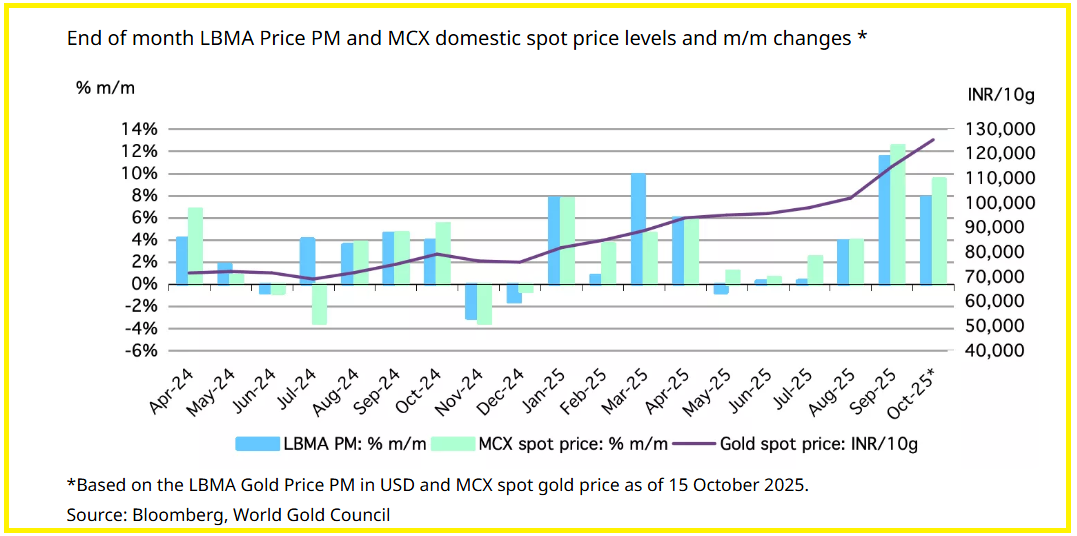

Record festival demand, heavy imports, and rising premiums pushed Indian gold prices higher than global spot this November.

Gold imports in India reached about $14.72 billion in October, which is roughly triple last year’s level. That kind of volume places real pressure on the physical supply chain because the metal moves straight into retail channels instead of sitting in warehouses.

This season’s Gold demand in India created a market where local prices reacted more to availability than to global macro signals, and that shift shaped how traders viewed November’s price action.

ALSO READ: Can the Gold Rally Extend or Is a Retrace Coming?

Festival Gold Demand And Import Shock

India’s festival and wedding season usually lifts gold consumption, but this year’s increase stood out. The $14.72 billion import figure shows that buyers acted early and at scale, and that pushed refiners and wholesalers to accelerate shipments from hubs like Switzerland and the UAE.

When import flows concentrate into a short window, the domestic market becomes more sensitive to small shortages. That sensitivity showed up in retail turnover, where coins and bars sold faster than usual.

This pattern developed through the month because stronger coin demand often reflects households acting on price dips rather than waiting for seasonal discounts. Once those small-lot purchases pick up speed, dealers start competing for whatever metal is already in the system.

This is why the physical side, not the futures market, shaped much of November’s movement.

RECOMMENDED: How Renewed Central-Bank Gold Purchases Are Re-Shaping Prices

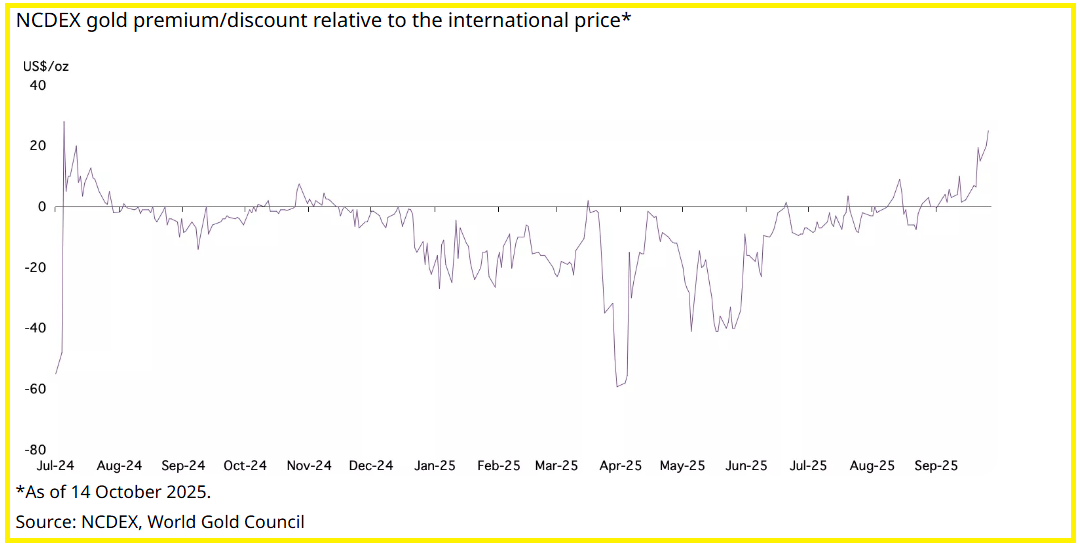

Product Mix And Local Premiums Change Price Mechanics

Indian buyers leaned toward coins and bars this season, and that shift matters because these products leave the supply chain quickly. Jewellery orders can take longer to deliver, but coins move immediately, so inventories drain faster.

As inventories thinned, dealers lifted gold premiums in India to about $25 per ounce at times, which signaled real stress in the local market. When premiums rise that sharply, domestic gold prices can disconnect from international spot.

Pay close attention to those moments because they often reveal where the next price adjustment will come from. In November, the premium spike suggested that local buyers were setting the tone rather than global traders.

RECOMMENDED: Smart Investors Are Buying Gold in 2025: 9 Must-Know Reasons

Conclusion

India’s festival surge, concentrated imports, and aggressive small-lot buying created a market where physical supply shaped the price trajectory.

The mix of strong gold demand in India and tight inventories made November’s moves more about real-world flows than investor positioning.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- Precious Metals – The Candles Are Clear (Nov 1th)

- Gold, Silver, Miners – The Message of the Charts (Nov 8th)

- What’s Next For Precious Metals? (Nov 2nd)

- The Expected Pullback Is Here. How Much Downside Is There In Precious Metals? (Oct 25th)

- Gold Overheated. Silver Breakout Back Test. What’s Next? (Oct 18th)