Rolls-Royce stock has fired on all cylinders under CEO Tufan Erginbilgic over the past two years. But is there any further upside left in RR shares?

Rolls-Royce (RR) has been rather lucrative as an investment over the past two years as the defense and aerospace contractor continued to turn around under its chief executive Tufan Erginbilgic.

The multinational has reshaped operations, improved margins, and repaid debt to emerge as a much more resilient business – driving its share price up by more than 500% in the trailing 24 months.

Simply put, $10,000 invested in Rolls-Royce in July of 2023 would be worth more than $60,000 at the time of writing. Following this cosmic run, however, it’s reasonable to question whether RR shares have any further upside left.

The Bull Case for Rolls-Royce Stock

While Rolls-Royce shares have had a cosmic rally already, there are structural tailwinds indicating potential for continued gains ahead.

For starters, UK plans on raising its defense spending to 2.6% of the gross domestic product (GDP) by 2027 – and NATO allies want to push it up further to 5.0% over the next 10 years.

RR stock could emerge as a notable beneficiary of higher spending on defense given its role in the UK’s nuclear submarine program and more broadly in military propulsion and power systems.

Additionally, Keir Starmer – the country’s prime minister has recently confirmed support for Rolls-Royce’s small modular nuclear reactor (SMR) initiative, which could help drive its share price up further in the back half of 2025.

A 0.68% dividend yield and authorization to repurchase more than £850 million of its shares are great reasons to have Rolls-Royce stock in your investment portfolio as well.

The Bear Case for RR Shares

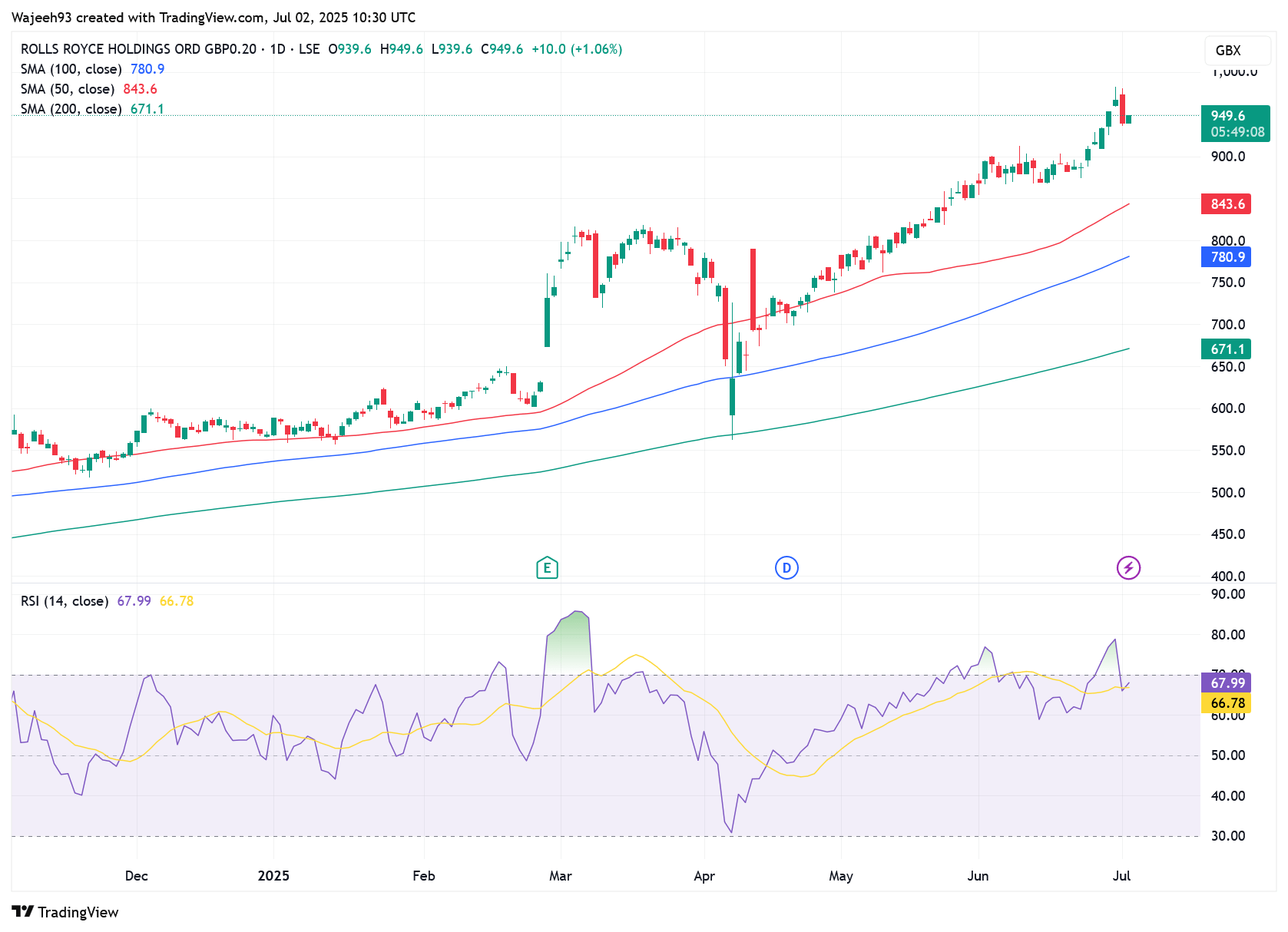

Rolls-Royce remains attractive also because its trading comfortably above all of its major moving averages (20-day, 50-day, 100-day, 200-day).

However, its valuation does appear rather stretched at the time of writing. RR shares are currently going for a forward price-to-earnings multiple of nearly 50 – significantly higher than a bunch of AI stocks, even including Nvidia at less than 40.

This suggests Rolls-Royce stock is priced to near perfection – and any signs of delays in project execution or top-line weakness could trigger a sell-off.

Plus, the company’s civil aerospace business that contributes significantly to its profit significantly depends on global air travel. If rising geopolitical tensions, particularly in the Middle East, results in a sharp increase in oil prices and weighs on passenger demand – RR stock could take a hit.

Should You Invest in Rolls-Royce Today?

All in all, it’s reasonable to believe that Rolls-Royce stock could extend gains further – but it will need flawless execution to justify its premium valuation and sustain investor confidence amid rising expectations.

For now, analysts have an “overweight” rating on RR shares but the mean target no long represents any meaningful upside from here.

Our most recent alerts – instantly accessible

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)

- Gold & Silver – The Big Picture Charts That Matter (June 21)

- Gold & Silver Shine but Not Simultaneously… The Market Loves To Confuse Investors (June 15)

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)