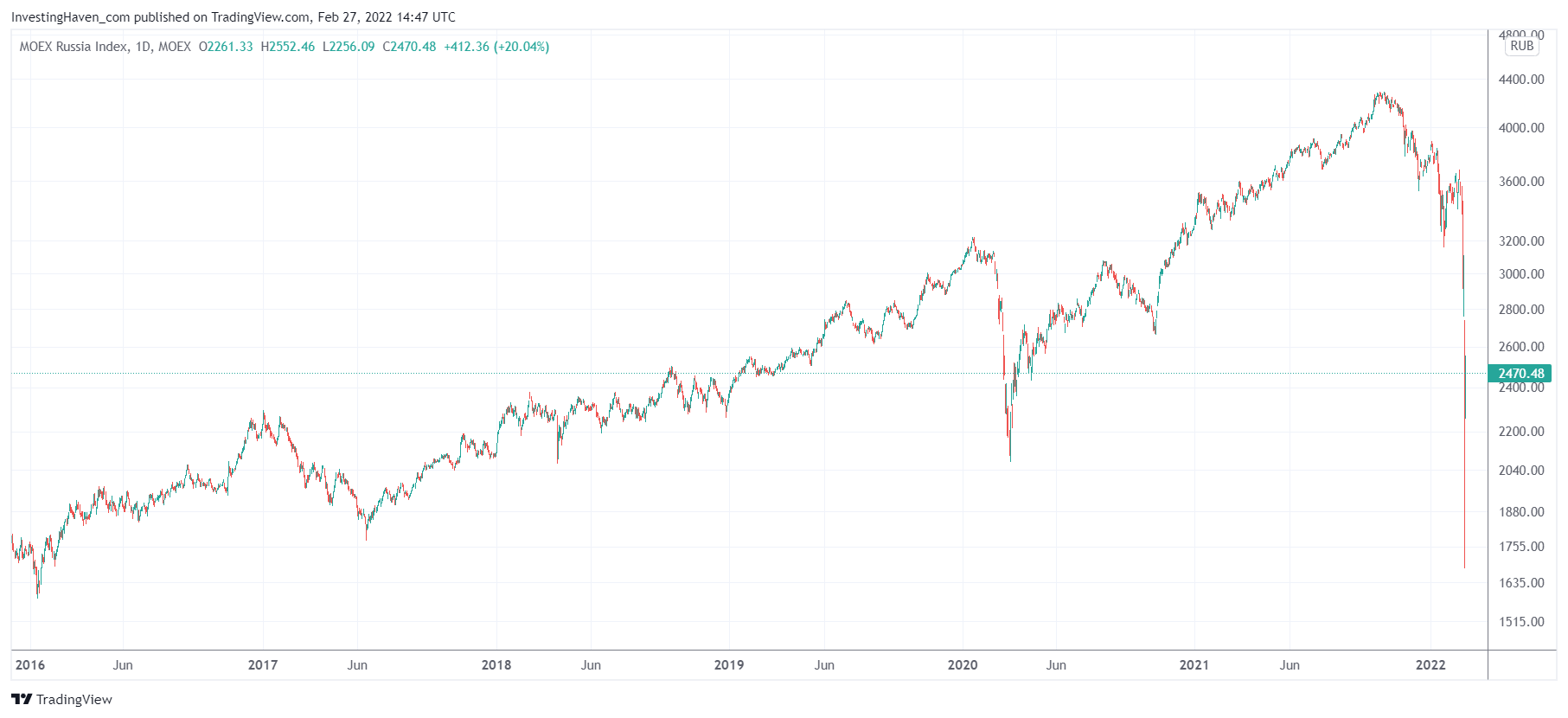

Thursday, February 24th, 2022 was not just a historic day when it comes to humanity. It will also go in stock market history books. The Russian stock market index crashed more than 50% in 24 hours. After hitting ATH in November the Russian index came down some 65% in 3 months.

Before we look at a chart we want to emphasize two things:

- We hate war and everything that sounds or smells like abuse of power. We will not make any association with politics in this article, also this article is only meant to learn from charting, nothing more nothing less.

- During every crash we must respect the old saying “don’t try to catch a falling knife.” There is a reason for this saying. In no way are we promoting the idea to buy Russian stocks, on the contrary. This article is only meant to learn from charting, nothing more nothing less.

The chart of the Russian stock index is the most extreme version of what a crash could look like. It’s even worse than the crash of many China stocks last year.

The most important thing we can learn from this chart is the period heading into the crash. As you can clearly see a steep decline started in December, two months before the invasion. Is this a coincidence? If anything, global markets got very volatile since December. However, most indexes came down around 10%. When compared to the Russian stock index there is a big divergence: Russia came down 27% before the big crash of Feb 24th.

The weekly chart on 16 years shows that this crash was as devastating as the 2008 decline, even much more damaging than the Corona crash.

Two lessons we learn from this:

- Never, ever try to to catch a falling knife when investing, never!

- A crash mostly precedes a period of significant weakness. There is no reason to be invested when a market is coming down sharply, because whatever goes down can go much lower.

Please remember these wise lessons from the 2022 Russian stock market crash.