You can use fixed, recurring crypto purchases to smooth costs during volatility. Data shows dollar-cost averaging eases risk but often trails lump-sum in bull cycles.

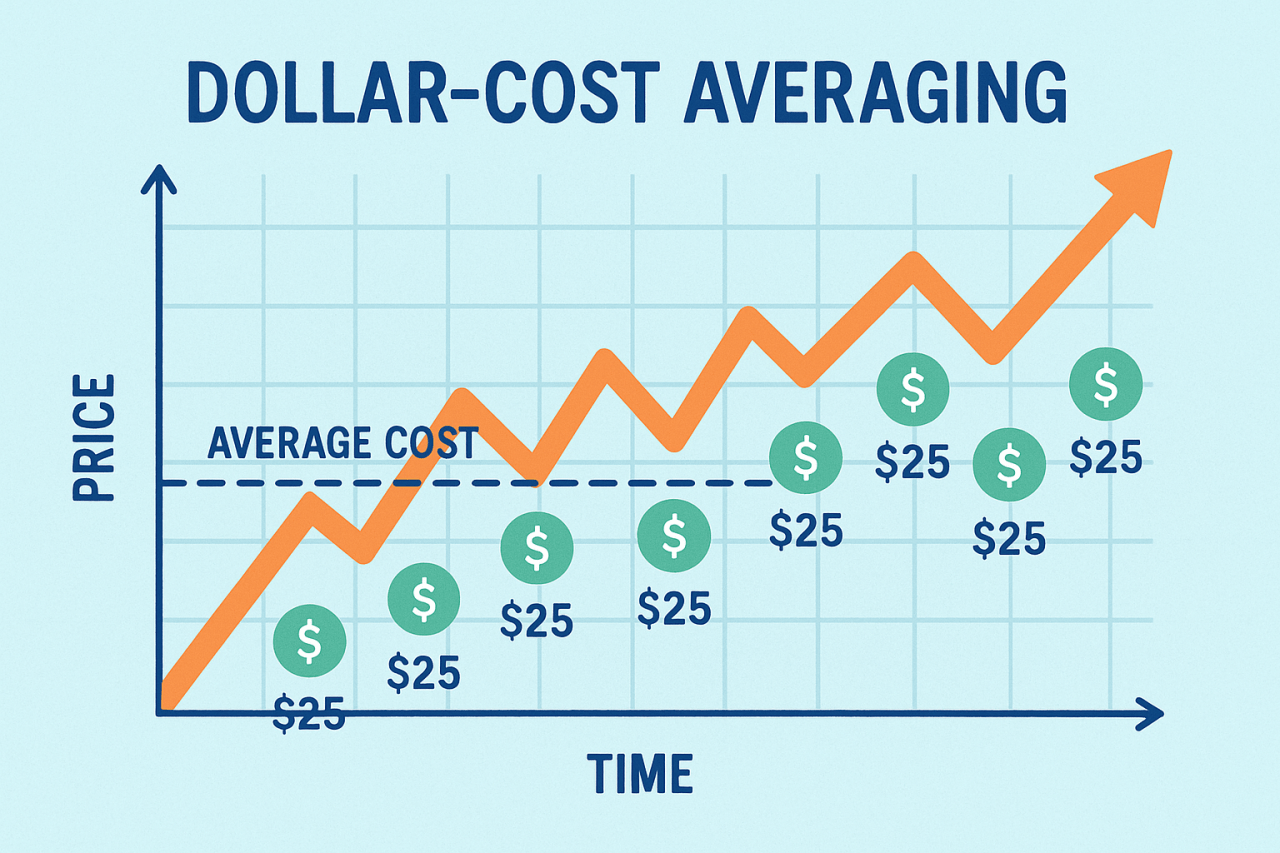

Dollar-Cost Averaging in crypto means investing a fixed amount at regular intervals, regardless of price.

This method averages purchase cost over time and eliminates guessing the market bottom. In highly volatile crypto markets, DCA gives disciplined investors steady exposure while reducing emotional pressure and avoiding poor market timing.

RECOMMENDED: How to Make $1M with Bitcoin in 10 Years With Dollar-cost Averaging

How Dollar-Cost Averaging Works in Crypto

With DCA, you divide your budget into equal parts and invest at regular intervals. For instance, when designing a Bitcoin investment strategy, you can invest say $100 each month. You buy more when prices fall and less when prices rise, so your average cost per coin stays balanced over time.

For instance, Kraken reports that 59.13 % of crypto investors use DCA as their primary strategy. BitPay illustrates this with $50,000 spread over five purchases at varying prices, which lowered the average cost basis and increased total holdings.

RECOMMENDED: How to Make $1M with Gold in 10 Years With Dollar-cost Averaging

Benefits and Limitations in Crypto

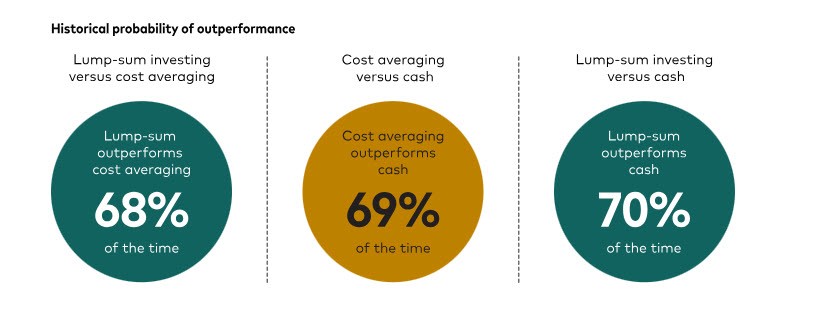

DCA reduces risk of large losses from badly timed investments. BitIRA shows lump-sum wins 68% of the time, but DCA eases psychological stress when market prices stay high or fall sharply.

During bear phases DCA may outperform. Nakamoto Portfolio’s simulation from 2017 to today shows lump-sum generally outperforms, but DCA excels in down-trending periods.

DCA also improves emotional discipline and keeps you consistently investing even when prices drop or rally. Yet lump-sum captures returns faster in rising markets. Forbes finds lump-sum beats DCA 64 % of the time over six months and 92 % over 36 months.

RECOMMENDED: How to Make $1M with XRP in 10 Years With Dollar-cost Averaging

Conclusion

DCA helps crypto investors stay disciplined and buffer volatility. It suits those without a lump sum and who value emotional resilience.

In strong bull markets, lump-sum wins on results. Choose DCA if you prefer steady, automated entry and reduced stress. Tailor strategy to your budget, risk appetite, and emotional objectives.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service — delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.