China’s central bank keeps adding gold to its reserves. The steady pace is tightening supply and lifting long-term price expectations.

China has now reported 14 straight months of gold reserve additions.

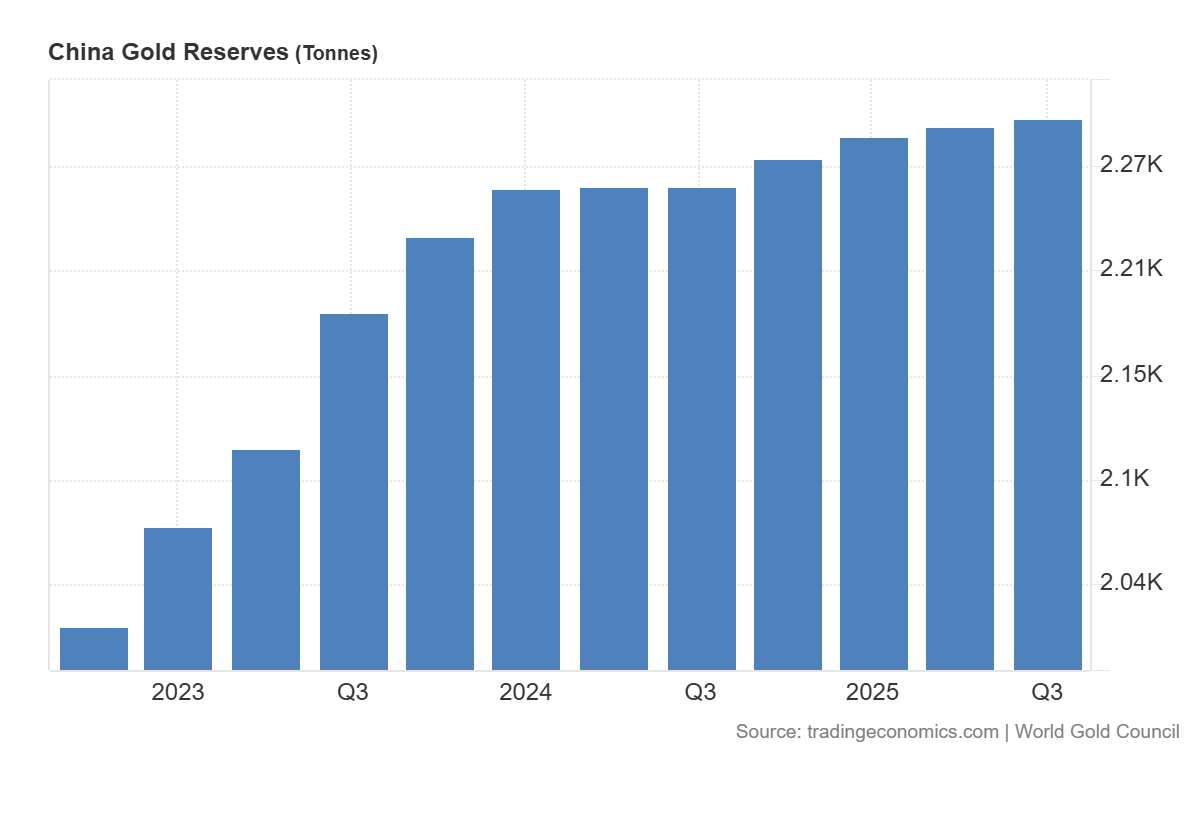

Official holdings stand at about 74.15M fine troy ounces, worth roughly $319.45B, with Beijing adding roughly 1.35M oz ( about 42 tonnes) since November 2024.

This buying pattern signals a long-term shift in how one of the world’s largest economies manages its reserves.

For a more in-depth review of Gold we will be covering Gold and other assets that we believe have high investment potential for 2026 in our next Premium Investing alert

RECOMMENDED: How Renewed Central-Bank Gold Purchases Are Re-Shaping Prices

China’s Gold Buying In Numbers

China’s central bank has added gold every month since late 2024, choosing consistency over aggressive buying.

The total increase of about 42 tonnes may look modest relative to global supply, but its impact is outsized.

Central banks do not trade frequently, and once gold enters official reserves, it rarely returns to the open market.

This is crucial because global mine output grows slowly. When a large buyer absorbs physical metal month after month, less gold remains available for ETFs, jewelers, and industrial users.

Over time, this tightens liquidity and increases price sensitivity to new demand.

RECOMMENDED: Italy’s Gold Politics: Central-Bank Independence Versus Fiscal Pressure

Why China Is Increasing Gold Reserves

The motive appears strategic rather than speculative. Gold offers protection from currency risk and financial sanctions while providing a neutral store of value.

By gradually raising gold’s share of reserves, China reduces exposure to foreign debt assets and currency swings.

The steady pace also avoids shocking markets. Instead of one large purchase that spikes prices, monthly additions quietly reshape reserve composition.

Other central banks have followed similar paths, reinforcing a broader shift toward gold in official holdings.

What This Means For Gold Prices

Central-bank buying changes market structure. Unlike short-term investors, official buyers do not sell during pullbacks.

This creates a stronger price base over time. Analysts tracking central-bank flows now factor official demand into long-term gold valuations, not just inflation or interest rates.

If China continues buying at this pace, gold prices are likely to remain well supported even during periods of weaker investor demand.

ALSO READ: Can Gold Hit $5,000 and What’s The Timeline?

Conclusion

China’s ongoing gold accumulation is not a short-term signal. It shows a durable change in reserve strategy that steadily tightens supply.

As long as central banks remain consistent buyers, gold’s long-term pricing outlook stays firm.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

Check out our latest precious metals premium analysis: Where or When Will Silver Set A Top?

In this article we talk about the probability of Silver reaching $90, $150 and $200 and whether we believe it is a time to sell or hold.

You can read more about our Premium precious metal investing service here

If you are interested in becoming a VIP member and benefiting from personal charting requests and personalised AI prompting for precious metal investing you can see the options here