In the last 2 weeks it was clearly airline stocks crashing because of the knee jerk reaction of the population canceling their travel. Airline stocks were able to drag down the rest of the broad market indexes. So if airline stocks are leading this decline will they also be able to stop the decline? If so at which point? Let’s revise this question, and see when our bullish stocks forecast for 2020 turns invalid.

The black swan event ‘Corona virus’ is hitting markets, and the question is whether it is a regular (though ultra fast) correction or that the acceleration of the crash is underway.

For sure the global market sell off did hit peak fear last week so technically we are seeing stretched indicators across the board. But the point is that stretched can become even more stretched.

One of the indicators we watch is the airlines stock sector. It’s so far one of the 2 victims of the Corona fear. The other sector is crude oil stocks which logically are the ‘fuel’ for airline stocks.

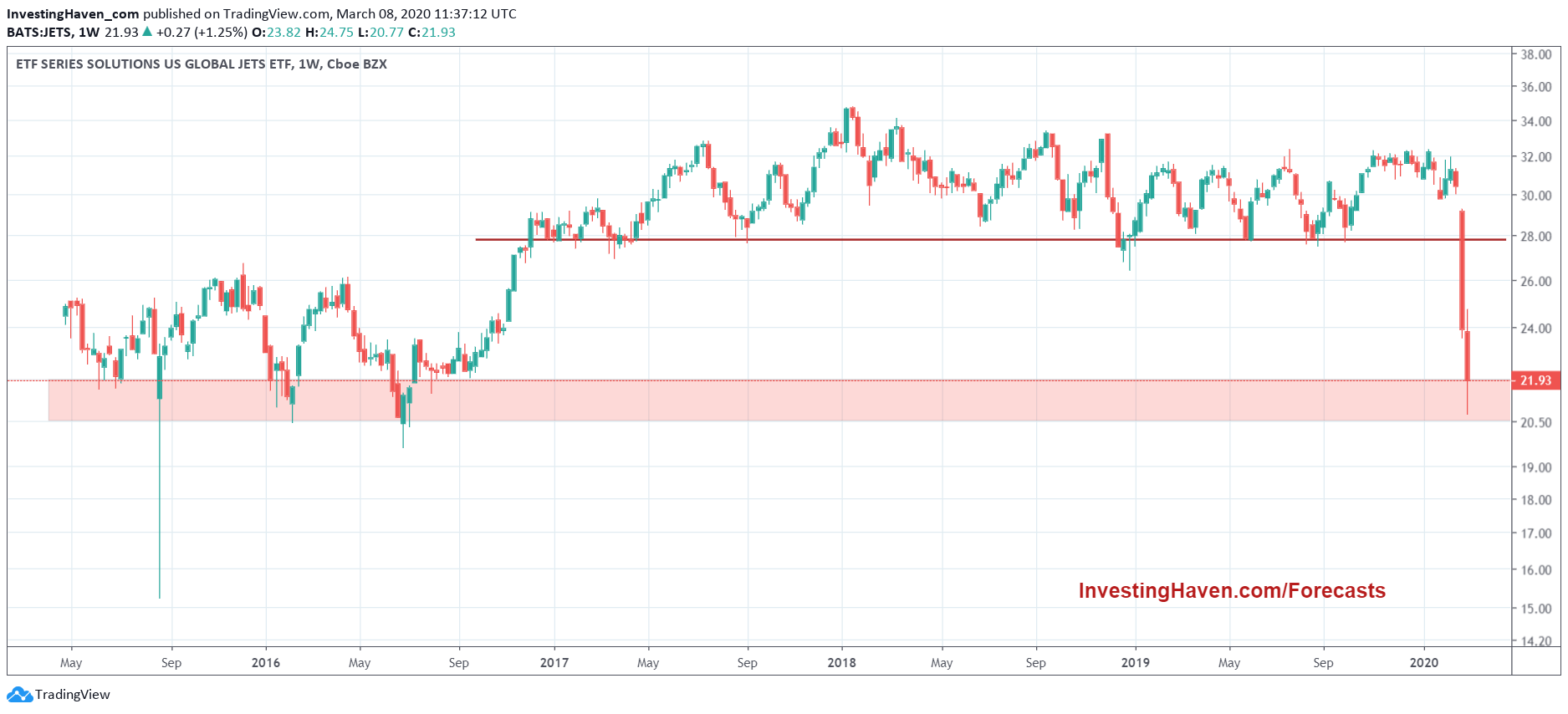

The JETS ETF represents airline stocks. Unfortunately we only have 5 years of data.

What this long term chart tells us is that we are hitting support, the same level as during the 2015/2016 sell off. That was aggressive, so presumably this support level will help avoid a disaster scenario.

However the bad news is that if (a big IF) support does not hold we will see much lower airline stock prices. Rest reassured broad indexes will go sharply lower in that scenario. In that scenario we may have to revise our bullish stock market outlook for 2020, but certainly not yet at this point in time with the current stock market chart setup.