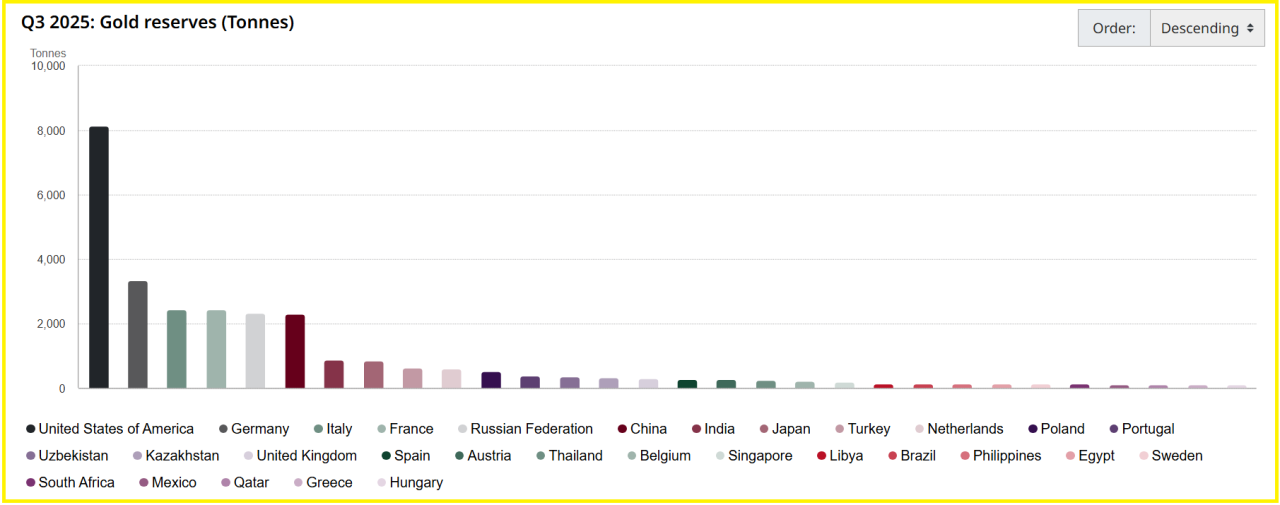

Central banks and BRICS countries are buying large volumes of gold, reducing market supply. This trend is supporting stronger price levels and reshaping gold’s role in global reserves.

Gold is attracting serious attention from central banks, especially BRICS nations looking to diversify their reserve holdings. Annual official BRICS gold purchases have held above 1,000 tonnes in recent years, with one quarterly period in 2025 showing gains of about 166 tonnes.

These steady flows remove metal from circulation and influence how the market values gold.

YOU MIGHT LIKE: Central Banks and Long-Term Investors Fuel Gold’s Surge

BRICS Gold Purchases: Why BRICS Reserve Strategy Matters

BRICS countries want to rely less on traditional reserve currencies, so they are actively building their gold reserves. Some recent reports show around 20 tonnes of purchases in November 2025 alone.

These moves are not short-term trades. They aim to build long-term protection and financial independence. As multiple countries accumulate at similar times, demand becomes consistent and meaningful.

This activity limits available gold for commercial and investment use, creating a tighter supply environment.

RECOMMENDED: Smart Investors Are Buying Gold in 2025: 9 Must-Know Reasons

How Official Buying Affects Gold Price Outlook

When central banks add gold to their reserves, the metal leaves the open market permanently. That means less supply for investors, manufacturers, and ETFs. Reduced liquidity often leads to stronger price reactions, as smaller moves in demand trigger larger market responses.

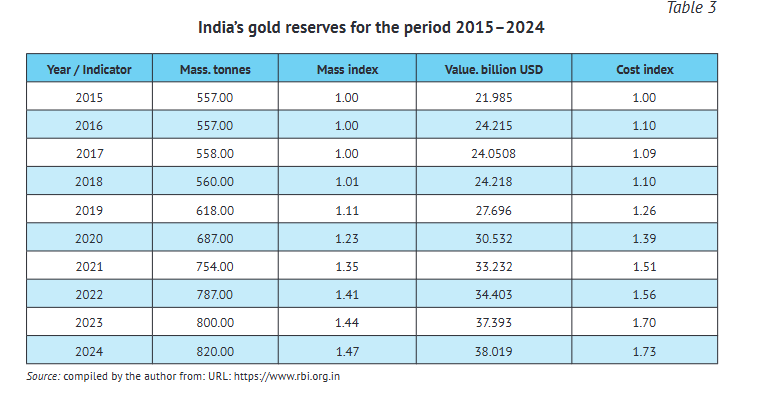

In India, gold now accounts for over $100bn of reserve value, showing how influential it has become.

With less gold available, the market absorbs shocks poorly, which often results in stronger price floors.

RECOMMENDED: Gold Demand In India: Festival-Fueled Imports Tightens Supply

What To Track Going Forward

Watch official purchase data, Gold market trends 2025, IMF reserve updates, World Gold Council monthly flow reports, and announcements from BRICS-related events.

Also , focus on consistent multi-month or quarterly buying activity, as that signals lasting change rather than temporary interest.

Conclusion

Strong and sustained BRICS gold purchases can reprice bullion by tightening supply and strengthening its position as a core reserve asset. Keep an eye on central-bank flow trends to understand where gold could move from here.

How to Invest in Gold with eToro

Looking to benefit from the current gold trend and your gold price forecast or prediction? With eToro you can get exposure to gold in just a few clicks.

- Open a free eToro account and complete verification.

- Search for “Gold” or related instruments on the platform.

- Decide your position size, set risk parameters, and place your trade.

Start Investing in Gold on eToro

Disclaimer: 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- Precious Metals – The Candles Are Clear (Nov 1th)

- Gold, Silver, Miners – The Message of the Charts (Nov 8th)

- What’s Next For Precious Metals? (Nov 2nd)

- The Expected Pullback Is Here. How Much Downside Is There In Precious Metals? (Oct 25th)

What Our Members Say

“I have to say — your gold and market analysis is INCREDIBLE. The timing of your pullback forecasts has been spot on. People forget that even the strongest trends need healthy corrections!”

“The way you distinguish between accumulation moments and profit-taking moments has helped me tremendously. You've been right so many times — it’s honestly impressive.”

— Premium Newsletter Member

“Your team puts an extraordinary amount of work into the Gold Alerts and premium market updates. After all these years, the passion and consistency are still there. Respect.”

“Thanks to your research, I’ve become a much more patient investor. My decision-making is calmer, clearer, and more strategic — and the results show it.”

“Looking at gold, silver, and the S&P 500 from a long-term perspective has reduced so much stress. Your approach consistently outperforms short-term trading — the difference is night and day.”

— Gold Alert Subscriber

“I really appreciate the clarity and wisdom in your gold and market commentaries. The way you simplify complex trends has helped me understand the big picture like never before.”

— Long-Time Member