Are lithium stocks trading at attractive entry levels? Yes, we think so, provided the double bottom on the spot lithium chart holds. We will explore the current state of the lithium market, where the charts are painting a compelling narrative, part of the green battery metals boom.

Lithium, a key component in the electrification of our world, is undergoing a fascinating long term transformation. We emphasize the word ‘long term’ to ensure lithium investors remain focused on the 10-year cycle.

One of our lithium market leading indicators is spot lithium. Its charts reveal a potential double bottom formation, both in the short term and on a broader scale, at the 68.2% retracement level of a significant rally. What does this mean for investors? We believe it signifies a major secular buy opportunity in the making. Let’s dive deep into the analysis to understand why.

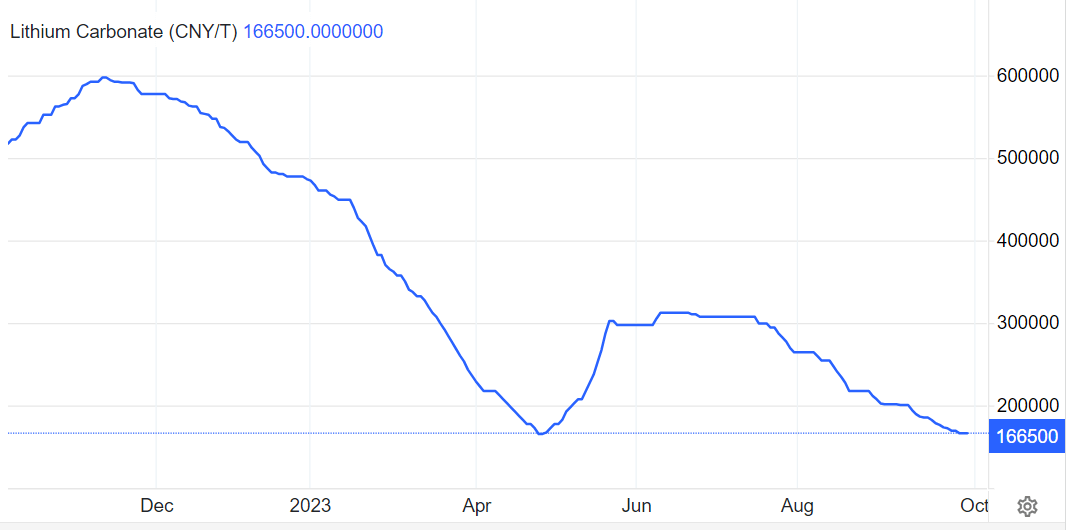

The Short-Term View – Spot Lithium Double Bottom

First, let’s take a closer look at the short-term perspective. The 6-month chart [Insert Chart Link] shows a clear double bottom formation. This pattern is a bullish signal in technical analysis, indicating that after a decline, the price has found support at a certain level and is potentially poised for an upward move. In this case, spot lithium prices appear to be testing this crucial support zone.

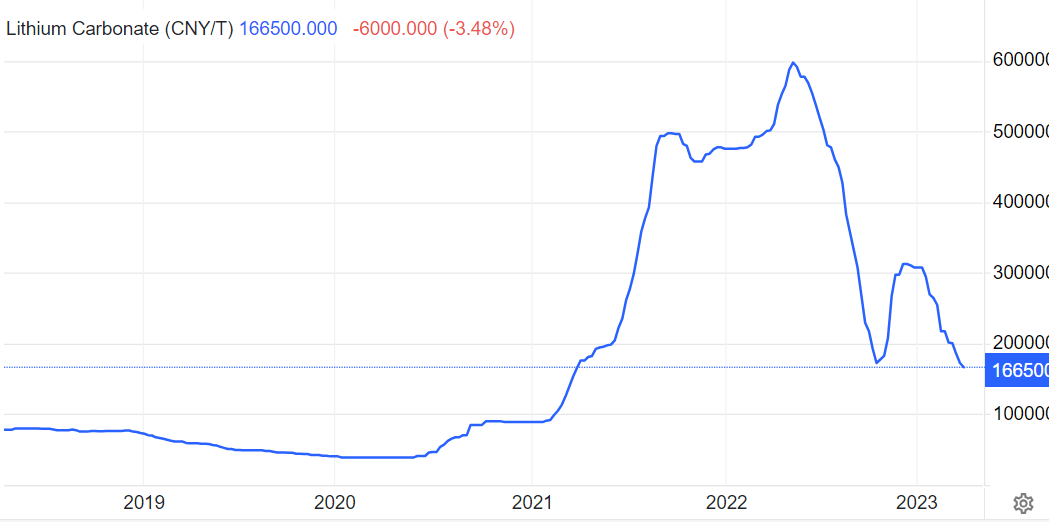

The Long-Term View – Lithium’s Double Bottom In Perspective

Zooming out to the bigger picture, the 5-year chart [Insert Chart Link] unveils a double bottom formation at the 68.2% retracement level of a significant rally. This is a noteworthy retracement level, often associated with potential trend reversals. It suggests that the recent decline in lithium prices might have reached a crucial inflection point, one that has historically marked major turning points in the market.

Understanding Lithium’s Secular Mega Cycle

To comprehend the significance of these patterns, we must consider the broader context. The lithium market operates within a secular mega cycle, characterized by long-term trends that span several years. This cycle is driven by the global shift toward clean energy, electric vehicles, and renewable technologies. Lithium, as a critical component in batteries, is at the forefront of this transformation.

Lithium’s Mid-Cycle Pullback

The recent decline in lithium prices, when viewed in the context of the secular mega cycle, can be interpreted as a mid-cycle pullback. Such pullbacks are common in long-term trends, providing an opportunity for markets to recalibrate before resuming their upward trajectory. Importantly, they often coincide with attractive entry points for investors looking to participate in the long-term growth story.

Lithium Stocks – Very Attractive Entry Points

Provided the current level in spot lithium holds, the recent decline may indeed be a mid-cycle pullback within the larger secular mega cycle. This presents an enticing opportunity for investors. Lithium stocks, at their current valuations, qualify as very attractive entry points. These stocks are positioned to benefit from the continued electrification of vehicles, renewable energy adoption, and advancements in energy storage technologies.

Conclusion – The Potential for Major Gains

In conclusion, the charts are sending a clear message: lithium is testing a double bottom, and a major secular buy opportunity may be in the making. The short-term and long-term patterns suggest that we are at a pivotal juncture in the lithium market’s evolution. Investors who recognize the significance of this moment and position themselves wisely could stand to reap major gains as the secular mega cycle continues to unfold.

As always, it’s essential to conduct thorough research and consider your investment strategy and risk tolerance. The lithium market’s potential is undeniably exciting, but success in investing requires a well-informed and disciplined approach. Stay tuned for more updates on this fascinating journey through the world of lithium.

In August, we hit a hidden gem lithium stock, in our premium service, it went up 100% after which we shared exit options to our premium service members. Similar opportunities are arising, our premium service members will receive the details from our research team whenever the time is right.

We are helping investors by selecting top lithium stocks.