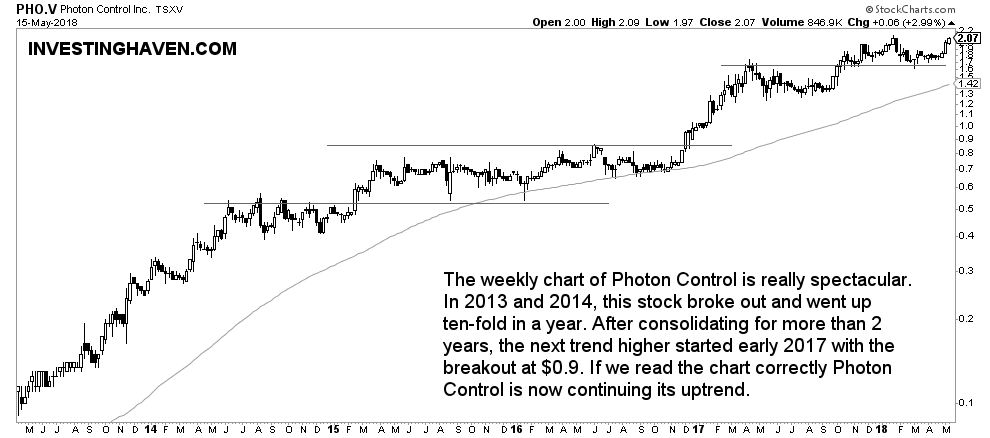

Photon Control has an amazing long term chart. It is a small cap stock in Canada, in a niche sector within the semiconductors space. It is a textbook example of a company that provides strong and fundamental value, both in its financial results (fundamentally) but also on its chart (technically).

Photon Control designs and manufactures optical sensors for temperature and positioning which is used in water measurements.

The company is a critical systems supplier to the largest customers in their space. Key take-aways from the investor presentation on their investor relations site:

- Leader in a large, growing market with a rich new product funnel offering $12 – $15mm in revenue per year at full run rate when fully deployed.

- Enviable financial metrics.

- Generating significant cash to invest in the business, buy back shares and opportunistically pursue acquisitions

They have doubled their revenue in recent 2 years, and have a clear path to double revenue again in the next 2 years (by 2020):

- Strategy is focused on the development of innovative new products

- Many of these products are under development now

- M&A may also play a role in revenue growth

Their Q1 2018 financials were really gorgeous as seen here:

- Solid revenue growth.

- Solid earnings growth.

- Costs under control.

What else does an investor need? The company has a market cap of $229M.

Its chart looks gorgeous. With a clear plan to double revenue in the next 2 years, with a strong technology roadmap, with a good management team and a proven track record to grow, we believe this stock provides great long term value.