UBS sees gold at $3,600 by March 2026 and $3,700 by mid 2026. ETF inflows and central banks strengthen demand.

Gold has outperformed major assets in 2025, with year to date gains near 28%. UBS now projects $3,600 per ounce by March 2026 and $3,700 by June and September 2026.

You can read our Full Gold Price Prediction Here: A Gold Price Prediction for 2025 2026 2027 – 2030

The bank cites persistent U.S. macro risks, questions around policy credibility, ongoing geopolitical tension, and a gradual shift away from the dollar in reserves. The main downside risk is a renewed rise in real yields.

RECOMMENDED: 5 Reasons to Buy Gold in 2025

Why UBS Raised Its Targets

UBS links higher targets to fragile U.S. fiscal dynamics, the possibility of slower growth, and uncertain policy paths that keep demand for defensive assets elevated.

Its bullish call on gold also leans on the prospect of easier policy into 2026, which would lower real yields and support non-yielding assets.

UBS highlights de-dollarization at the margins and resilient investor interest. The house view maps to $3,600 by March 2026, stepping to $3,700 by mid 2026, with the risk case tied to stickier inflation and a stronger dollar.

RECOMMENDED: Want to Make $1M with Gold? Here’s How in 10 Years or Less

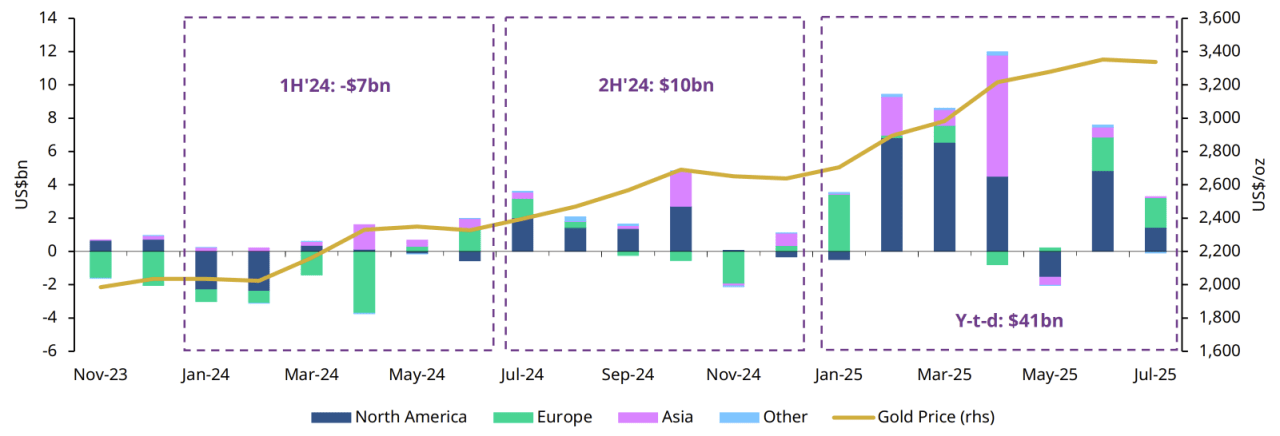

Flows, ETFs And Central Banks

Global gold ETF holdings rose by 23 tonnes in July to 3,639 tonnes, while AUM reached a month-end high near $386 billion. UBS lifted its 2025 ETF demand estimate to 600 tonnes and now sees total gold demand rising about 3% to 4,760 tonnes, the strongest since 2011.

Official sector buying remains substantial, at 244 tonnes in Q1 and 166 tonnes in Q2, taking H1 2025 net purchases to about 415 tonnes.

A 2025 WGC survey shows 95% of reserve managers expect global official gold reserves to increase in the next 12 months, and 43% plan to add to their own holdings.

RECOMMENDED: Why Gold Makes Sense for Long-Term Investors

What Could Change The Path

A firm dollar, higher-for-longer real yields, or a stall in ETF inflows could cap prices. Faster policy easing, renewed geopolitical shocks, or continued official accumulation would support UBS’s roadmap.

Track real yields, DXY, monthly ETF net flows, and quarterly central-bank purchases as the highest-signal indicators.

RECOMMENDED: 9 Reasons To Invest In Gold In 2025

Conclusion

UBS’s $3,600 to $3,700 for gold path rests on identifiable pillars, policy and flows. If real yields ease and investment demand holds, the targets look attainable through mid 2026.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service — delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean?(Aug 16)

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)