Despite extreme volatility, Tesla stock has been lucrative for investors over the past year. But is there any further upside left in TSLA shares for those interested in gaining exposure today?

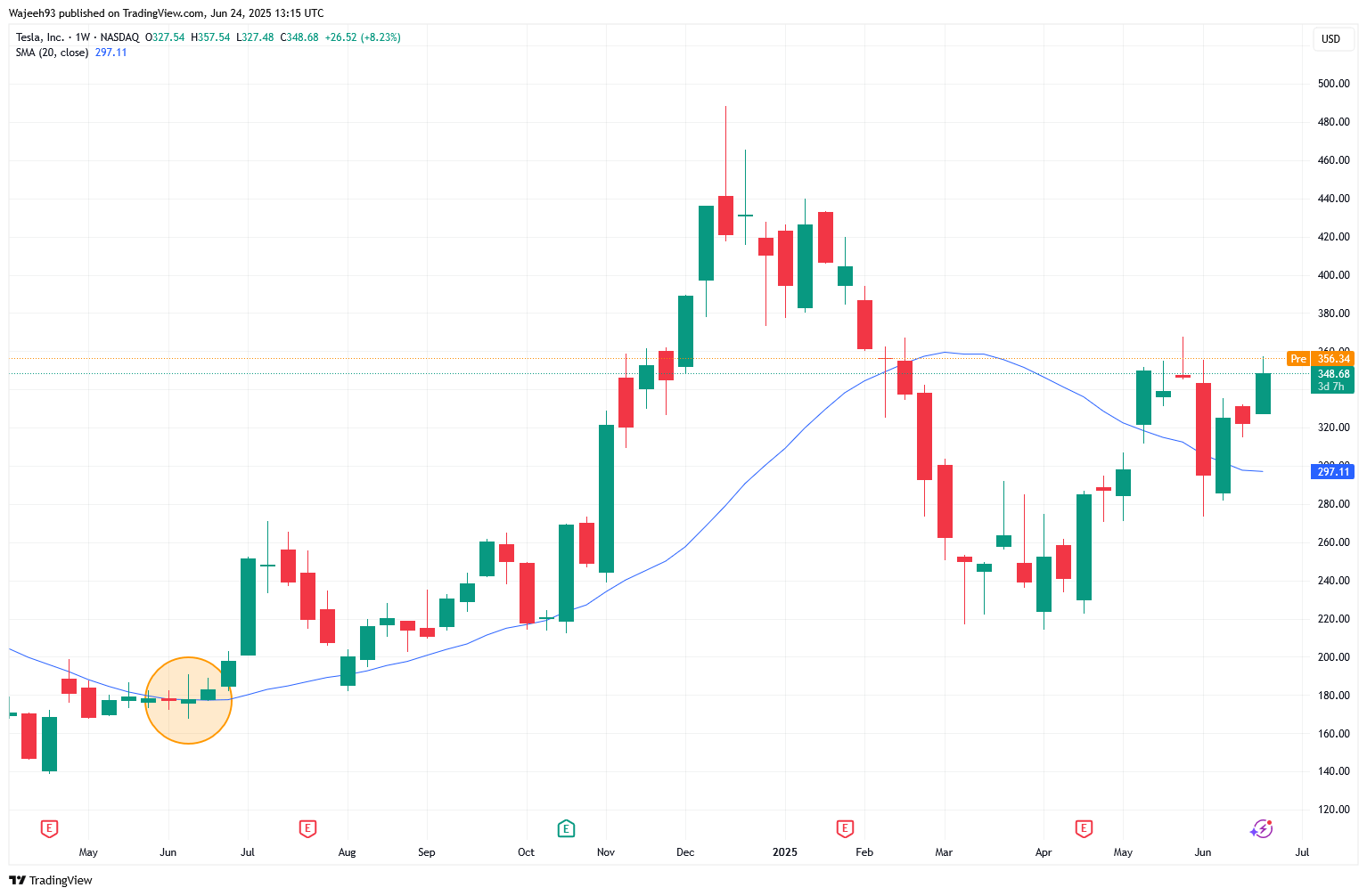

Like any other stock that trades heavily on sentiment, volatility has long been a hallmark of Tesla Inc (TSLA) – and the past year has not been any different in that regard.

In the first quarter of 2025, the EV giant lost as much as 55% due to reputational damage from its billionaire chief executive, Elon Musk’s controversial role in the Trump administration.

Still, net-net, TSLA shares have been rather lucrative for investors over the past 12 months. In fact, $10,000 invested in the EV stock in June of 2024 are worth nearly $19,000 at the time of writing.

This raises a serious question for potential investors interested in building a position in Tesla stock at current levels – is there any further upside left in TSLA?

The Bull Case for Tesla Stock

Despite a massive surge in Tesla shares since June of last year, Wedbush senior analyst Dan Ives remains bullish as ever on the automaker for the next 12-18 months.

Ives drives his optimism on the EV stock primarily from the company’s recent launch of robotaxi services in Austin, which he believes could help double its market cap to $2.0 trillion by the end of next year.

Plus, the multinational’s work on humanoid robots is seen unlocking significant further upside in TSLA stock as well. In his latest research note, Ives even called Tesla Inc the “most undervalued stock” within the artificial intelligence (AI) space.

Wedbush currently has a $500 price target on Tesla stock that indicates potential for another 45% upside from current levels.

The Bear Case for TSLA Shares

TSLA shares may be worth owning at writing also because they’ve recently surpassed all of their major moving averages (20-day, 50-day, 100-day, 200-day).

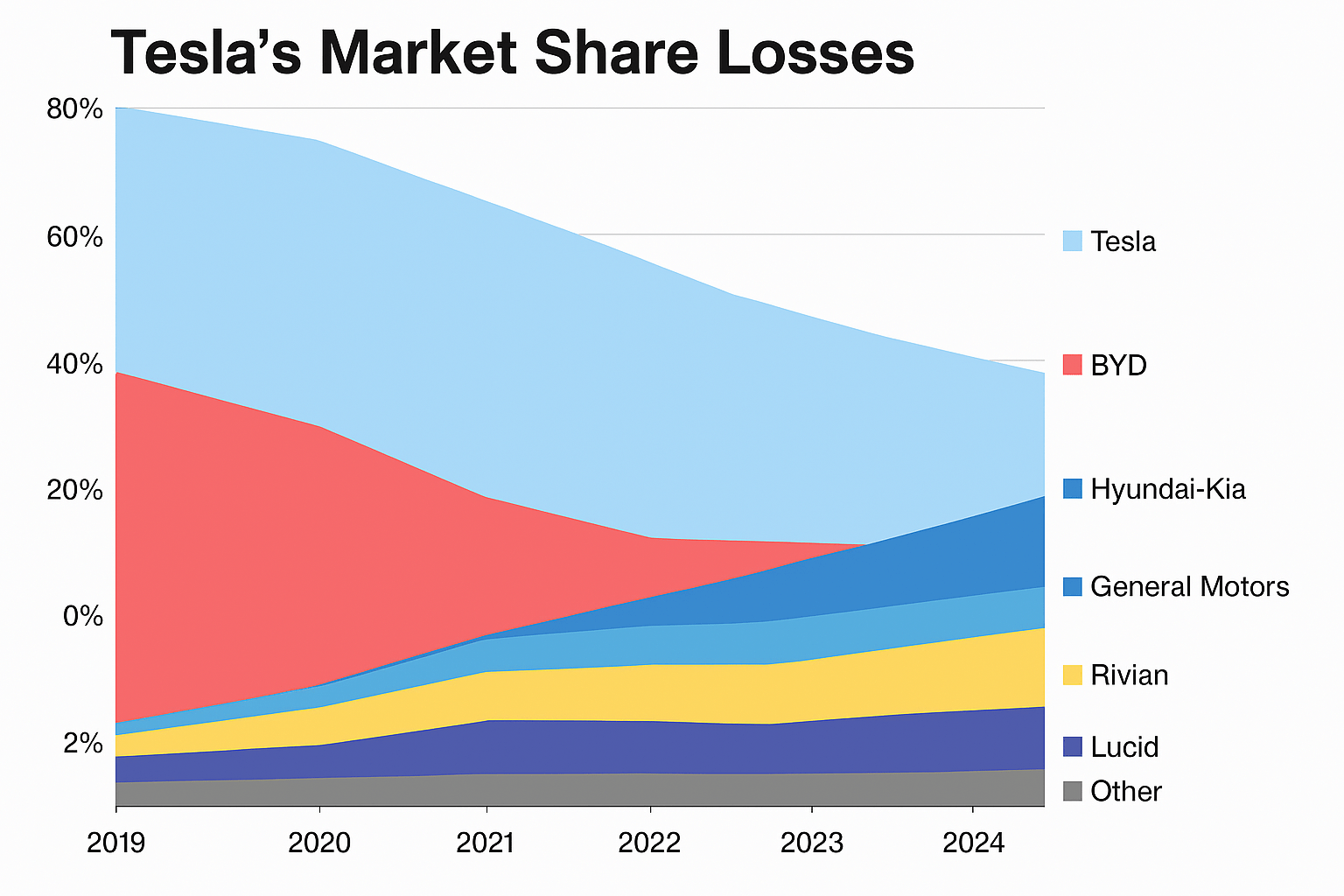

Still, slowing sales in the wake of rising competition, particularly from the likes of BYD, warrants caution in going long on Tesla at current levels, argued Colin Langan – a top Wells Fargo analyst in his recent note to clients.

The automaker’s global deliveries in May were down 23% on a year-on-year basis, indicating “risk to Q2 margins.”

With its aggressive pricing, advanced driver-assistance technology, better driving range, and super-fast charging, BYD is already giving TSLA a run for its money in 2025, he added.

In fact, the Chinese electric vehicle manufacturer has already beat Tesla to $100 billion in annual sales.

Is Tesla Worth Investing in Today?

In conclusion, for investors eyeing Tesla stock, the next leg likely hinges on whether the EV maker can execute – not just captivate.

For now, analysts are leaning more towards pulling out of TSLA shares following their cosmic run over the past year. The consensus rating on Tesla currently sits at “hold” only with average price target of about $306 indicating potential downside of well over 10% from here.