Falling real yields and heavy ETF buying pushed gold and silver to multi-year highs. Traders now watch real yields, ETF flows, the dollar, and options skew for short-term signals.

Gold climbed to record levels in 2025, hitting roughly $3,895 per ounce and rising about 47% year-to-date, while silver soared over 60% YTD.

These moves reflect a clear shift in where macro cash flows go as bond markets price faster Fed easing and real yields fall.

RECOMMENDED: De-Dollarization Driving Gold Higher, Is The Next Rally Here?

The Numbers: Yields Down, Metals Up

Global physically backed gold ETFs recorded tens of billions of dollars of inflows in the first half of 2025, leaving total holdings at multi-year highs.

The SPDR Gold Trust alone pulled in roughly $12.9B so far in 2025, and it posted one of its largest single-day inflows on record.

Those fund flows supply durable buying that moved the market.

RECOMMENDED: Ray Dalio Says Gold Will Rally Further As U.S. Debt Mounts

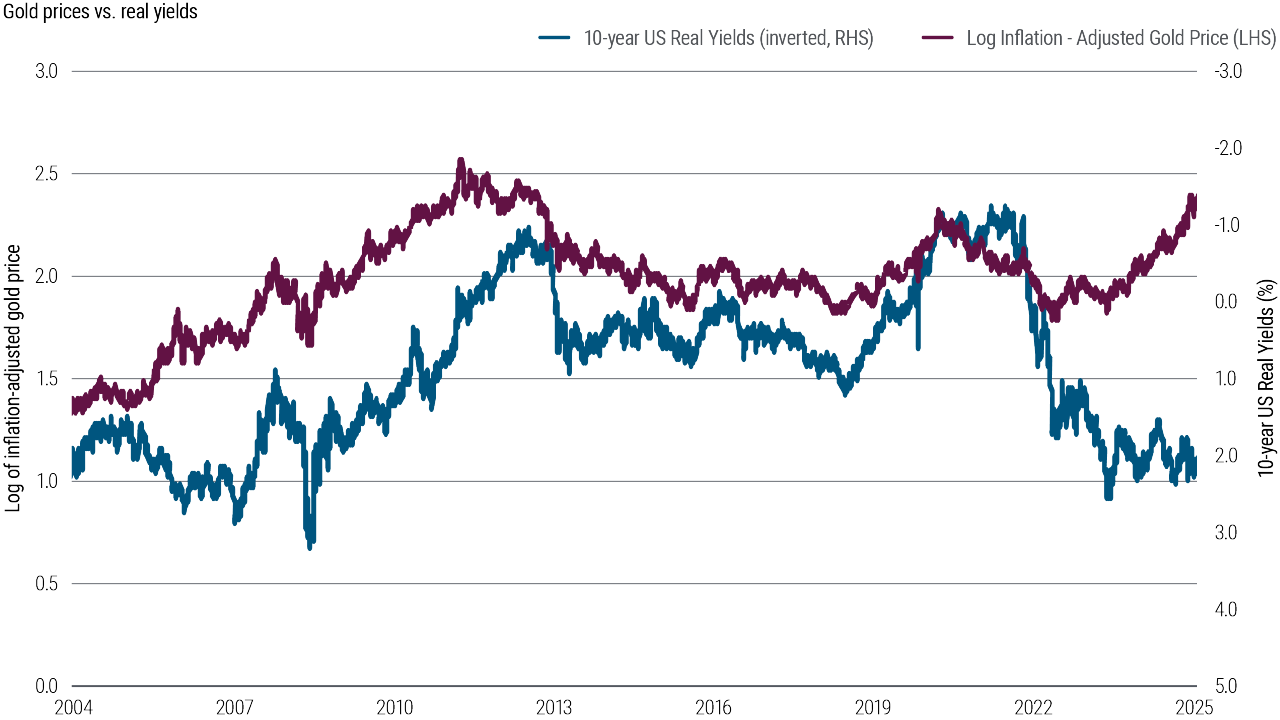

Why Real Yields And The Dollar Matter

Real 10-year yields set the opportunity cost of holding non-yielding metals. Research that regress gold on the TIPS 10-year real yield shows a historical link: a 100 basis point rise in real yields corresponds to about an 18% drop in inflation-adjusted gold.

At the same time, a softer dollar and growing odds of Fed rate cuts have reduced bond yields and lifted precious metals.

RECOMMENDED: Silver Up 45% in 2025: Structural Deficit Or Short-Lived Spike?

What To Watch As a Trader

Focus on four live indicators:

- TIPS-implied 10-year real yields and gold prices for trend direction.

- Weekly Gold ETF flows and GLD activity as a proxy for investor demand.

- The DXY dollar index for cross-currency pressure.

- Options skew and open interest for signs of speculative positioning that can amplify moves.

We recommend you use these together rather than singly to judge momentum and risk.

ALSO READ: Gold Eyes $4,000–$5,000: Momentum Fueled by Fed Outlook

Conclusion

2025’s yield moves changed the market regime. Treat gold and silver as macro-flow assets and monitor yields, flows, the dollar, and derivatives to time trades and manage risk.

When is The Best Time To Buy Gold & Silver?

To receive key alerts and analysis on the best times to buy Gold and Silver, you should consider Joining the original market-timing research service — delivering premium insights since 2017.

InvestingHaven alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience.

This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Will Silver Set a Major Top at $50/oz? Our Deepest Analysis Yet. (Sept 27)

- Silver Rally Fueled by Absent Speculators (Sept 20)

- What Happens When Silver Hits 50 USD/oz? (Sept 13)

- Monster Basing Patterns in Precious Metals Resolving Higher (Sept 6th)

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean? (Aug 16)