Gold, silver, and platinum stand out this July amid U.S. fiscal concerns, green-tech growth, and undervaluation opportunities.

July brings a fresh macroeconomic backdrop—U.S. fiscal strain, a depressed dollar, and mounting green‑technology investment are spotlighting gold, silver, and platinum.

This month’s trio offers a diversified view: gold as a defensive anchor, silver leaning on momentum, and platinum appealing through underappreciated value and clean‑energy demand.

1. Gold – Safe‑Haven on Shaky Ground

Gold climbed 2.2% this week, holding near $3,344/oz, as the U.S. House passed a tax‑cut and spending plan projected to add $3.4 trillion to the national debt over the next decade. The dollar is extending a three‑year decline, pushing investors toward bullion.

Technically, HSBC warns that gold may be entering a “toppy” zone and estimates a $3,215 average for 2025, though many analysts still expect prices to remain above $3,000 into year-end.

2. Silver – Hybrid Momentum Metal

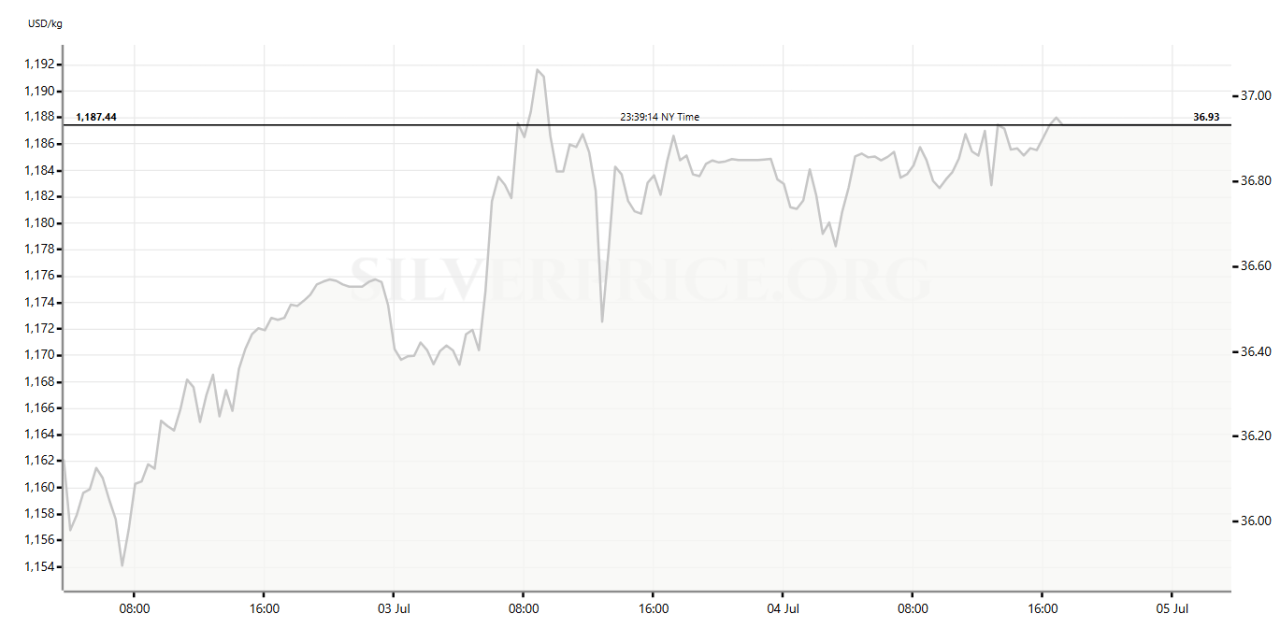

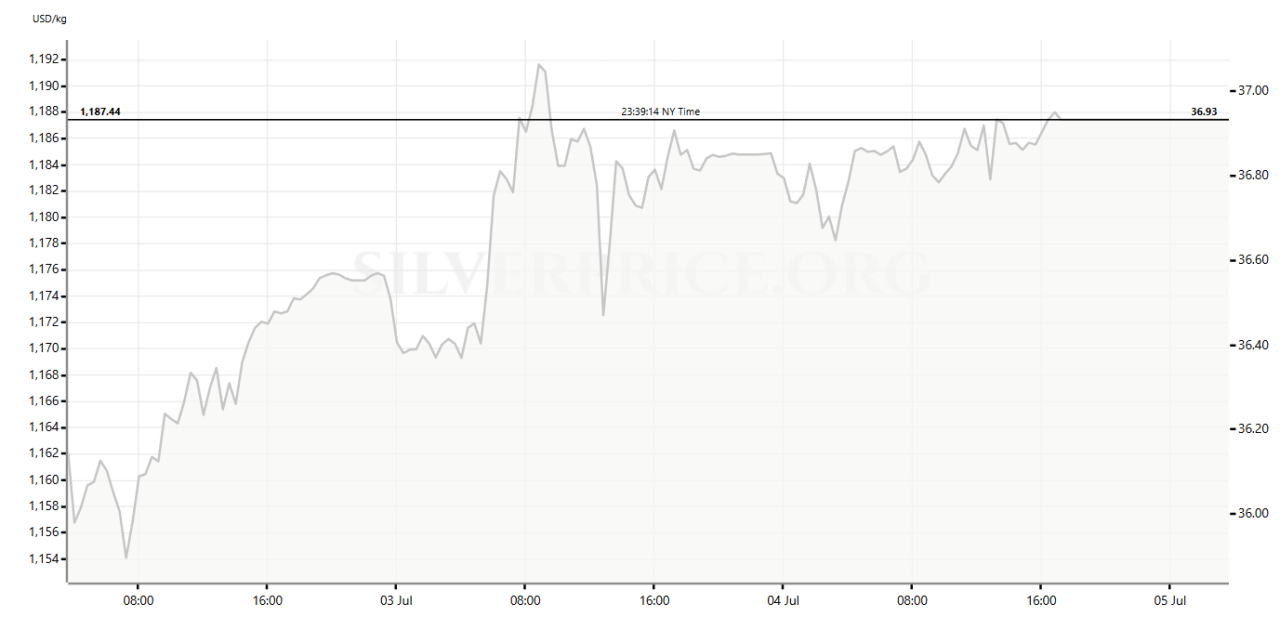

Silver has surged to ~$36.93/oz, reaching multi‑year highs—up roughly 22‑26% YTD—on the back of soaring ETF inflows (~$1.6 billion in June) and growing industrial demand (~60% of total usage tied to tech and solar).

The gold‑silver ratio remains elevated (~100:1 vs historical ~68), signaling potential further upside. Technical breakout above Q2 resistance near $35.44 supports a short‑to medium‑term target of $38–$40/oz.

3. Platinum – Undervalued Green Play

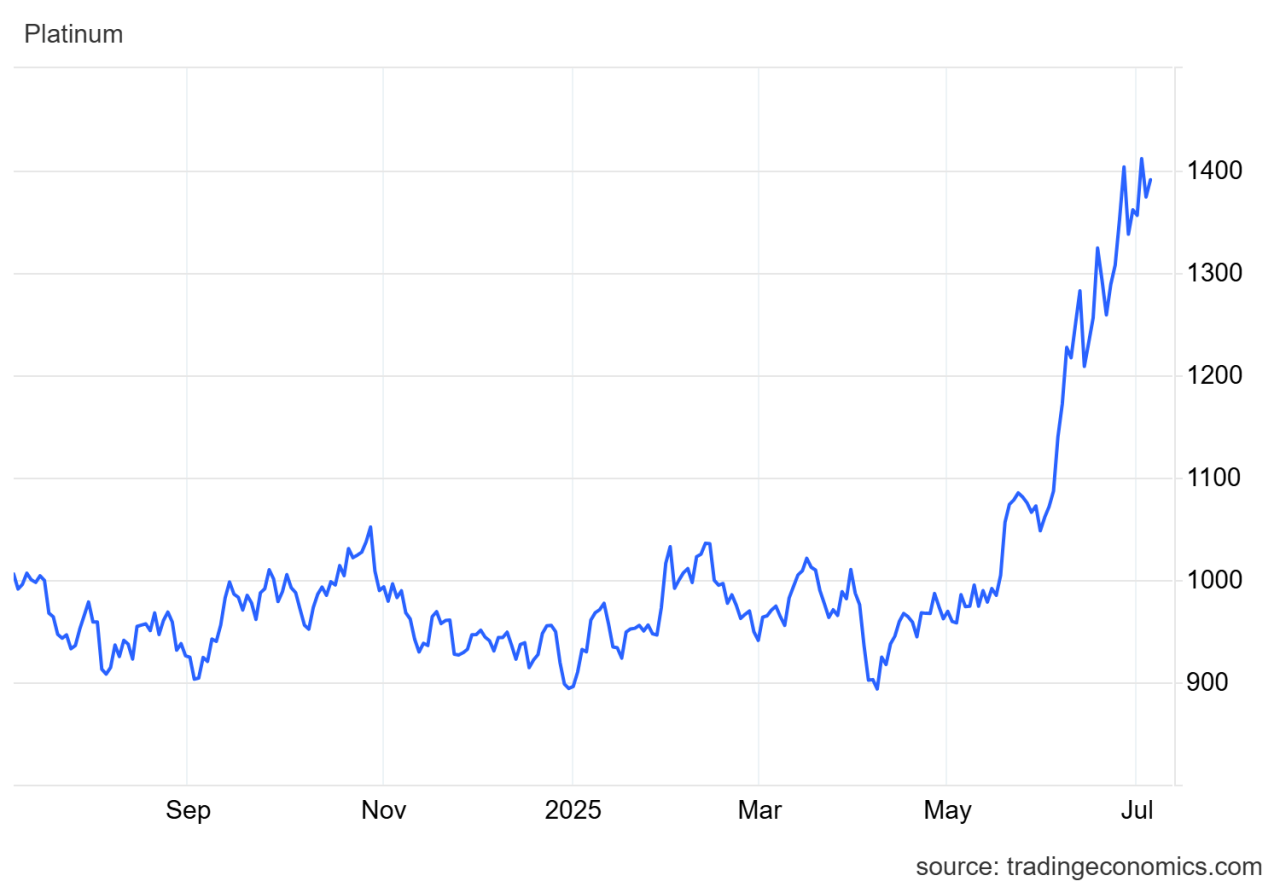

Platinum has been the quarter’s standout, rallying ~36–49% in Q2, peaking near $1,432/oz—an 11‑year high—propelled by Chinese demand and supply disruptions in South Africa.

Yet the gold‑platinum ratio remains lofty (~3.3), suggesting platinum is deeply undervalued. Deficits are forecasted to continue through 2025 (~700‑960 koz annually), with substitution trends (palladium to platinum in auto catalysts and hydrogen fuel cells) providing structural upside.

Conclusion

A balanced allocation might look like 60% gold, 25% silver, 15% platinum—gold for core defense, silver for momentum, and platinum for value/green‑tech positioning.

With elevated volatility ahead—watch for U.S. tariff updates around July 9 and debt‑limit headlines—a rebalance in August could capture momentum or trim exposure. Consider ETF or physical access to each metal, and track ratio shifts and macro drivers as July unfolds.

Our most recent alerts – instantly accessible

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)

- Gold & Silver – The Big Picture Charts That Matter (June 21)

- Gold & Silver Shine but Not Simultaneously… The Market Loves To Confuse Investors (June 15)

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)