If anything, 2021 is characterized by momentum implosion (February/ March) followed by momentum capping across the board (post-March). All momentum attempts are capped, almost all breakouts invalidate, there are hardly sustained bull runs out there. But here might be an exception, maybe the only exception: the Baltic Dry Index.

It does make sense because the entire world is facing supply chain challenges. Products that need to be transported by ship are suffering post-Covid issues primarily congestion issues in ports.

This pushes the prices of carriers higher, much higher, as evidenced by the Baltic Dry Index trend.

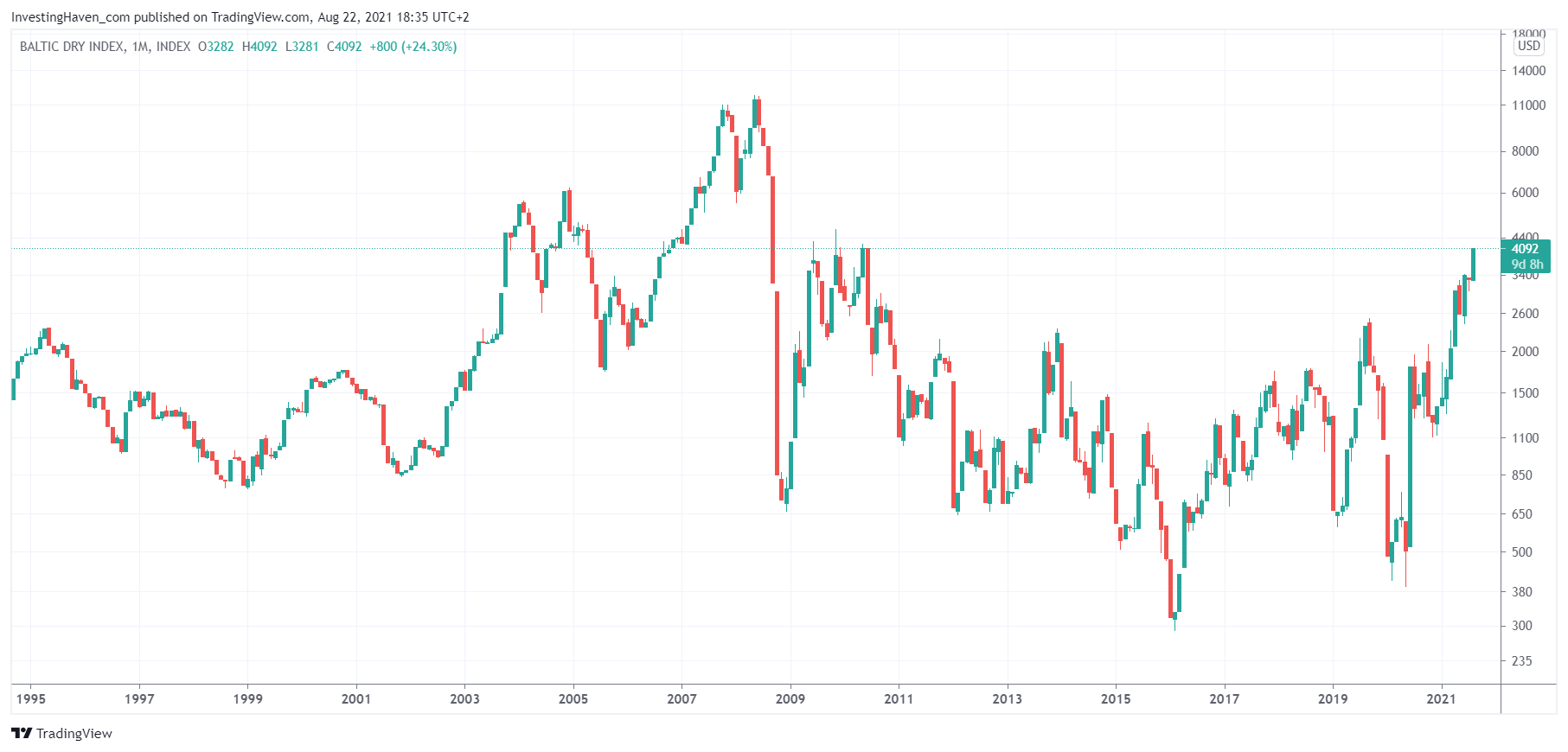

As seen on the monthly long term chart of the Baltic Dry Index there is something really unusual happening. Remember, this is a monthly chart, the longest timeframe, and we can clearly see a very powerful long term reversal on this chart.

Moreover, the current level (4000 points) is a secular breakout level.

Will this Baltic Dry Index bull run be the big exception of 2021? If this index pushes a little bit higher, and respects 4000 points, it will. It might be the ONLY real bull market of the year. We have to be wary though, at a certain point demand for shipping will normalize, but this chart suggests that’s not now.

In our Momentum Investing portfolio we noticed this trend and opened a 25% allocation in one stock that carries product by sea. The chart, both daily and longer timeframes (weekly, even monthly) look spectacular. Once the Baltic Dry Index pushes above 4000 points we can reasonably expect our stock pick to outperform the market. We need the S&P 500 to stay up though.