Gold gains from weaker real yields and steady fund demand. Silver tightens on festival buying and lower imports in India and China.

Gold has shown strength as the 10-year TIPS yield has eased and large funds added metal this year. Silver has seen firmer local demand, especially small coins and jewelry, while imports remain below recent norms.

This week, data on real yields, US inflation, India festival buying, and ETF flows will set the tone.

ALSO READ: 2025 Treasury Moves Drive Safe-Haven Flows Into Gold and Silver

Real Rates And Macro Signals

Real yields matter more than nominal yields for precious metals. When the 10-year TIPS yield falls, gold becomes more attractive because holding non-yielding bullion costs less.

Market participants will focus on headline and core US inflation prints and Fed comments that can push real yields and the dollar. A clear drop in real yields tends to lift gold, while a rise usually creates downward pressure.

RECOMMENDED: Central Banks and Long-Term Investors Fuel Gold’s Surge

Jewelry Seasonality And Physical Demand

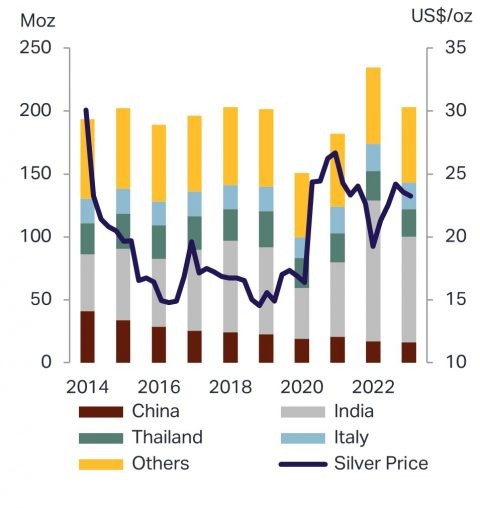

India and China drive much of physical demand, especially for silver coins and small gold pieces. Indian festival buying, such as Dhanteras and Diwali, often increases retail purchases and tightens local supplies when imports lag.

Recent reports show below-average silver imports earlier this year, which can magnify price moves if festival demand remains strong. Expect local retail flows to influence silver more than paper markets this week.

RECOMMENDED: Smart Investors Are Buying Gold in 2025: 9 Must-Know Reasons

ETF Flows And Central Bank Purchases

ETFs and central banks provide visible signs of investor interest. Gold ETFs have posted net inflows year to date and central banks continue to add reserves, which supports a price floor.

Track daily GLD and SLV creations and weekly ETF flow summaries, since large redemptions or creations can trigger fast swings. Mining output and producer hedging matter too, but they usually shape medium-term trends rather than weekly moves.

RECOMMENDED: Overbought Signals in Metals: Will Gold and Silver Pullback?

Conclusion

If real yields fall and investors keep adding to ETFs, gold could extend its rally while silver benefits from strong festival demand. If inflation data and interest rates stay stable, both metals may pause and trade within a narrow range as buyers and sellers balance out.

However, a rise in real yields or a stronger dollar could spark profit-taking and push prices lower. The most important signals to watch this week are the 10-year TIPS yield, US inflation results, central bank and ETF activity, and India’s import and jewellery demand trends.