Artificial intelligence stocks were hot in the month of January. Some believe it’s another bubble or temporary meme stock phenomenon. We don’t think so, AI stocks are probably just starting an epic secular bull market.

It was not only in the stock market that artificial intelligence stocks did well. Even the AI tokens did very well, we hit a few multi-baggers in our crypto service in the month of January, at a time of mass exodus of crypto investors.

That’s how it always goes: the majority of market participants miss the best opportunities.

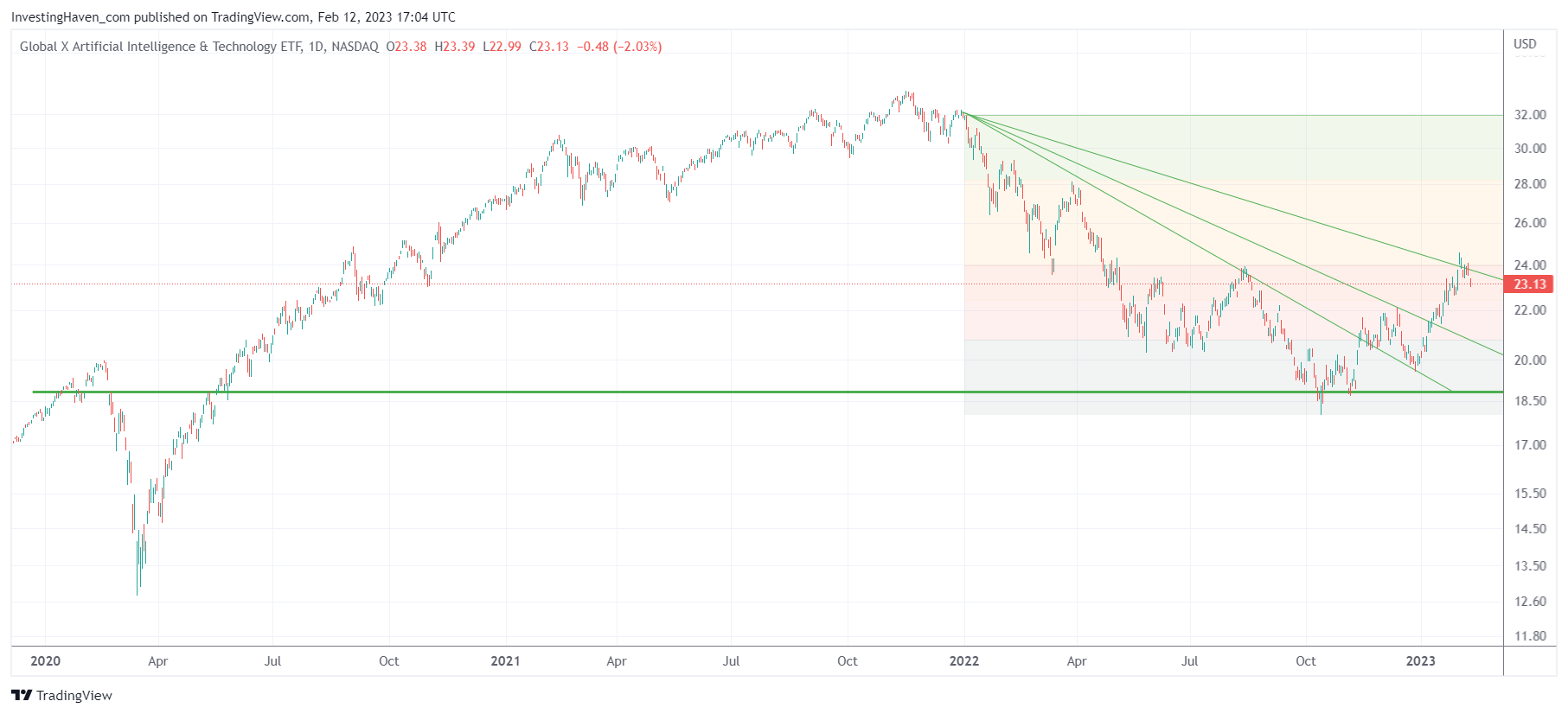

That said, artificial intelligence stocks as per the Global X Artificial Intelligence & Technology ETF (AIQ ETF) are working on a very bullish setup.

Just to be clear, this bullish reversal is not complete. There are a few reasons for this:

- Broad markets are not ready for a bullish momentum rally, not yet. Please read Leading Indicators Confirming A Pullback Is Underway and A Reasonable NYSE Target For March of 2023.

- Tech stocks are not ready for a bullish momentum rally, not yet. Please read Tech Stocks Getting Close To A Secular Test And Potential Buy The Dip Opportunity.

- The AIQ ETF chart hit resistance, the same level as last August.

A drop from the top to the bottom of the red shaded area that is annotated on our chart below is what we need in order to improve (even more) the profile of this AI ETF. If 21 points will hold, we need the highest of 3 falling green trendlines to be broken to the upside.

If both conditions will be in place, this chart will have an epic bullish reversal, one that will push AI stocks much, much higher!

In our stock market investing service Momentum Investing we are preparing a special about artificial intelligence stocks. We will pick out 2 high potential tech stocks to buy in March, aiming for 50 to 100 pct upside potential.