaker consumer affordability.

RECOMMENDED: Central Banks Are On A Gold-Buying Stampede In 2026

Conclusion

The 5,002 tonne record marks a clear shift in how gold demand forms. Investment flows now play a larger role, while high prices influence traditional consumer markets.

Should You Invest In Gold Right Now?

Before you invest in Gold, you’re going to want to read our latest Premium Gold & Silver Investing alert. We reveal our outlook for Silver in the short and long term.

We called the rally in Gold long before it happened, and earlier in the week we suggested Gold could be primed for profit taking.

Our premium members were ahead of the curve, not panic buying or selling.

- Gold to Silver Ratio at 50. Ready for Rotation? (Jan 25th)

- Time To Take Profits? (Jan 17th)