Gold remains a reliable long-term asset, offering inflation protection, diversification, and resilience amid global debt and market uncertainty. Analysts expect prices to rise further, with opportunities even during potential pullbacks.

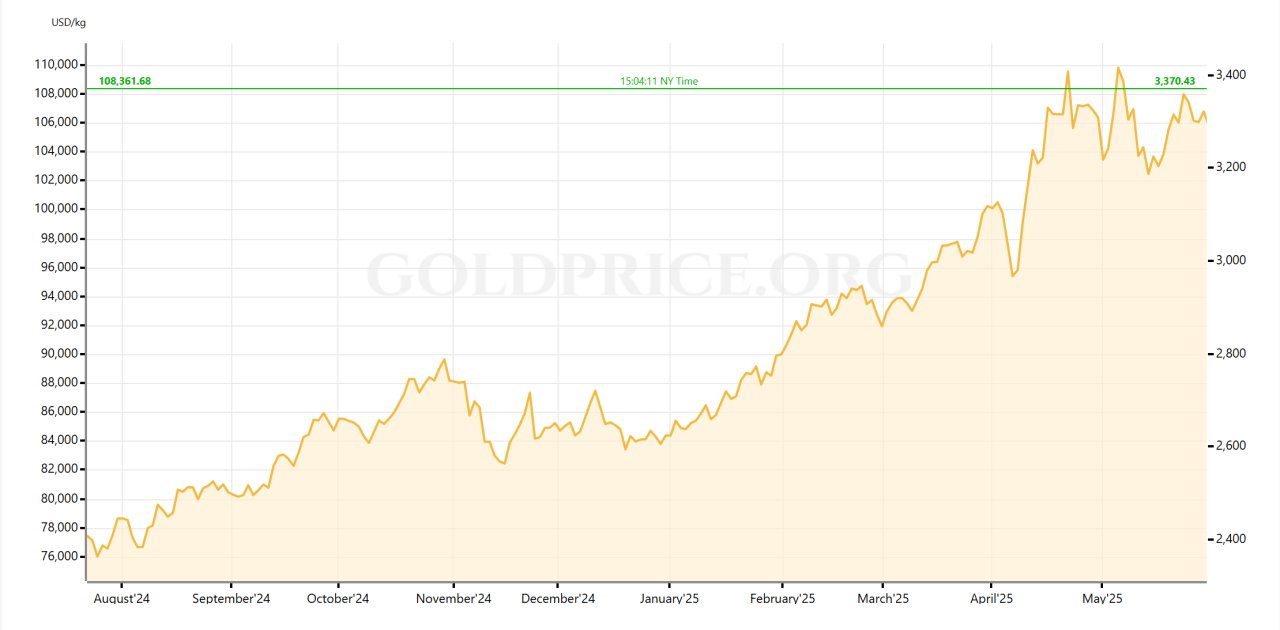

In 2025, gold has once again proven its staying power as a trusted store of value. With prices surging nearly 30% year-to-date to hover around $3,400 per ounce, investors are paying close attention.

While gold often grabs headlines during crises, its true value lies in how it supports a long-term investment strategy—offering diversification, inflation protection, and a shield against systemic risks.

Here are some reasons why Gold is perfect for long-term investments.

A Proven Hedge in Uncertain Times

One of gold’s strongest selling points is its historical role as a hedge when other assets stumble. Central banks worldwide continue to buy gold aggressively—over 1,000 tonnes annually—led by countries like China, India, and Turkey. This trend signals deep institutional faith in gold’s enduring worth.

History backs this confidence: since 1973, gold delivered positive returns in eight of the ten worst quarters for global equities. During market downturns or unexpected geopolitical events, gold tends to hold its ground or appreciate, helping investors cushion portfolio losses.

Insurance Against Inflation and Soaring Debt

With global inflation still hovering near multi-decade highs—averaging about 4.5% across major economies—gold’s reputation as an inflation hedge remains solid. During the high inflation era of the 1970s, and more recently following the 2008 financial crisis and massive central bank stimulus programs, gold prices soared dramatically.

Adding to this is the ballooning global debt burden, which hit a record $324 trillion in Q1 2025. High debt levels often lead to currency devaluation or policy shifts that can erode fiat money’s purchasing power. In contrast, gold—an asset with no counterparty risk—retains value when trust in paper currencies wavers.

Diversification and Low Correlation

For long-term investors, gold’s relatively low correlation with traditional asset classes like stocks and bonds makes it an excellent diversification tool.

Over the past few decades, its correlation with equities has typically ranged between −0.2 and +0.3, meaning gold’s price movements often differ from the broader market.

This non-correlation is valuable during times of market stress. When both equities and bonds decline, gold has historically provided stability or even positive returns, smoothing out portfolio volatility.

Robust Structural Demand

Gold’s appeal isn’t just theoretical—it’s underpinned by resilient demand from multiple fronts. Central banks have increased their gold reserves to diversify away from the U.S. dollar, while consumer demand remains strong, especially in China and India, which together account for over 50% of global gold jewelry purchases.

On the investment side, gold-backed ETFs still manage assets worth about $374 billion globally. Although there were modest outflows in May, overall holdings remain near multi-year highs, reflecting sustained investor interest.

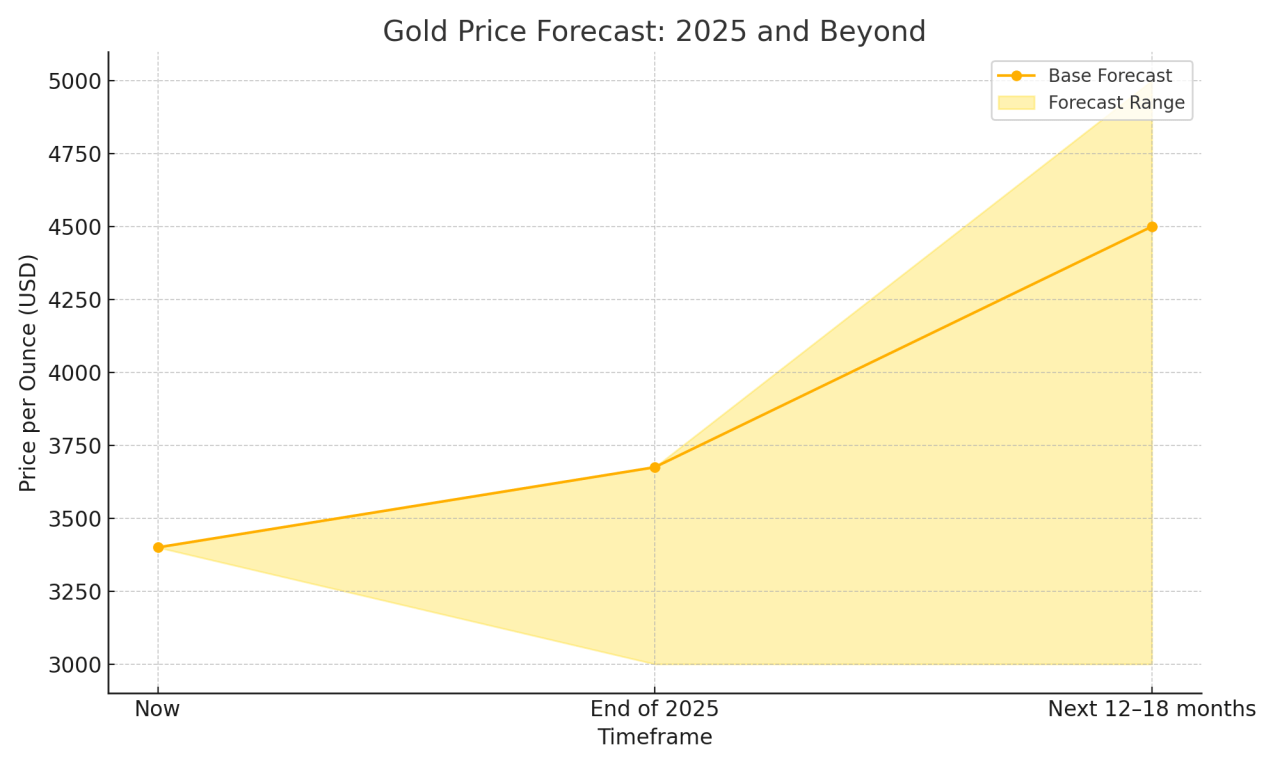

A Positive Price Outlook, with Caveats

Looking ahead, many analysts are optimistic. JP Morgan recently forecasted gold could approach $3,675 by the end of 2025, with some experts like Ed Yardeni even projecting $4,000 to $5,000 per ounce within the next 12–18 months.

However, not all forecasts are bullish—Citi analysts warn of a potential dip below $3,000 if inflation eases significantly or real yields rise. Such pullbacks, however, could present attractive buying opportunities for disciplined investors.

Conclusion

With the current economic uncertainty, stubborn inflation, and record debt levels, gold remains a timeless portfolio stabilizer. It offers reliable diversification, protection against currency debasement, and a safety net during turbulent markets.

For long-term investors, allocating a modest portion—typically 5% to 15%—to gold can enhance risk-adjusted returns. Rather than chasing quick gains, the smart strategy is steady accumulation, mindful of macroeconomic shifts and central bank policies that shape gold’s trajectory.

Our most recent alerts – instantly accessible

- Gold & Silver Shine but Not Simultaneously… The Market Loves To Confuse Investors (June 15)

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)