Platinum’s sharp rise shows how tight supplies and strong industrial demand have fueled gains in precious metals, with silver, gold, and palladium also performing well.

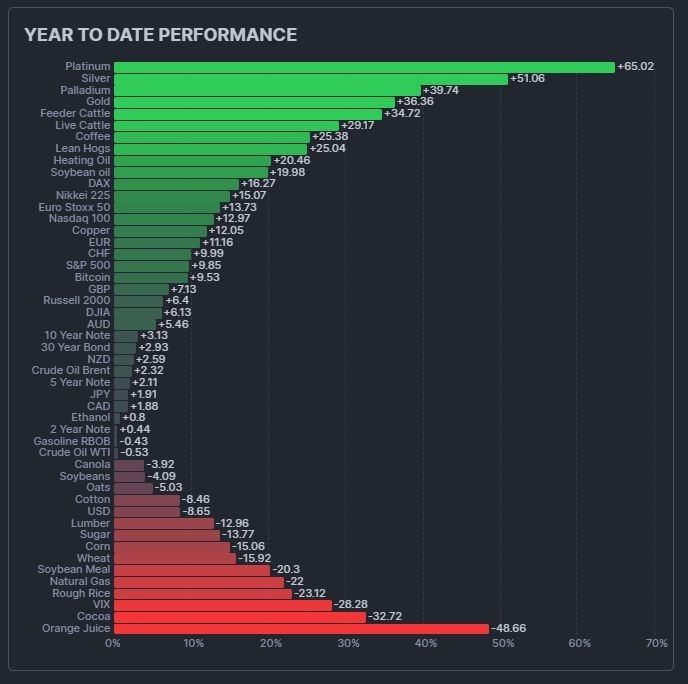

Commodities have taken the spotlight this year. Platinum has surged 65.02%, silver is up 51.06%, gold has gained 36.36%, and palladium has risen 39.74%. These best-performing metals have clearly outperformed most major stock and bond indexes, making them standout assets in 2025.

The rally reflects a mix of supply shortages, steady industrial demand, and investors seeking protection in uncertain markets.

RECOMMENDED: 2025 Treasury Moves Drive Safe-Haven Flows Into Gold and Silver

Who Are The Top Performers YTD?

Platinum holds the top spot with a 65.02% gain this year, the strongest among all tracked commodities. Silver follows closely at 51.06%, supported by heavy industrial use and investment demand.

Gold’s 36.36% rise shows that its appeal as a safe store of value remains strong, while palladium’s 39.74% increase highlights its importance in the auto industry.

Compared with stocks, these numbers are striking. The S&P 500 has climbed 9.85% year to date, while the Dow Jones Industrial Average is up just 6.13%.

The contrast shows how investors have favored tangible assets like metals over traditional markets.

RECOMMENDED: Smart Investors Are Buying Gold in 2025: 9 Must-Know Reasons

What’s Driving the Rally?

Platinum performance this year comes from falling mine production and tight physical supply.

Global Silver demand is soaring, mainly from solar panel manufacturing and electronics, while limited new supply keeps prices high.

Gold continues to attract investors as inflation worries linger and interest rates start easing. Palladium remains essential for vehicle emission systems, and reduced output from key producers has supported its price.

Precious metals ETF inflows and retail buying have added more fuel to these gains, showing broad participation across markets. Supply trends, recycling activity, and central bank policies will continue to shape prices in the coming months.

RECOMMENDED: ETFs & Retail FOMO: Are Passive Flows Now the Main Driver of Precious Metals Moves?

What This Means for Investors

Precious metals can add stability to a portfolio, especially when stock markets slow down. However, they can also swing sharply in price.

Ensure to keep positions moderate and track key indicators such as inflation, currency moves, and industrial demand. Choosing between physical metals, ETFs, or mining stocks depends on one’s goals and risk tolerance.

RECOMMENDED: Central Banks and Long-Term Investors Fuel Gold’s Surge

Conclusion

Platinum, silver, gold, and palladium have outpaced nearly every other asset this year. Their strength reflects a mix of tight supply and steady demand.

While they remain attractive for diversification, you should stay alert to changing market and economic conditions that could shift momentum ahead.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service — delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Gold Overheated. Silver Breakout Back Test. What’s Next? (Oct 18th)

- In Focus: Gold’s Hot Sentiment and Silver’s Intraday Reversal. (Oct 11th)

- Is Silver Ready To Crush Its 45-Year Resistance? (Oct 4th)

- Will Silver Set a Major Top at $50/oz? Our Deepest Analysis Yet. (Sept 27)

- Silver Rally Fueled by Absent Speculators (Sept 20)