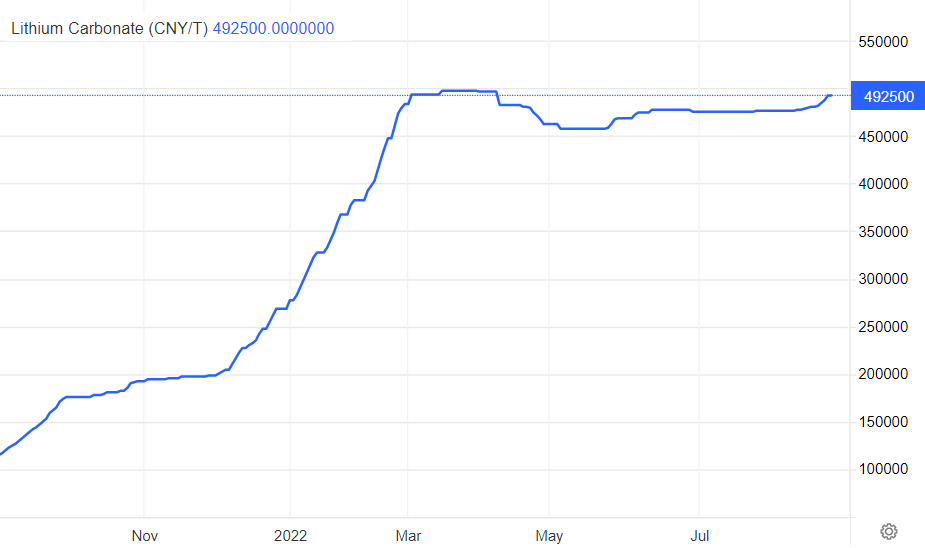

While most market segments are hit by unusual volatility, turning any bullish attempt into a doubtful outcome, there is one sector that says BOOMING BUSINESS. At a time when most stock charts and sector charts look very choppy there are two charts that look amazing: the lithium price chart and the battery metals sector chart.

We will show in this article how the lithium price and green battery metals stocks are both wildly bullish, but in a very different way.

All Covid Momentum Stocks Are Back To Ground Zero signaling the end of the big Covid momentum cycle in markets. However, here is one trend that is only now taking off: battery metals!

As explained in The Hottest Commodity Of This Decade, The Only One Still Near ATH:

The lithium space had a major divergence between the price of its leading indicator (lithium price) and the miners. This divergence did not last for long. We would argue that there still is a divergence, but it’s in the process of disappearing.

As said in The Only Commodity Not Impacted In 2022, Currently Right Below ATH:

Most, if not all, of our lithium stocks selection look really good as they confirm a long term basing pattern, setting the stage for a continued rally in the next 18 months. In our latest Momentum Investing shortlist we featured several lithium stocks that will be really well in the next 18 months!

We confirmed the following in our post Lithium Outlook 2022 And Sector Darling Lithium Americas:

Lithium related stocks remain Bullish on the long term and therefore our Lithium price forecast for 2022 is still on track. The main risk we see for the sector is the social and environmental impact (Pollution, water depletion, chemicals used in the process.). On the other hand, we believe that the extraction and treatment processes will hopefully become more environmentally friendly as the sector matures.

The lithium price chart, below, is the only commodity trading at all time highs.

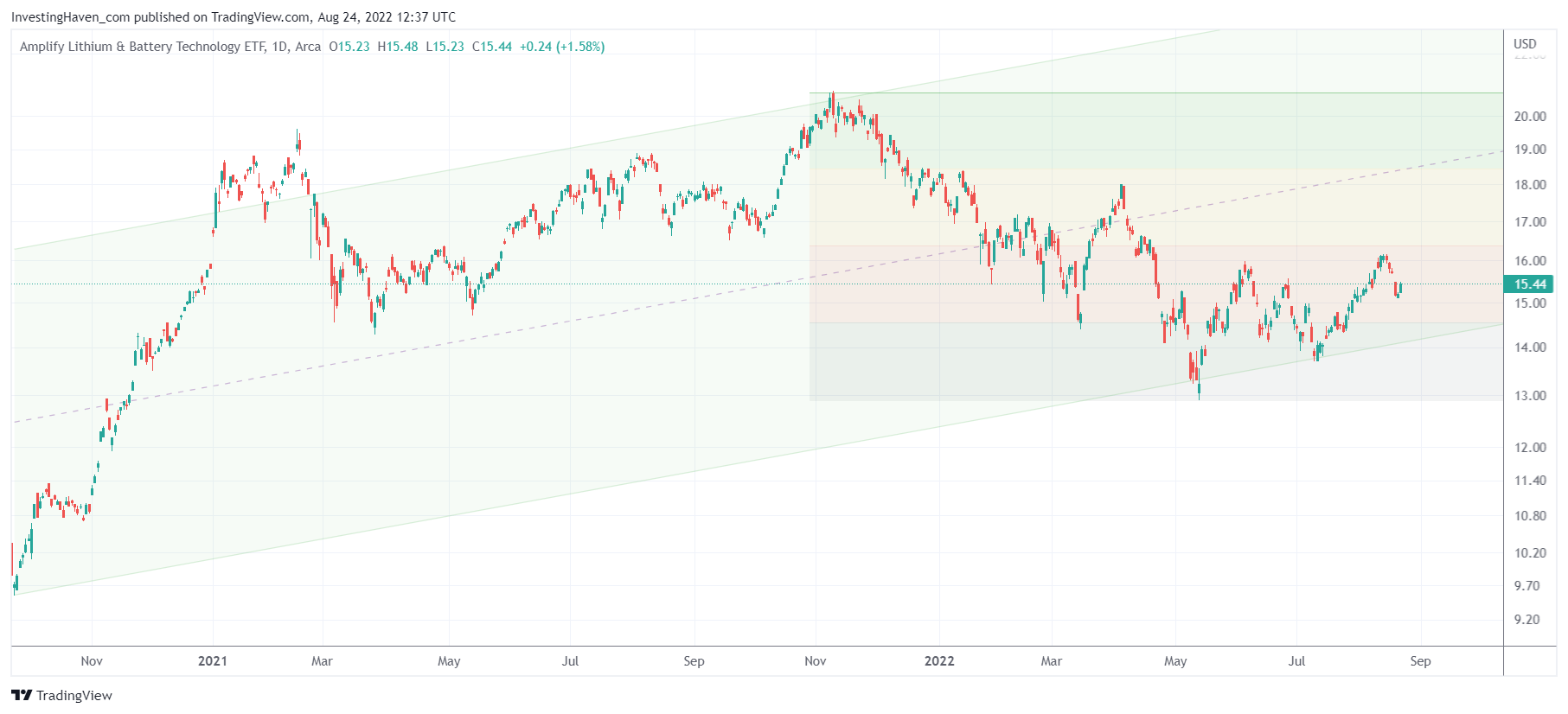

There are many ETFs out there (think LIT), mostly covering large caps like SQM and ALB. However, we prefer to focus on BATT ETF as it exhibits the most relevant companies in our view.

There are many ETFs out there (think LIT), mostly covering large caps like SQM and ALB. However, we prefer to focus on BATT ETF as it exhibits the most relevant companies in our view.

BATT ETF has a tremendously bullish setup. In fact, it is one of the few sector charts that we like a lot, currently. It is one of the few sector charts that has such a bullish reversal in 2022.