Blockchain stocks are the hottest sector right now. Here is the big news for investors: “you ain’t seen nothing yet.” InvestingHaven is on record forecasting that the blockchain stocks bull market will become as big, if not bigger, than the dotcom bull market. There are some specific challenges investing in blockchain stocks. How to invest in blockchain stocks, and which blockchain stocks to select? That is a challenge in and on itself.

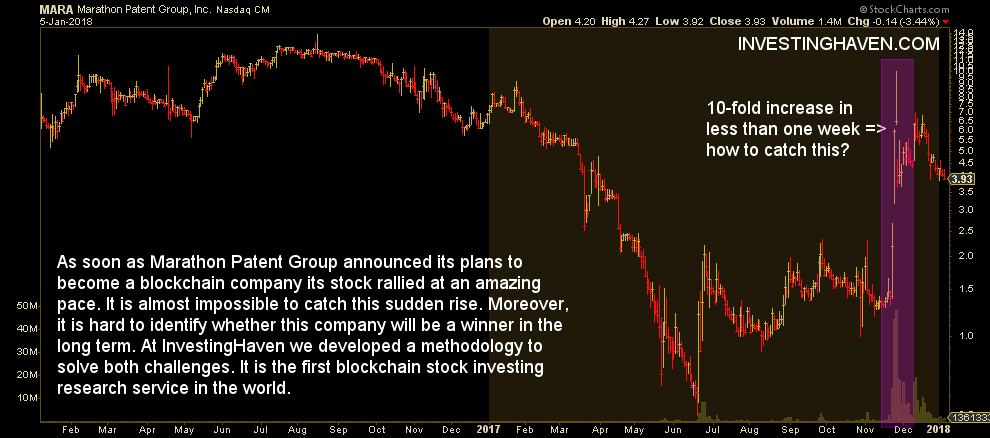

Let’s illustrate this with an example. Marathon Patent Group, a nano cap stock in 2017, with a steeply declining stock price, announced early December that it would become a blockchain company focusing on mining cryptocurrencies. In 3 days the stock price of this company went up 10-fold.

It is not just Marathon Patent Group behaving like this. Almost each new blockchain company (IPO) or existing company engaging in the blockchain sector (typically through a reverse takeover) shows a similar pattern, though not necessarily as extreme.

There are two specific challenges associated with this case:

- How to know about these blockchain stocks coming online? You’ll have to monitor the whole stock market and news on a daily basis to identify these stocks immediately.

- How to know which blockchain stocks are worth investing in, and which ones not, knowing that there many ‘charlatans’ out there seeing the opportunity of a lifetime to add ‘blockchain’ in the name of their loss-making company. Yes there are quite some scams out there, and investors better not hold those stocks in their (long term) portfolio.

At InvestingHaven we developed a methodology which solves both challenges outlined above. It is the First Blockchain Investing Research Service In The World >>

A strategy for selecting blockchain stocks worth investing in

The strategic approach for selecting the right blockchain stocks is based on this guiding principle:

- We do not focus on catching every blockchain stock that goes balllistic.

- We do not focus on catching every new blockchain stock per se.

- We do focus on future winners, and try to catch the future Amazon / Ebay / Paypal in the blockchain space (at a time when they were still a startup).

That is a handful of pure play blockchain stocks, probably 5% or less.

In order to catch that 5% that will generate formidable returns in 10 years from now, without knowing the future, we worked out our own proprietary methodology based on two 2 assessments:

- We calculate a score based on several key success factors like product/market fit (essential part of startup methodologies), technological strength and maturity, financial strength and ability to generate revenue, leadership team, etc.

- We continuously monitor and adjust the scores based on progressive insights and evolution of the company.

- We aim to acquire shares in a riskless way in a select number of blockchain stocks.

With this strategy we do not take huge risks but we play on the success principle that you get in as early as possible in a company that has amazing future growth. In case you get in early you will have formidable returns on the long run. In case your acquired stock will not survive the burst of the bubble (inevitable at a later point in time) at least you did not loose anything.

Investors are invited to consider a low-cost subscription: Blockchain Investing Research Service >>