Strong central bank demand and tight supply could push gold sharply higher. Even small portfolio shifts may move prices fast.

Gold could see one of its strongest years in decades. J.P. Morgan expects prices to reach $6,300 per ounce by year-end as official buyers stay active and available supply remains limited.

The bank’s forecast stands out because it relies on measurable flows instead of market sentiment. In some scenarios, prices extend well beyond current levels if buying continues at recent rates.

RELATED: Goldman Sachs Just Raised Its 2026 Gold Price Target to $5,400

Why JP Morgan Is Bullish On Gold

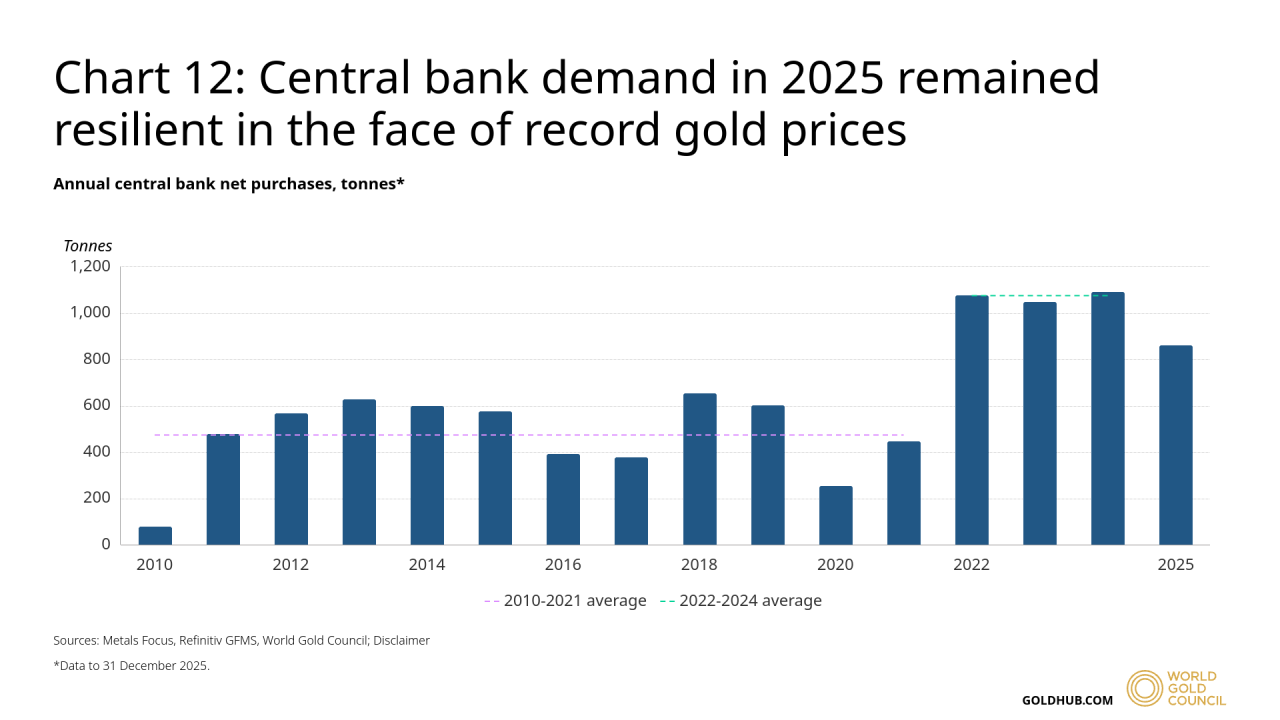

J.P. Morgan points to steady central bank purchases as a key support for prices.

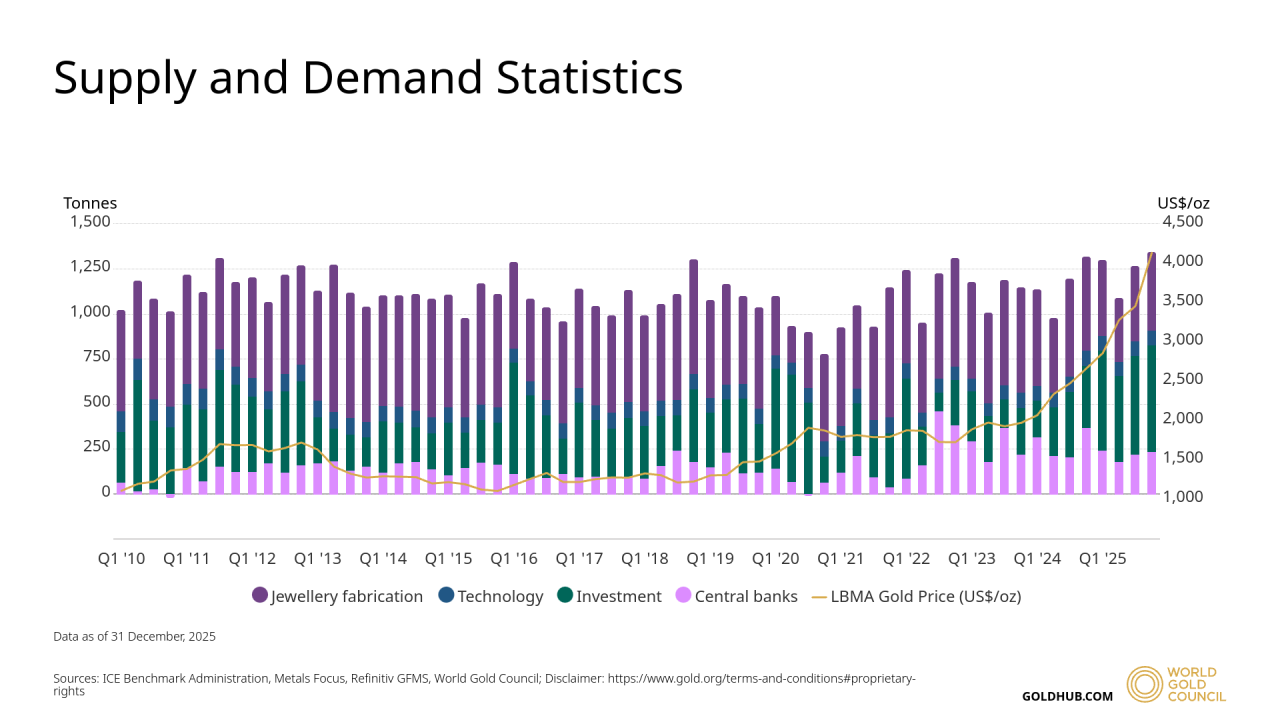

Over the past year, official buyers have absorbed hundreds of tonnes of gold, reducing what is available to private investors.

At the same time, global mine output has grown slowly, limiting new supply.

The bank also expects institutions to increase gold exposure as part of long-term portfolio rebalancing.

Even a minor rise in allocation targets can require large physical purchases due to gold’s relatively small market size.

RECOMMENDED: Central Banks Are On A Gold-Buying Stampede In 2026

How Gold Could Reach $6,300 This Year

The path to $6,300 does not require extreme assumptions.

Continued central bank buying, combined with moderate inflows into ETFs and managed funds, would be enough to tighten the market.

J.P. Morgan’s models show that a few hundred tonnes of additional demand over a year could push prices significantly higher.

With supply unable to respond quickly, prices must rise to balance the market. That math explains why gold can move sharply in a short period.

RECOMMENDED: Will Central-Bank Buying Keep Gold’s Rally Alive?

What Could Hold Gold Back

Higher interest rates remain the main threat. If real yields rise, gold becomes less attractive compared to cash and bonds.

Sudden margin changes or liquidity stress can also trigger forced selling, even during bullish trends.

Other major banks hold lower price targets, which shows forecasts remain divided and outcomes are not guaranteed.

Conclusion

J.P. Morgan’s $6,300 forecast is based on Gold’s supply and demand dynamics rather than speculation. Gold’s direction now depends on central bank activity, investor flows, and monetary policy decisions.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

You can read more about the service here