The lithium market is waking up… again. After a downturn in spot lithium, one that lasted exactly 6 months, it looks like the price of lithium is bouncing. This comes with major implications for investors as lithium investing will soon rank among the top performing sectors. In our Momentum Investing service, we continue to recommend lithium (as well as silver) as the cornerstone of our long term holdings. We hit many multi-baggers with lithium (we’ll soon hit multi-baggers in the silver space as well). One thing is clear: our members will be reward with our top lithium tips, in 2023, as per our lithium forecast. The retracement in markets that is currently developing will come with a buy opportunity in lithium miners.

InvestingHaven’s research team has turned its attention to the lithium market, recognizing the immense growth potential it holds. As one of the fastest-growing markets in history, lithium plays a pivotal role in meeting the soaring demand for electric vehicles (EVs) and other lithium-ion battery applications. The supply of lithium to support this demand has become unprecedented, making it an exciting sector for investors to monitor closely.

Analyzing the Lithium Chart Structure and Unique Characteristics

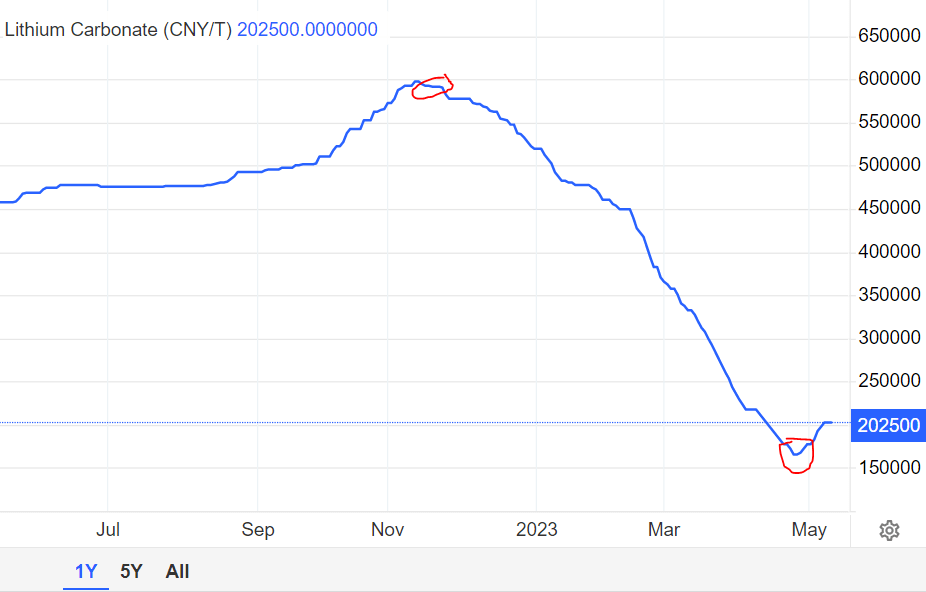

The chart of lithium prices over the past 12 months reveals a significant drop from 600k to 170k CNY per tonne. What sets this drop apart is the steepness of the decline, resembling a sharp and almost linear trajectory. Such a swift descent highlights the market’s vulnerability and the urgency to evaluate its potential for a bottoming formation.

Remarkably, while lithium prices experienced a substantial drop, lithium miners displayed relative resilience. In most cases, when a commodity experiences a 70% decline, stocks within that sector tend to plummet even further. However, the same cannot be said for lithium stocks, particularly those identified in our top lithium selection. These stocks showcased remarkable strength, with some even reaching new all-time highs despite the challenging market conditions.

A Promising Lithium Market Outlook

Based on the chart patterns and market dynamics observed, it appears that the lithium market is currently in a bottoming formation. To confirm this formation, it is crucial for the market to respect the 170k CNY/t level, which serves as a key support level. Should the market hold this level, it suggests a halt to further downside momentum and increases the likelihood of a potential recovery.

Looking ahead, we anticipate that lithium miners will embark on a new bullish trend, potentially starting as early as this summer. The resolution of the debt ceiling drama, coupled with favorable market conditions, will be vital catalysts for this anticipated upswing. A resolution of the debt ceiling issue will remove a significant source of uncertainty in the broader market, allowing investors to focus on the positive fundamentals of the lithium sector. Additionally, a more subdued tone from the Federal Reserve during its next meeting would provide further stability and support for the market.

The lithium market’s bottoming formation, along with the strength exhibited by lithium miners, sets the stage for a potentially bullish trend. As the market stabilizes and spot lithium prices find support, investors should closely follow the developments in the lithium sector, ensuring they are ready to seize the opportunities that lie ahead.

Selection of top lithium stocks

At InvestingHaven, we are currently in the process of updating the charts of our top lithium selection. We are pleased to report that our lithium miners demonstrated impressive resilience during the recent decline in spot lithium prices. Several lithium miners within our selection possess exceptionally powerful long-term chart setups, further enhancing their investment potential.

In the next one to two weeks, we will be releasing an updated list of our top lithium selection to our premium members. This selection aims to identify opportunities to “buy the dip” in quality lithium miners, allowing investors to position themselves strategically to capitalize on the potential upswing in the lithium market.

As the lithium market continues to evolve, it presents investors with significant opportunities for growth and profit. By closely monitoring chart patterns, market dynamics, and key support levels, investors can make informed decisions and participate in the potential resurgence of the lithium sector.