Surging global debt is pushing investors toward gold and silver as safe havens amid fiscal stress and negative real yields.

Global debt has surged to record levels, topping $324 trillion in Q1 2025, a $7.5 trillion jump in just three months . As governments borrow more, investors increasingly turn toward hard assets. This rising global debt is shifting investor behavior toward precious metals like gold and silver.

Debt Loads Fuel Precious‑Metal Demand

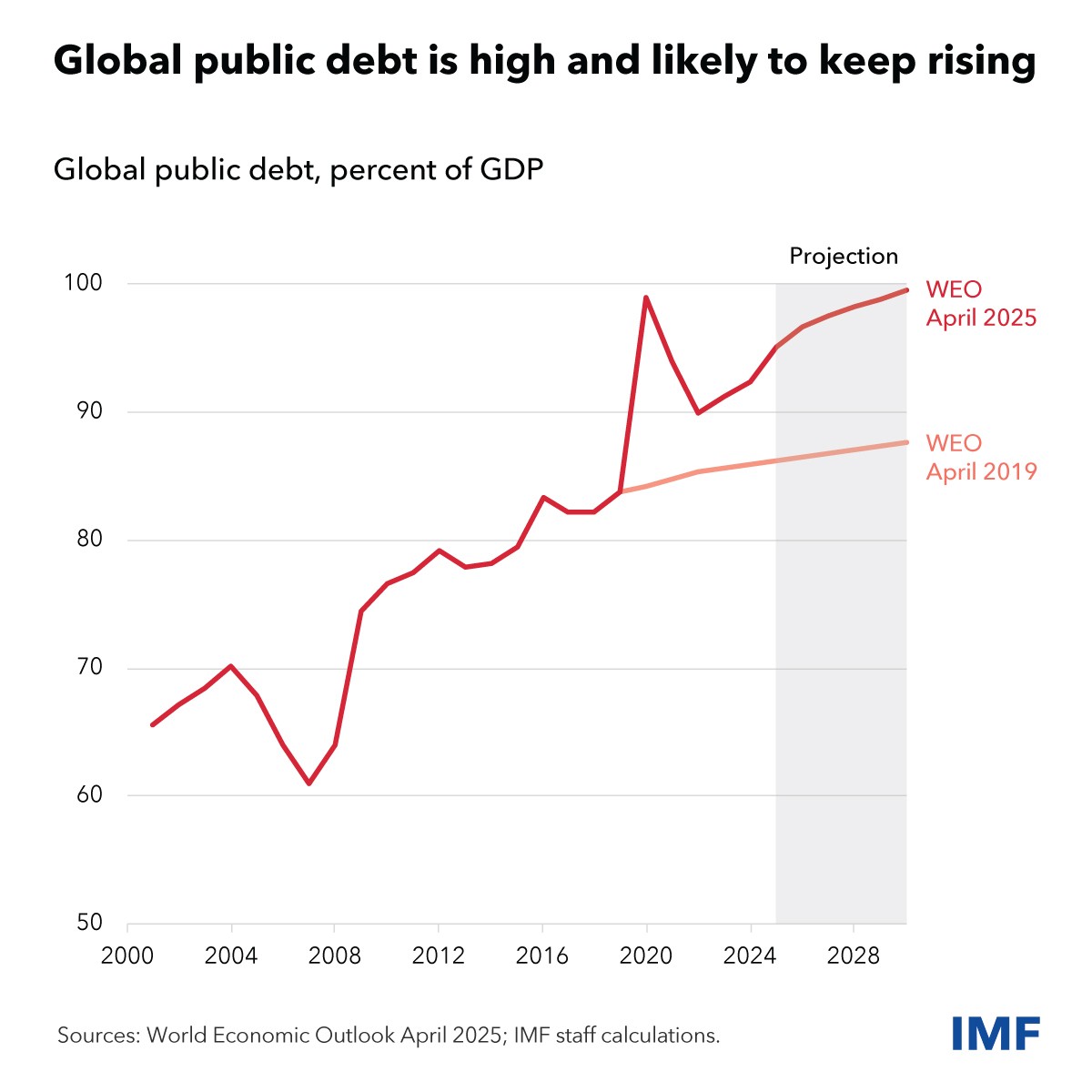

Public debt is now nearing 100% of global GDP, with 80% of countries experiencing rising debt-to-GDP ratios .

In the U.S. alone, national debt exceeds $36 trillion, and China’s debt is expected to hit 100% of GDP by year-end.

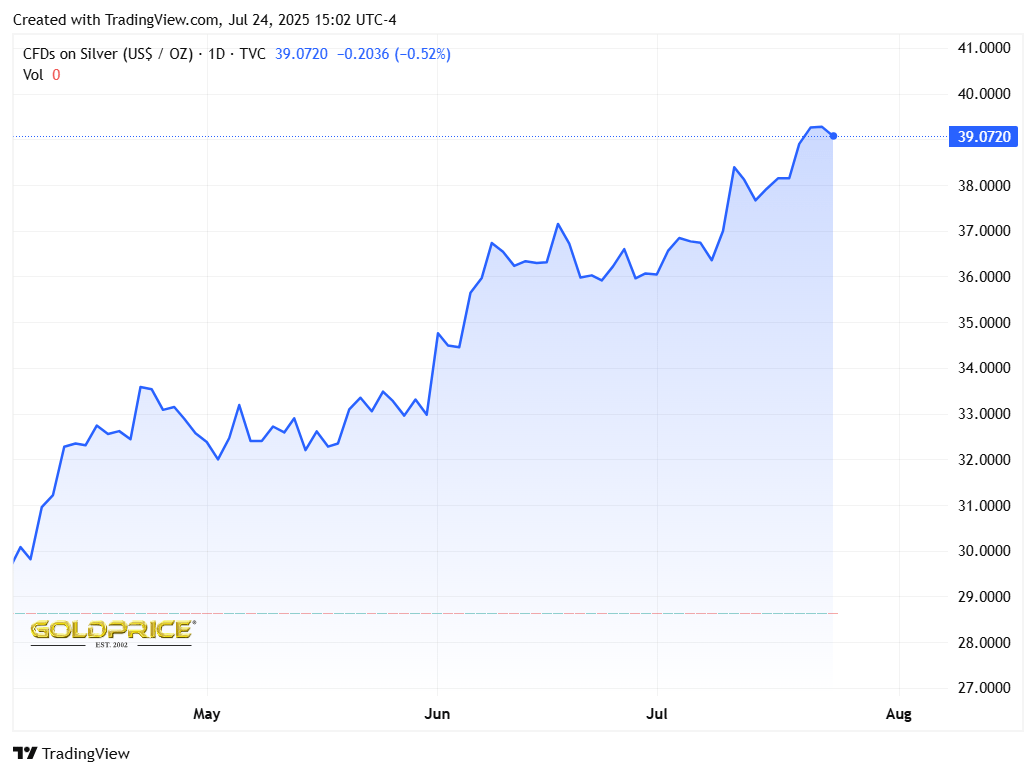

This debt crisis weakens faith in fiat currencies, making gold a preferred store of value. Gold has rallied roughly 29% year‑to‑date, while silver has climbed about 25–36%, reflecting how debt levels boost silver prices and strengthen gold’s appeal.

Market Mechanics: Bond Yields, Currency & Metal Inflows

Heavy government borrowing increases bond issuance, pressures yields upward, and can strain currencies. When real interest rates turn negative, meaning yields below inflation, precious metals outperform.

Silver, for instance, surged to $39.40/oz, its highest since 2011, up 36% YTD, outpacing gold’s 31%. Industrial demand, tight supply, and investor interest fueled this rally. Central banks and metal ETFs also are increasing holdings, reinforcing inflows into gold and silver as safe havens.

Sovereign Debt Crises & Looming Currency Risks

Sharp debt growth sometimes mirrors historical debt crises; Japan’s 260% debt/GDP model offers a cautionary tale. As governments struggle to service liabilities, their fiat currencies come under pressure.

With US gold reserves representing just 2% of debt liabilities, any escalation in debt worry could trigger material re‑rating of metal prices – especially in a high debt‑to‑GDP environment

Conclusion

The combination of historic debt expansion and negative real rates underpins a strong case for precious‑metal investment.

Unless governments rein in fiscal deficits, metals remain structurally supported. For investors tracking fiscal data, tactical exposure to gold and silver can offer a hedge against macro uncertainty.

Our most recent alerts – instantly accessible

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)

- Gold & Silver – The Big Picture Charts That Matter (June 21)