After a short consolidation phase, the gold price has resumed the positive confirmation bias following the FOMC meeting. Is this is a buy or sell signal? find out below.

After rallying to a new all-time high fueled by aggressive trade policies in Washington, gold prices experienced slight corrections, even dipping toward $3200.

However, gold has started hinting at a possible bullish uptrend at the time of writing. It has even climbed back above $3300, currently trading around $3340.

Why is Gold Rallying Today?

The biggest price driver of the recent bullish wave for gold seems to be the stream of negative economic news from the US.

It started with a negative ISM Services PMI reading on Monday, which emboldened gold’s move above $3,300. The Fed’s interest rate decision after the May FOMC Meeting which took place this week and resulted in no change, further fuelled the price of gold.

What was the Most Likely FED Interest Rate Decision?

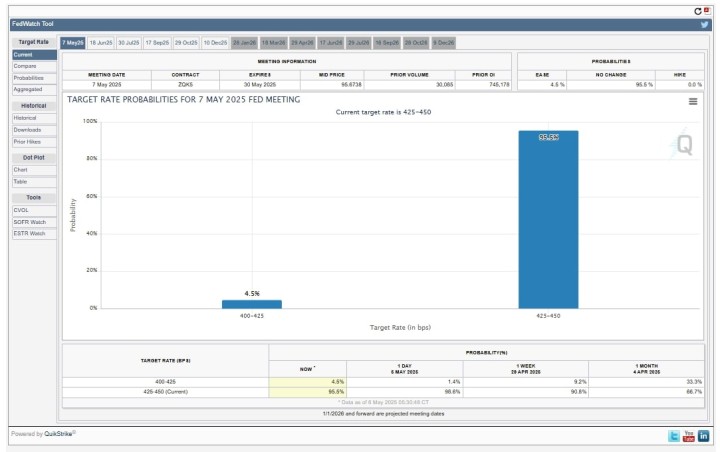

The FED was expected to hold interest rates steady at the current range of between 4.25% and 4.50%. The most probable explanation for this is that inflation remains above the central banker’s 2% target and could get even worse due to the ongoing tariff wars.

Prior to the event, data from the CME FEDWatch tool indicated that 99.5% of analysts agreed with this argument and expected the FED to leave interest rates unchanged.

Should You Buy or Sell Gold Right Now?

Although the FED did not cut interest rates this week, it is likely that it will reaffirm its commitment to make two cuts before year-end.

This, combined with the fact that the US Dollar continues to lose value against popular global currencies, creates a perfect Launchpad for gold’s next leg of bullish run.

The recent price rebound for gold is, therefore, a potential buy signal. We are also wildly bullish about gold’s future price action, with our analysis suggesting that it has the potential to peak above $3600 before year-end.

Much of this uptrend will be driven by the aggressive Trump tariffs, fears of US and global economic recession, rising global political tensions, and central bank buying.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Gold Retracing, Silver and Miners at a Critical Level (May 4th)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27th)

- Highly Unusual Readings In Gold & Silver Markets (April 20th)

- Gold Miners Breaking Out, Here Are A Few Gold Stock Tips. What About Silver & Miners? (April 13)

- Gold, Silver, Miners – Bottoming or More Downside? (April 5th)

- Why Next Week Matters for Gold — But Less So for Silver (March 29th)

- Is the USD About to Bounce? What Are the Implications? (March 22nd)