It is getting a mess in the cannabis space. After the breakdown in Canopy Growth (WEED.TO) it is now another top tier cannabis producer that is breaking down. Aurora Cannabis (ACB.TO), one of our top favorites for 2019, has officially confirmed its breakdown this week. We concluded recently in Cannabis Market Breaks Down As High Beta Conditions Improve that the cannabis market is morphing into a fragmented market with some strong / weak / neutral stocks. However, with 2 of the top cannabis stocks in breakdown territory we may need to review what’s going on.

Broad markets are improving, and as per our ‘risk on’ vs ‘risk off’ cycle analysis we believe this is the start of a new ‘risk on’ cycle that may last 12 to 18 months. That’s what we explained in Investing Opportunities: What The 2nd Part Of 2019 May Bring.

If general conditions are favorable for high beta stocks like cannabis then why are the largest cannabis stocks breaking down?

Aurora Cannabis Breakdown: What Does It Mean?

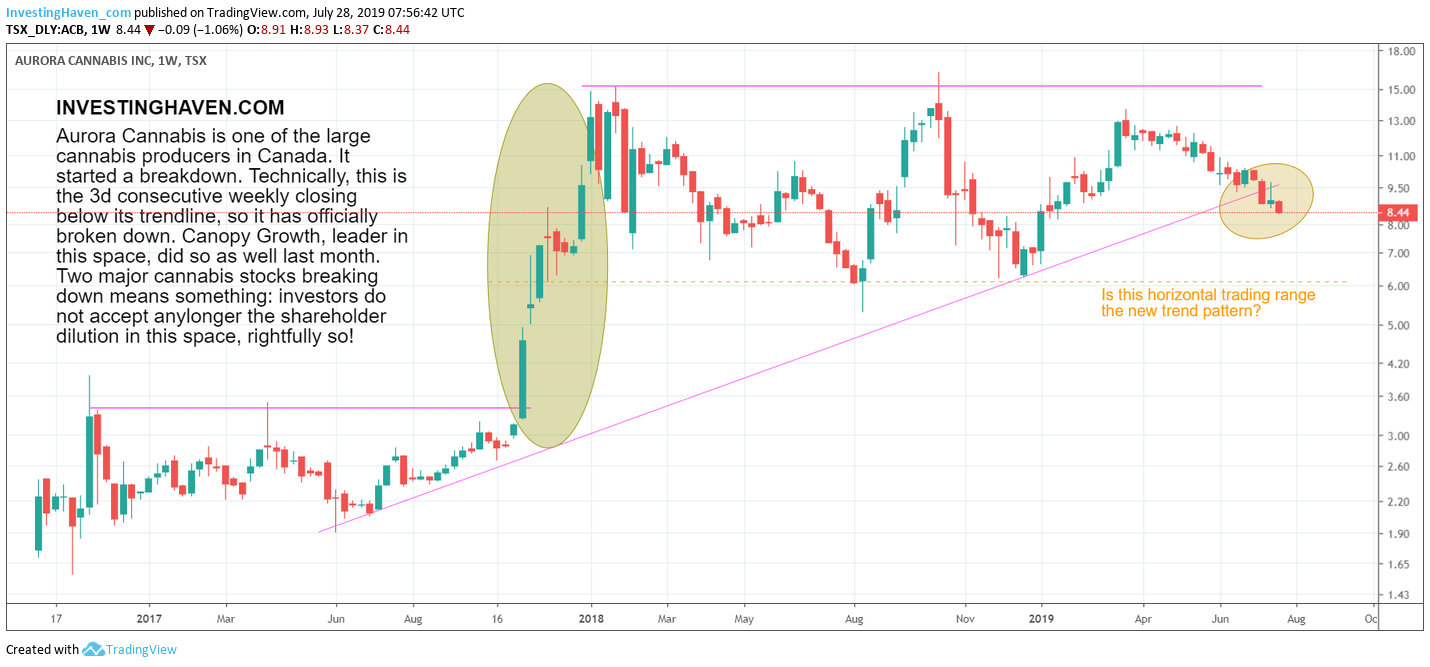

Aurora Cannabis is one of the large cannabis producers in Canada. It started a breakdown early July, and confirmed it this week.

Technically, this is the 3d consecutive weekly closing below its trendline, so it has officially broken down. Canopy Growth, leader in this space, did so as well last month. Two major cannabis stocks breaking down means something.

What does it mean?

We believe that shareholder dilution, in general, is becoming too big of an issue in the cannabis market. Investors do not accept any longer the shareholder dilution in this space, rightfully so!

Cannabis production is a highly capital intensive business activity, and there is a race to build up infrastructure to meet growing demand. Note that this is a new market so hardly any infrastructure did exist until recently.

Cannabis companies are very aggressive to get ‘first mover advantages’ and one common technique is to suck capital out of the stock market by creating new shares, options and warrants. Yes this results in shareholder dilution.

And this works for as long as it works … until it doesn’t. That’s likely the message of the breakdowns we see on the charts, a warning sign that the practices outlined above are not accepted by the market.

We believe the market is sending a strong signal to the cannabis companies.

The End Of The Cannabis Bull Market?

How bad will this become?

There are 2 options:

- Either, worst case, the cannabis bull market is over! We will see charts deteriorate, and continue the breakdown (even accelerate breaking down).

- Either, neutral case, a consolidation phase has started. We will see sideways ranges in top cannabis stocks like Canopy Growth and Aurora Cannabis.

We believe option #2 is most likely to happen provided cannabis companies understand the message of the market. A market that is expected to grow 5-fold in the next 5 years is an amazing opportunity, see this market research. The end of the bull market with such growth prospects does not make sense whatsoever.

However, if cannabis companies continue to suck capital out of the market and create shareholder dilution, in a stubborn way, we will see scenario #1 play out.

Time will tell, but cannabis companies hold the key to their own future as well as the value created for shareholders!