The lithium sector pulled back in December and stabilized in January. That’s because the price of lithium pulled back from ATH. Are we still bullish on lithium as per our Lithium Forecast 2023? Did anything change in recent weeks that would invalidate our lithium forecast or even the broader green battery metals forecast?

The short answer is ‘no’.

Readers may want to check the fundamental data points that we shared in the two forecasts mentioned in the intro of this post. The growth rate of green battery metals in the coming years is exceptional, we don’t believe a temporary pullback is a bad thing, it’s a good thing, it lets some ‘hot air’ out of a market.

Moreover, and more importantly, we were very explicit in calling out how exactly we believe the green battery metals boom will develop this decade. From our article How To Play The Green Battery Super Cycle In 2023:

- The green battery super cycle will move with ups and downs.

- Specific to lithium, we are looking to buy the dip on lithium miners that have great deposits and are near-term producers.

- We look at: Size of the lithium deposit, richness of the lithium deposit, expected year of production, production volume, cost of production, offtake agreements.

- Whenever the lithium market is going to take off again, momentum will kick in and explorers will outperform.

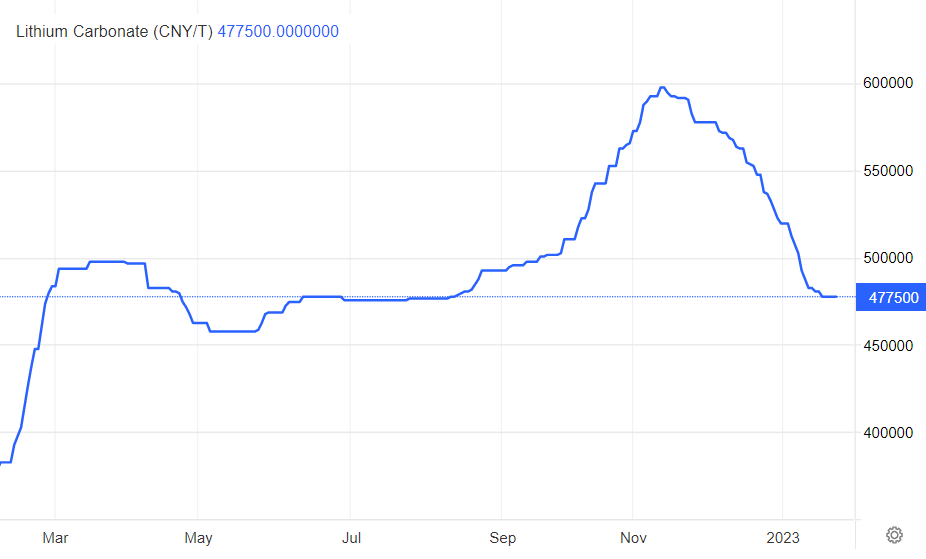

With that said, one of the leading indicators for the lithium sector is the lithium price. As seen on the lithium price chart, shown below, there was a dip in December after a big run higher in Oct/Nov.

This is a good thing, in our view, although the 2022 lows need to hold.

In other words, we will be really excited about the prospects of this sector if the lows of 2022 in spot lithium will hold in the coming months. That’s when we will get more aggressive entering lithium stocks, presumably in the next 2 to 4 months.

Investors interested in capitalizing on the long-term uptrend of lithium stocks should consider consulting our top lithium & graphite selection. In it, we share a very clear investing strategy based on risk/reward considerations. Out of hundreds of lithium & graphite stocks, we did make a selection of 15 top lithium & graphite stocks, based on fundamental analysis (including grades, deposit size, year of production, location) combined with charting analysis. Top Lithium & Graphite Stocks Selection >>