Central banks bought hundreds of tonnes of gold in 2025, reducing supply in the open market.

The buying is already picking up in 2026 and might help keep gold’s rally alive.

Gold traded above $5,100/oz after a strong run fueled by sustained sovereign demand.

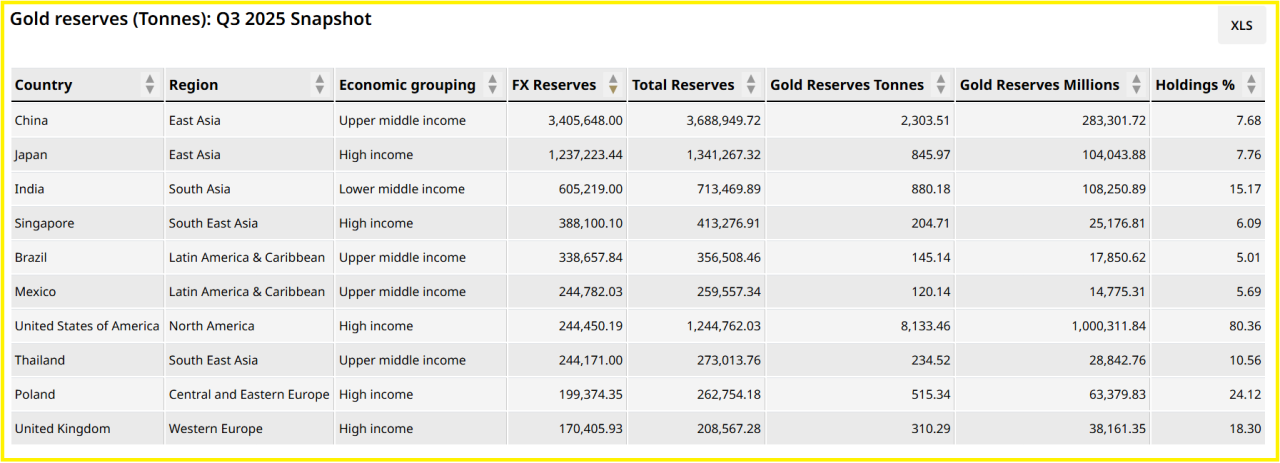

In 2025, central banks collectively bought close to 300 tonnes of gold in the first 11 months alone, with buying concentrated in a few large programs.

These flows stand out because they reflect policy decisions, and they add real pressure to a market with limited new supply.

YOU MIGHT LIKE: Central Banks Are On A Gold-Buying Stampede In 2026

How Much Gold Are Central Banks Buying?

Official data shows central banks bought about 297 tonnes of gold in the first 11 months of 2025.

Buying accelerated in Q3, when net purchases reached roughly 220 tonnes.

To put this in context, global mine production runs close to 3,000 tonnes a year. That means central banks absorbed close to 10% of annual supply in less than a year.

Poland, China, and other emerging-market buyers reported regular monthly additions, which signals ongoing programs rather than tactical moves.

Why Central Banks Keep Adding Gold

Reserve diversification remains the main reason.

Many central banks want to reduce reliance on major currencies and protect reserve value during periods of policy uncertainty.

Gold offers liquidity and does not depend on another country’s balance sheet.

Public statements and reserve data show that several banks plan to keep increasing allocations into 2026, which suggests this demand is not fading quickly.

RECOMMENDED: China Is Stockpiling Gold at Record Levels – What This Means for Global Gold Prices

How Much Support Does This Give Prices?

Central-bank buying tightens available supply and helps form a price floor, but it does not control the market.

ETF inflows, interest-rate expectations, and investor risk appetite still drive short-term moves.

When rates rise or ETF holdings fall, gold can pull back even if central banks keep buying.

Conclusion

Central-bank demand provides a strong backbone for gold prices, but it does not remove volatility.

The rally can continue if net purchases stay high and investor demand remains stable.

Monthly central-bank buying data, major reserve announcements, and ETF flows offer the clearest signals on whether this support will hold.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- Gold to Silver Ratio at 50. Ready for Rotation? (Jan 25th)

- Time To Take Profits? (Jan 17th)

- Why January 2026 Is An Unusually Important Month for Precious Metals(Jan 10th)

- Where or When Will Silver Set A Top? (Dec 29th)

- Watch the USD! (Dec 21st)