Gold trades above $3,640 with a 38% YTD gain. Fed rate-cut odds, heavy ETF inflows and steady central bank buying point to higher targets.

Spot gold current price sits around $3,644 an ounce, up roughly 38% year-to-date as markets price an expected Federal Reserve rate cut and global demand rises.

Markets put about an 89% chance on a 25bp Fed cut this month, while the dollar and the U.S. 10-year yield have softened, removing a key headwind for non-yielding gold.

RELATED: Trump’s Fed Threat Could Spark Gold Rally, Says BofA

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Macro Factors: Fed Path, Yields And Dollar

Expectations for lower U.S. rates reduce the opportunity cost of holding gold, and weaker real yields typically lift bullion. Traders now watch monthly U.S. jobs and inflation prints for signs the Fed will ease, which would sustain downward pressure on Treasury yields and the dollar.

Those moves create a clear macro path that supports higher nominal gold prices.

Investor Flows And Central Bank Demand

Exchange traded funds have attracted large allocations this year, with some gold and silver ETFs reporting returns up to 44% in 2025, drawing fresh retail and institutional money.

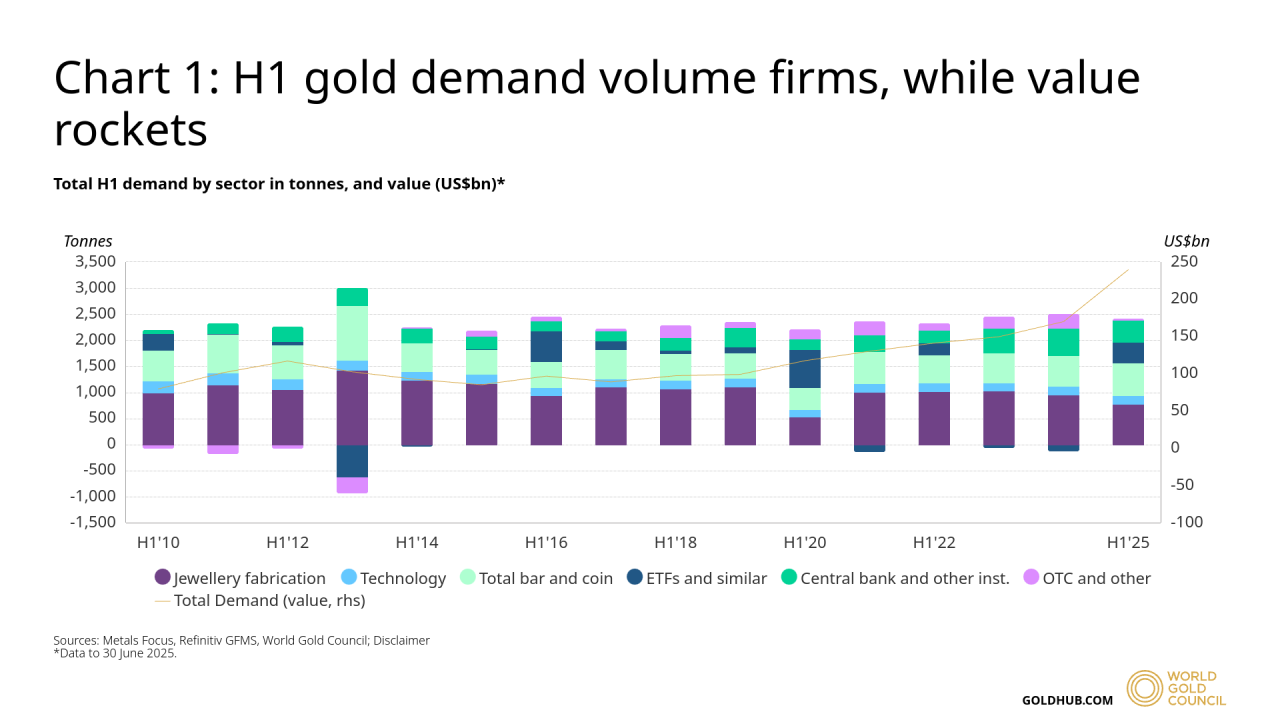

Global gold demand rose to about 1,249 tonnes in Q2 and value hit roughly US$132bn, while central banks continued net buying after a 244t net buy in Q1 and sizable purchases in Q2.

That combination keeps a steady baseline of physical demand beneath the price.

RECOMMENDED: De-Dollarization Driving Gold Higher, Is The Next Rally Here?

Price Levels And Signals To Watch

Models from major banks place base gold price prediction to roughly $3,700 by end-2025 and $4,000 by mid-2026 if current flows persist.

Upside to $4,500–$5,000 requires larger reallocations out of dollar assets or a serious loss of confidence in U.S. institutions, scenarios flagged by analysts as tail risks.

Watch these triggers closely: Fed policy surprises, weekly ETF net inflows, reported central bank purchases, the DXY, and the 10-year yield.

RECOMMENDED: 5 Reasons to Buy Gold in 2025

Conclusion

Gold shows a credible route to $4,000 given dovish Fed expectations and heavy buying. Higher targets above $4,500 remain possible but conditional on large reallocations or a material shock to confidence in dollar-based assets.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service, delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Monster Basing Patterns in Precious Metals Resolving Higher (Sept 6th)

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean?(Aug 16)

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)