Gold and the S&P 500 are rallying together. This reflects investor optimism tempered by macro uncertainty and central bank support.

Mid-2025 has witnessed a rare market phenomenon: gold, typically a defensive asset, and the S&P 500, a growth barometer, both pushing toward record highs. This unusual co-movement reflects a deeply balanced market where investor optimism is matched by underlying caution.

Embracing Optimism While Hedging Risks

Equities have surged on the back of solid economic data and big-tech optimism. The S&P 500 is hovering around 6,020, less than 2.3% below its all-time high of 6,144.15, supported by strong jobs numbers and improved U.S.–China trade sentiment.

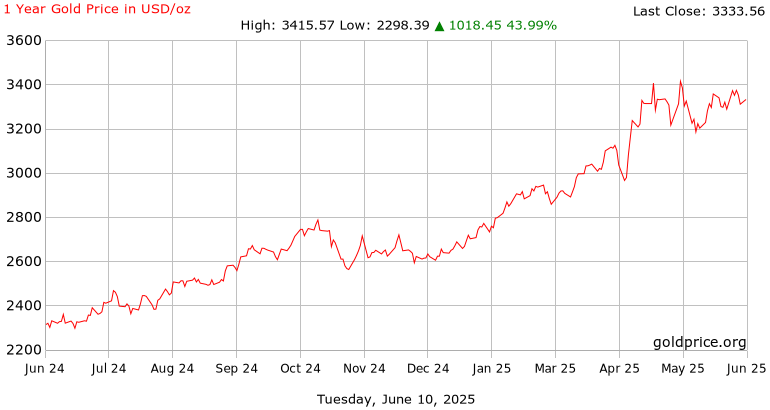

Concurrently, gold has soared nearly 27% year-to-date, trading just 2.1% shy of its April record. Investors are “eating salad and dessert at the same time” — chasing growth while guarding against geopolitical tensions, inflation, fiscal imbalances, and dollar weakness.

Institutional flows are reinforcing this dual rally. Central banks are on track to buy around 1,000 metric tons of gold this year—marking a fourth consecutive year of heavy accumulation, according to Reuters. Meanwhile, gold ETFs, despite holdings still trailing post-2020 levels, have seen renewed inflows, reinforcing a new price floor above $3,000/oz.

Indicators Flash Potential Caution

Technically, gold recently broke resistance in the $3,300–3,350 range, sitting well above its 200-day moving average, while the S&P’s RSI suggests elevated momentum. Historically, such elevated indicators often signal short-term consolidation risks—especially when growth and risk aversion coexist.

What’s Next?: Scenarios to Watch

A base-case scenario sees both markets coexisting: equities could crest at 6,500, while gold holds between $3,100–$3,500. Upside surprises—like renewed fiscal stress or inflation—could push gold toward $3,700–$4,000, whereas a hawkish Fed could reverse the correlation, sending equities lower even as gold remains a safety anchor.

Conclusion

This rare parallel rally is a “fragile dance” between growth appetite and structural caution. Sustaining it depends on dovish policy, steady economic sentiment, and just enough uncertainty to keep gold in vogue. Watch data, Fed signals, and momentum carefully — its disruption could tip the balance quickly.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)