Fed-cut odds and dollar moves will set short-term direction for bullion. Track ETF flows, real yields and $3,500–$3,674 in gold, $40–$42 in silver.

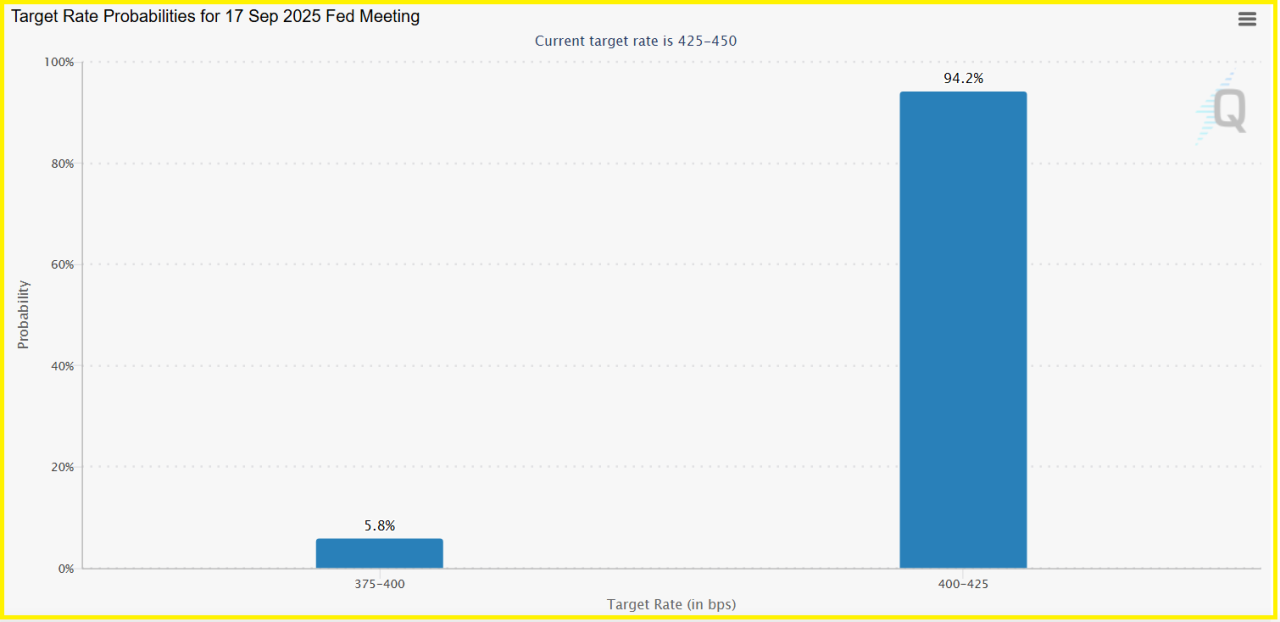

Markets price a very high chance of a 25bp Fed rate cut this week, roughly 94–97% by fed funds futures, and the dollar sits around 97.6 on the DXY.

Spot gold trades in the low $3,600s after a recent record at $3,673.95, while silver trades in the low $40s. These concrete readings will determine whether buyers push metals higher or the market pauses.

ALSO READ: Trump’s Fed Threat Could Spark Gold Rally, Says BofA

Macro Setup: Fed Cuts, Real Yields And The Dollar

Traders expect a policy pivot, and real 10-year yields reflect that shift, with TIPS yields around 1.7% this week. Historically, falling real yields increase the opportunity cost advantage for non-yielding metals, which helps explain gold’s rally as breakeven inflation and nominal yields move.

Any Fed language that changes the cut odds and the 10-year TIPS readout will likely spark immediate market reaction.

Positioning And ETF Flows

Global physically backed gold ETFs recorded roughly $5.5bn of inflows in August, extending a multi-month intake and lifting year-to-date net flows toward record levels.

Major banks upgraded price paths, with UBS raising its year-end gold price prediction to $3,800, supplying a clear institutional narrative to the flows.

Those inflows compress liquidity and increase the chance of short-term price extensions if the Fed confirms the market’s expectations.

RECOMMENDED: Gold Eyes $4,000–$5,000: Momentum Fueled by Fed Outlook

Silver: Industrial Demand And Volatility

Silver current price is around $42, and ETP accumulation has drawn meaningful metal inventories, with global silver-backed ETPs adding large volumes in H1 2025.

Silver’s industrial demand and smaller market size create wider swings, so expect larger percentage moves than gold on the same macro trigger.

RECOMMENDED: Silver’s Surge: Outshining Gold in 2025

Conclusion

This week, watch the Fed statement and CME FedWatch revisions, monitor DXY and the 10-year TIPS print, and use tactical levels: gold support $3,500, resistance $3,673.95; silver support $40, breakout above $42 confirms follow-through.

When is The Best Time To Buy Gold & Silver?

To receive key alerts and analysis on the best times to buy Gold and Silver, you should consider Joining the original market-timing research service — delivering premium insights since 2017.

InvestingHaven alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience.

This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Monster Basing Patterns in Precious Metals Resolving Higher (Sept 6th)

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean?(Aug 16)

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)