We explain how you can use disciplined dollar cost averaging to target $1,000,000 in ten years. Learn how to set monthly targets, vehicle choices, and realistic, conservative assumptions.

Many investors treat gold as a hedge rather than a growth asset. That view creates both opportunity and risk. So, can you make $1m with gold in just 10 years?

Over the past decade, gold returned about 186 % in total – roughly 11.1 % annually, offering strong upside potential. By using a strategy called dollar-cost averaging (DCA) you might achieve this target with measured return assumptions and precise monthly targets.

RELATED: 5 Reasons to Buy Gold in 2025

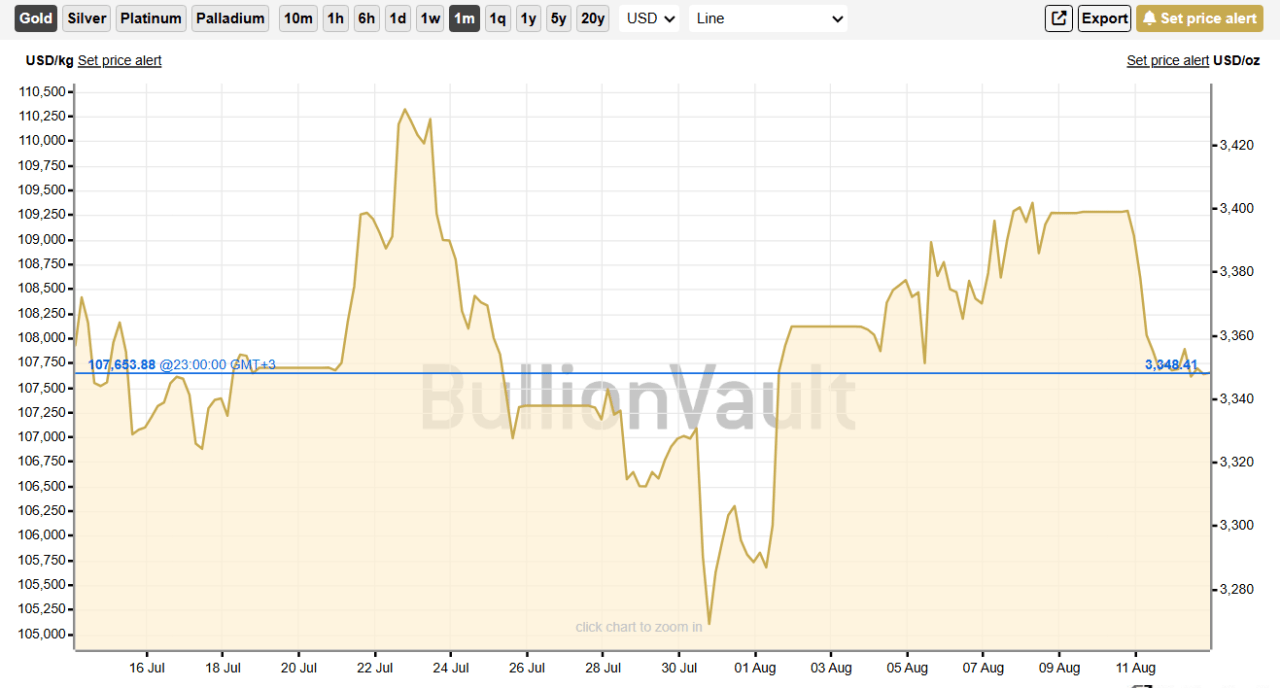

Gold’s Recent Track Record and Outlook

Gold gained roughly 26% in the first half of 2025 as investors sought a hedge against inflation and geopolitical risk. Over longer horizons gold has delivered substantial returns, producing about 10.9% annualized across twenty five years through 2025.

That record shows both strong gains and sharp swings. So if you are using a strategy like DCA, plan for episodic volatility and use conservative return scenarios when sizing monthly contributions.

Gold price forecasts will also vary, so build buffers and avoid relying on upside projections entirely.

RECOMMENDED: Why Gold Makes Sense for Long-Term Investors

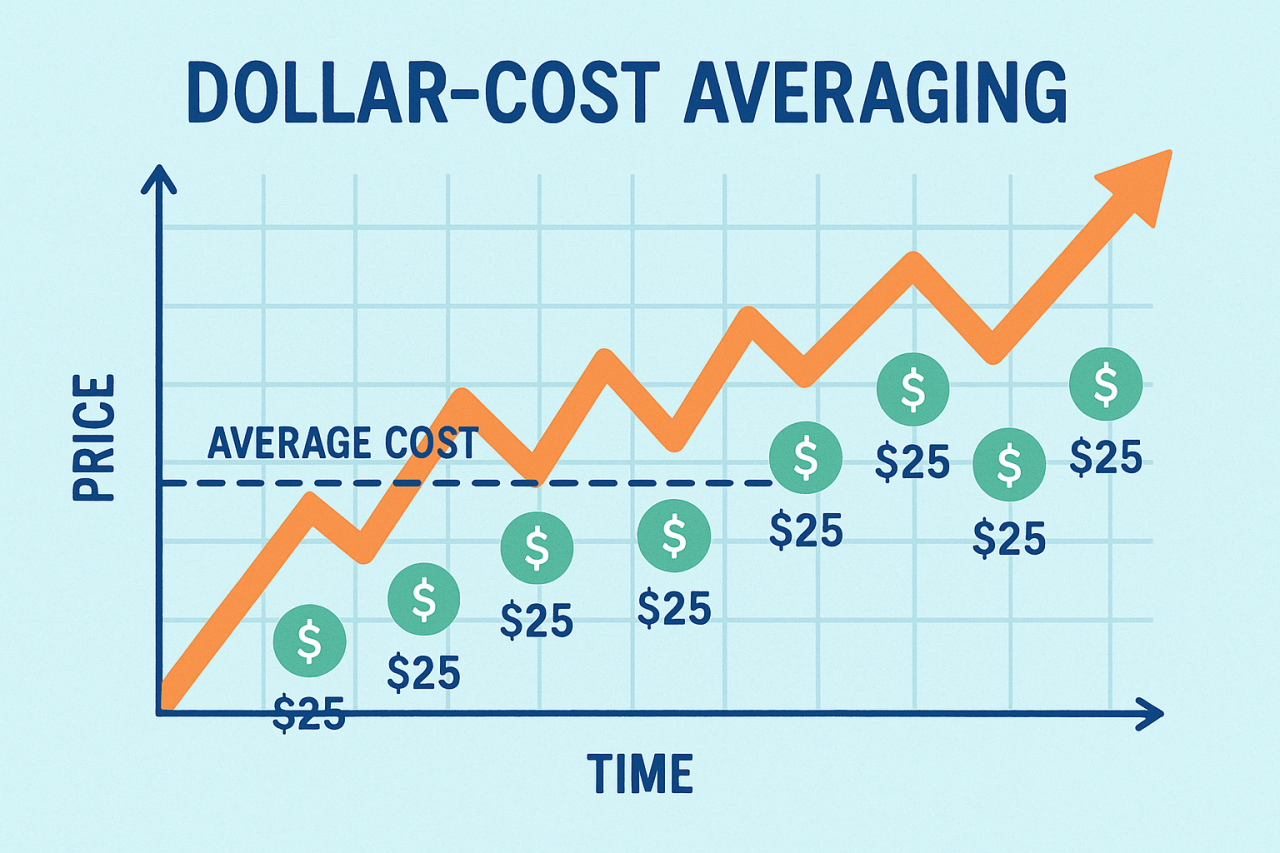

Why Dollar-Cost Averaging Works for Gold

Dollar cost averaging means investing a fixed dollar amount at set intervals, regardless of price. It reduces timing risk and enforces discipline. With gold, DCA buys more ounces when prices drop and fewer when prices rise, which lowers the average cost per ounce over time.

DCA also removes emotion from frequent trading and helps investors build position size steadily. You can use automatic monthly purchases into a gold ETF or a recurring bullion plan to implement DCA consistently. Also track fees, storage, and taxes because they reduce net returns and matter.

RECOMMENDED: 9 Reasons To Invest In Gold In 2025

How Much Do You Need to Invest in Gold to Make $1M in 10 Years?

To understand how much you need to invest, start by setting realistic return assumptions and remembering gold’s variability. Using standard future value math and assuming no initial lump sum, a 10% annualized return requires monthly purchases of about $4,881 to reach $1,000,000 in ten years.

If long term gold returns on average 8%, the required monthly amount rises to roughly $5,466. At 12%, monthly buys fall to about $4,347. Using a recent decade high of 13.6%, the monthly figure is near $3,954.

These examples show that small shifts in average annual returns change required contributions materially, so plan conservatively and revisit assumptions annually. A $50,000, for instance, starter reduces monthly needs significantly.

Don’t forget to include ETF expenses, transaction costs, storage, and taxes when modeling returns and leave a 10% buffer.

How to Choose Investment Vehicles and Handle Costs

Gold ETFs could be a great option to consider because they give you efficient exposure to gold. Options like iShares Gold Trust (IAU) charge 0.25% annual expenses, while SPDR Gold Shares (GLD) cost 0.40% but offer tighter spreads, reducing trading friction. GLD costs $200 annually on a $50,000 investment versus $125 for IAU, though its liquidity can save $20–40 per trade.

Some ETFs like IAUM charge as low as 0.09%. Physical gold adds costs from making charges, GST, storage, and insurance.

Ideally, you could hold gold ETFs inside tax-advantaged accounts when possible to avoid or reduce the tax on gains.

Conclusion

Consistently investing in gold using dollar-cost averaging offers a disciplined path toward $1,000,000 in under ten years.

Realistic assumptions, low-cost ETFs, automation, and annual reassessment will maximize your odds. Remember, physical gold brings heavy costs while ETFs inside tax-friendly accounts offer efficiency.

Need help identifying the best time to buy gold?

Join the original market-timing research service delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)