Gold and silver remain elevated as Middle East tensions rise, with potential breakouts if geopolitical risks or inflation concerns intensify.

Since mid‑June, rising geopolitical tensions in the Middle East have resulted in a meaningful increase in the demand and, therefore, the price of precious metals.

Israel’s June 13 strikes on Iran’s nuclear and military sites, followed by the U.S. bombing of three Iranian facilities on June 22 — has rippled through global markets, lifting gold to about $3,420–$3,440/oz and pushing silver above $37/oz.

Conflict-Fueled Market Drivers

The June 13 operation, dubbed Operation Rising Lion, demolished advanced centrifuges at Natanz, Isfahan, Arak, and Fordow — sparking a 7–11% jump in oil, straining shipping routes like the Strait of Hormuz, and triggering safe-haven demand.

This momentum carried through the June 22 U.S. strikes, which further reinforced risk aversion; analysts now expect gold to reach as high as $3,900/oz over the next 12 months if regional tensions persevere.

Key Price Levels to Track

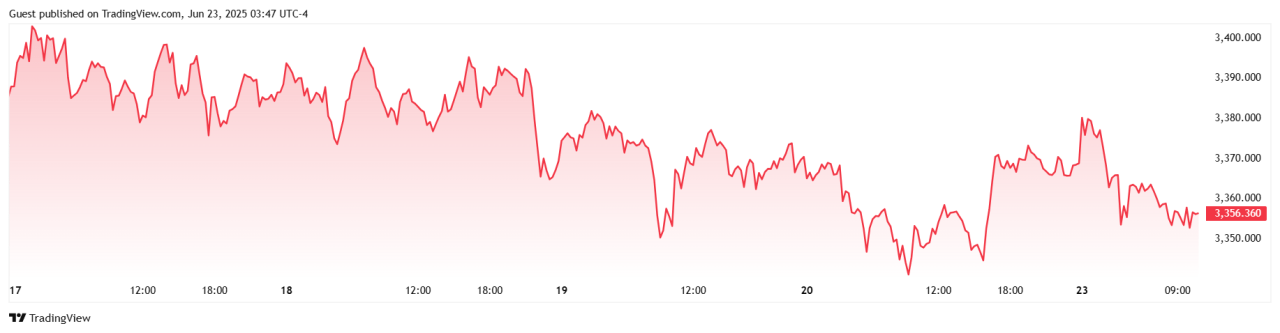

Gold pulled back slightly from its post‑strike high (~$3,439) to trade around $3,420–$3,440. Markets are watching $3,400 as key support; a slide below that could open the door to $3,330–$3,270 if tensions ease .

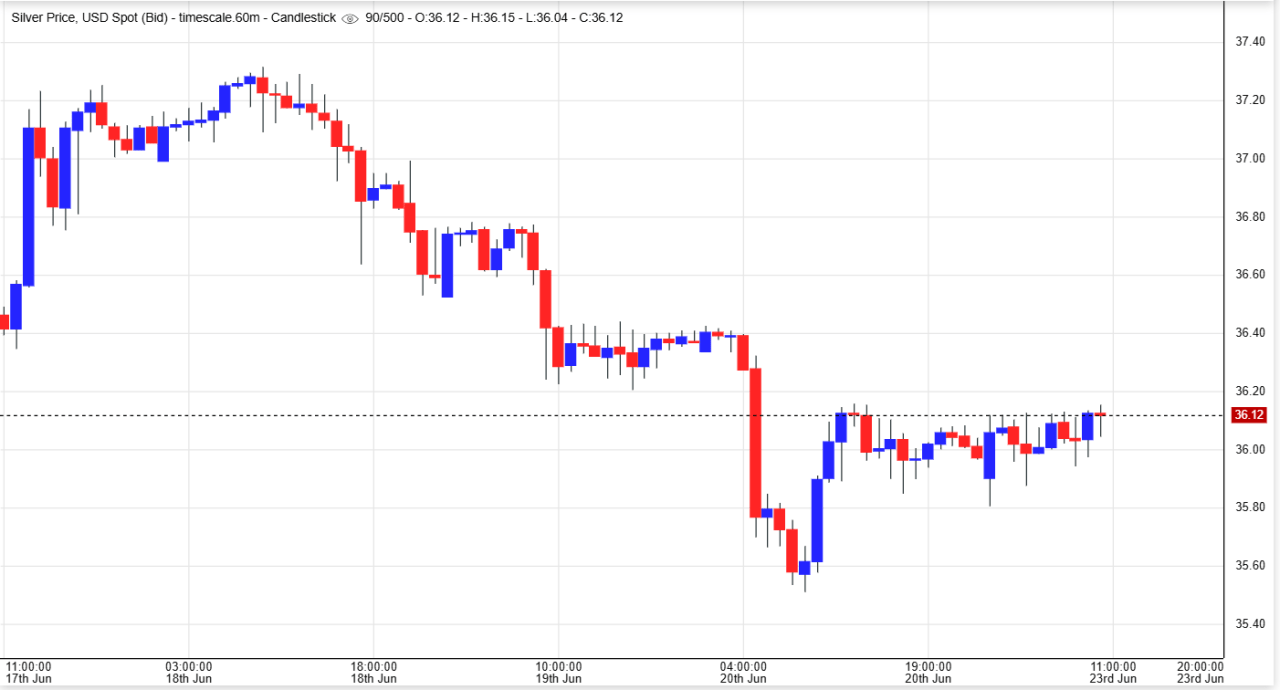

Silver has been the standout performer — rising to $37+, marking a 13‑year peak not seen since 2012 . It now eyes a move toward $40/oz, with near-term support around $36.

Meanwhile, a firm U.S. dollar has kept bullion gains in check — though any easing from the central bank could reignite the rally.

What to Watch This Week

- Middle‑East headlines: Any Iranian retaliation or threats to shipping lanes (Strait of Hormuz) could drive gold to $3,500–$3,600 and push silver past $40.

- Federal Reserve signals: The June 25 Fed meeting may influence dollar strength. A dovish tone could embolden bullion.

- Oil’s path: Renewed crude spikes would amplify inflation concerns, lifting precious metal demand.

Conclusion

Gold and silver are navigating a tense geopolitical backdrop — restrained now by a strong dollar, yet primed for powerful gains if tension escalates. Watch Middle‑East developments, Fed messaging, and oil prices: any fresh shock could propel these metals into new territory.

Our most recent alerts – instantly accessible

- Gold & Silver – The Big Picture Charts That Matter (June 21)

- Gold & Silver Shine but Not Simultaneously… The Market Loves To Confuse Investors (June 15)

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)