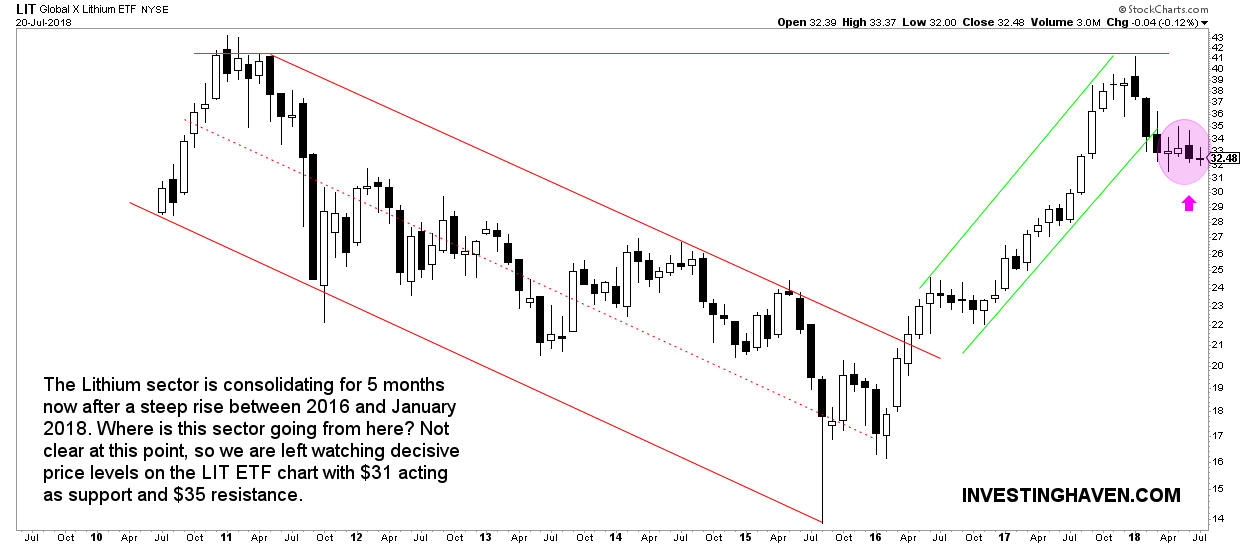

The lithium market was red hot in 2016 and 2017. LIT ETF, representing the lithium stock sector, went up from $16 to $41 in that time period, after which it retraced 22 pct to $32.48. What’s next for the lithium stock sector in 2018?

The meteoric rise of the lithium stock sector came with the amazing rise of base metals. No coincidence, of course, as they are all part of the same commodity segment.

With the retracement that followed in base metals as well as the lithium stock sector since January of 2018 we now see a consolidation period of 5 months. What’s next for the lithium stock sector in 2018 and beyond?

It is a tough question to answer at this point in time although we are inclined to say that lithium will continue its strong rise for several reasons:

- Strength in the US Dollar may be over. It was the first months of 2018 that the USD did rise strongly, up until recently, but this USD chart may suggest strength will be over.

- Fundamentally, lithium is used in electric cars, for its batteries, and, as we all know, we have only seen the start of this amazing growth trend. There is lots of potential, and likely all cars will be electric in the next one or two decades. Imagine how much lithium must be sold to accomplish this.

- Chart wise, lithium does not look like it saw an absolute top, on the contrary even. The long term chart of LIT ETF shown below suggests a small pause was taken in 2018, which is the preparation of the next uptrend which may start at any point in 2018.

We watch very closely what happens in the $31 to $35 range. Any attempt to breakout will be take seriously. Note that a breakout is defined as 3 consecutive weeks in which LIT ETF trades above $35.