As per our intermarket analysis principles movements of leading sectors as well as asset classes create an impact all markets. That’s why it is crucial to closely monitor the trends of a select number of sectors. The banking stocks sector is one of them. Although not part of our 15 leading indicators they play a crucial role. Right now, banking stocks are cornered. A tiny push higher or lower will trigger a new trend. Smart investors are closely watching banking stocks in the next few months as a major new trend is brewing, one that might have consequences on all markets.

As said in our 100 investing tips intermarket analysis is crucial for understanding the dominant trends in markets.

Markets move in relation to each other, they do not move in a vacuum. Capital flows from one market to another market, considering that cash is also a market (any currency). This flow of capital can be identified by thoroughly analyzing chart patterns and trends in a handful of leading assets. They are primarily treasuries, currencies, leading stock market indices, gold, crude oil.

The key success factor in intermarket analysis is to see how chart patterns relate to each other, and move against each other.

Banking stocks play an important role in the economy as well as in global markets.

When it comes to their impact on other markets, back to how chart patterns relate to each other, we now see a situation with an above average significance.

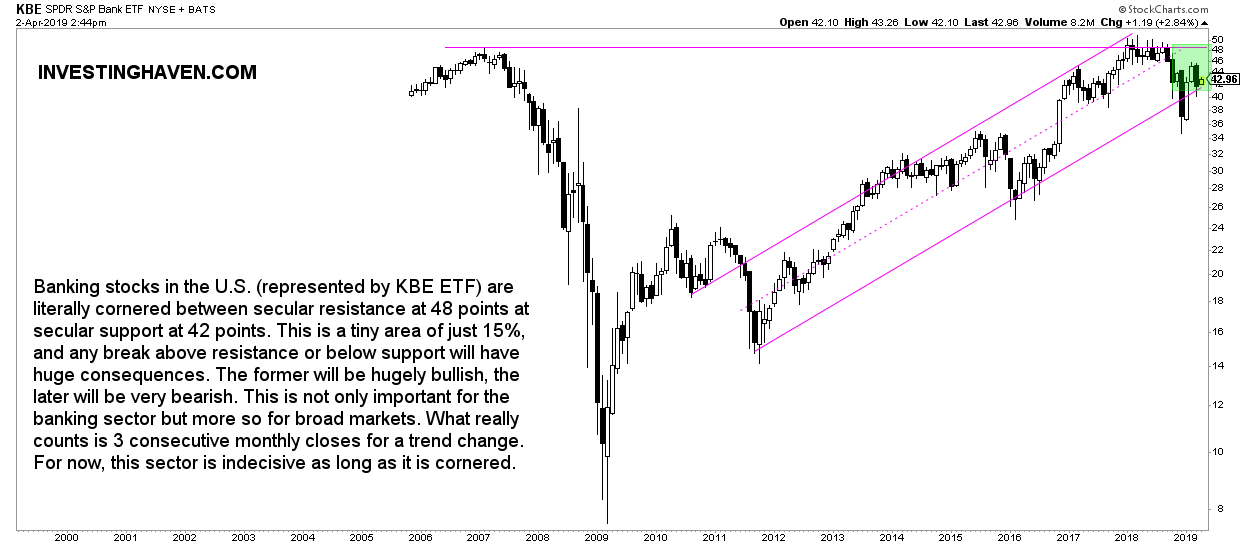

Banking stocks in the U.S. (represented by KBE ETF on the chart below) are literally cornered. They now trade between secular resistance at 48 points at secular support at 42 points. This is a tiny area of just 15%, and any break above resistance or below support will have huge consequences. The former will be hugely bullish, the later will be very bearish.

What really counts is 3 consecutive monthly closes for a trend change.

As per Tsaklanos his 1/99 Investing Principles it is an absolute minority of times that have an extremely high significance.

For now, this sector is indecisive as long as it is cornered. But it might create an important ‘domino effect’ once it starts trending. We expect this to happen around summer time. Smart investors monitor this chart closely in 2019.