Gold fell more than 5% in one session as investors reacted to reports of a more hawkish Fed chair pick.

A stronger dollar and rising bond yields triggered fast selling across precious metals.

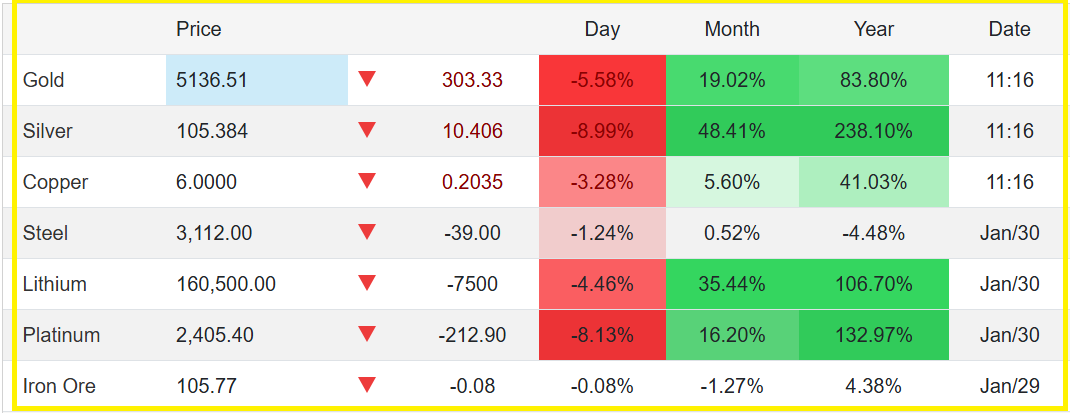

Gold prices dropped sharply on Friday, sliding about 5% to around $5,140 per ounce in U.S. trading.

The sudden fall followed reports that Kevin Warsh is emerging as the top candidate to lead the Federal Reserve.

The news shifted interest rate expectations, pushed the dollar higher, and sparked heavy selling in gold after weeks of strong gains.

RECOMMENDED: Will Central-Bank Buying Keep Gold’s Rally Alive?

How The Market Reacted To The Fed Rumor

Selling accelerated soon after the reports surfaced. Many short-term traders rushed to lock in profits, while automated trading systems added to the pressure. Spot gold fell from its session high to around $5,140 per ounce within hours.

At the same time, the U.S. dollar strengthened against major currencies.

Treasury yields also moved higher, making gold less attractive because it does not pay interest. Silver and platinum followed gold lower, showing that the move affected the entire precious metals sector.

Some gold-backed ETFs recorded heavier outflows, suggesting that retail and institutional investors both reduced exposure during the selloff.

RECOMMENDED: Goldman Sachs Just Raised Its 2026 Gold Price Target to $5,400

Why A Hawkish Fed Chair Hurts Gold Prices

Kevin Warsh is seen by many investors as more supportive of tighter monetary policy. If he becomes Fed chair, markets expect interest rates to stay higher for longer.

Higher rates usually support the dollar and raise borrowing costs. This makes holding gold less appealing compared with bonds or cash. As expectations shifted, traders quickly adjusted their positions.

January’s rally left many investors with large paper profits. When the policy outlook changed, those gains turned into selling pressure almost immediately.

What Comes Next?

Markets will now focus on official signals about the Fed leadership choice. Upcoming U.S. inflation and jobs data will also play a major role in shaping rate expectations.

If you are trading, monitor ETF flows, trading volumes, and key price levels to see whether buyers return. A slowdown in selling could signal that the market is stabilizing.

RECOMMENDED: Central Banks Are On A Gold-Buying Stampede In 2026

Conclusion

Gold’s sharp drop proves that markets are sensitive to changes in U.S. policy expectations. Until the Fed chair decision becomes clear, price swings are likely to remain intense and unpredictable.

Should You Invest In Gold Right Now?

Before you invest in Gold, you’re going to want to read our latest Premium Gold & Silver Investing alert. We reveal our outlook for Silver in the short and long term.

We called the rally in Gold long before it happened, and earlier in the week we suggested Gold could be primed for profit taking.

Our premium members were ahead of the curve, not panic buying or selling.

- Gold to Silver Ratio at 50. Ready for Rotation? (Jan 25th)

- Time To Take Profits? (Jan 17th)