Gold’s rally has been fueled by strong investor and central bank demand, but rising yields and a stronger dollar could test its momentum.

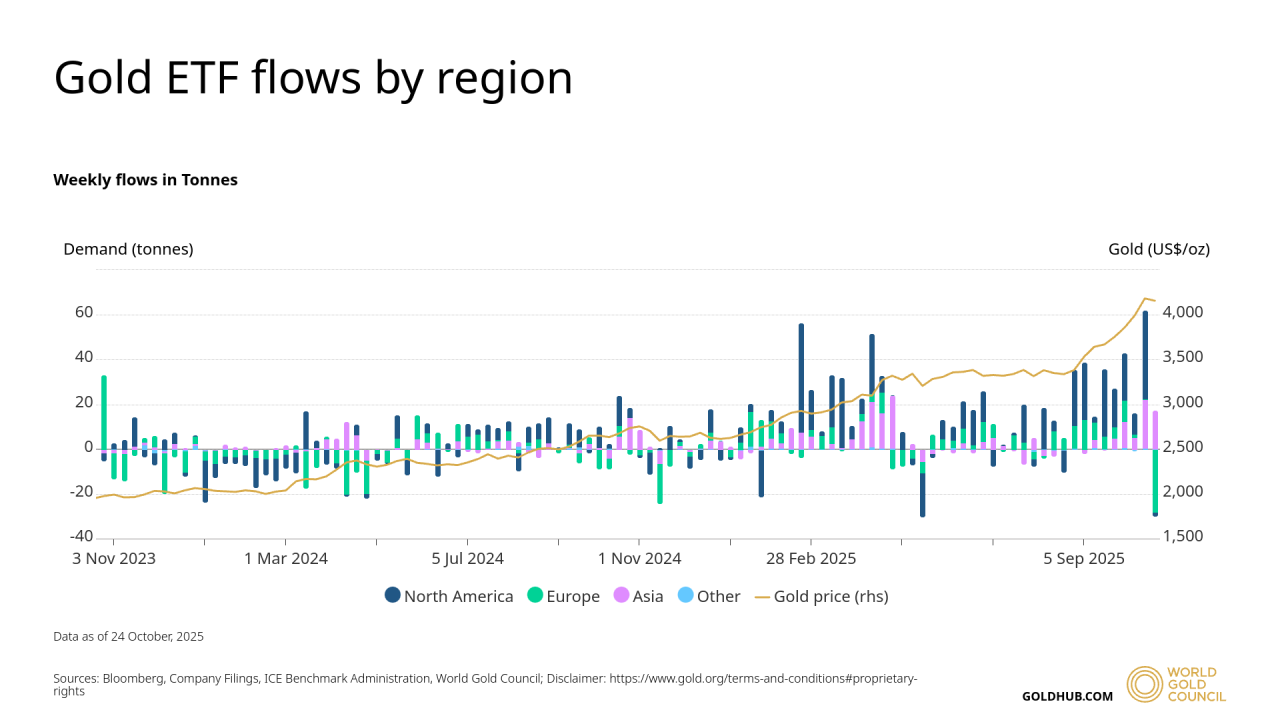

Gold prices hit a record high above $4,380 an ounce in late October, majorly due to strong investment demand and steady buying from central banks. Global gold ETFs added about US$26 billion in Q3, the biggest quarterly inflow this year, as investors sought stability during currency and bond market volatility.

Bar and coin purchases also increased sharply in India and China, helping sustain prices even as interest rates stayed elevated.

RELATED: Gold: Technical Pause Or New Trend?

ETF Flows, Physical Demand, and Central Bank Buying

Investment inflows have been a major support for gold’s strength. Global ETFs added more than 220 tonnes of gold last quarter, reversing the outflows seen earlier in the year.

At the same time, central banks continued to expand their reserves, with steady buying from Asia and the Middle East.

Physical demand also stayed firm, with Indian jewelry demand rising around 10% and Chinese bar and coin purchases up strongly as investors looked for protection against currency weakness. Together, these trends have kept the market well bid in recent weeks.

RECOMMENDED: 2025 Treasury Moves Drive Safe-Haven Flows Into Gold and Silver

Technical Picture and Short-Term Risks

After reaching record highs, gold pulled back below the $4,000 level, which now acts as key support. Volatility has risen, and some short-term traders have started taking profits, suggesting a possible period of consolidation.

Options data shows rising hedging activity, hinting that investors expect more swings in the coming sessions. If momentum slows and ETF inflows ease, a short retrace cannot be ruled out.

RECOMMENDED: Gold Crashes 5%: Investors Stunned By Largest Drop Since 2020

Key Factors to Watch This Week

This week’s direction will depend on real yields, the dollar, and upcoming US data. A drop in yields or a softer dollar could extend the rally, while stronger inflation or jobs numbers might push yields higher and weigh on gold.

ETF holdings and central bank gold buying will gauge whether buying strength is holding up.

RECOMMENDED: Central Banks and Long-Term Investors Fuel Gold’s Surge

Conclusion

Gold’s long-term story remains positive thanks to steady investment and official demand, but short-term moves will hinge on macro data and investor positioning.

If yields stay contained and ETF flows remain firm, the rally could continue. If not, prices may test support near $4,000 before finding a new footing.