According to our emerging stock markets forecast 2019 we identified the current price levels as the make-or-break level. In other words any sustained push higher or lower would result in a confirmed breakout (very bullish) or confirmed breakdown (neutral to bearish). In this article we present a different perspective as we are waiting for the market to confirm whether it recommends to buy emerging stock markets for 2019.

Let’s start with a quick update on how emerging stock markets (EEM) are doing at present time.

Smart investors buy emerging stock markets for 2019

As per Forbes, a good read published yesterday, it seems that emerging stock markets are getting a bid. Smart investors believe emerging stock markets are a buy for 2019, visibly.

It’s already happening. Don’t let the recent sell-off scare you: The smart money is moving out of the U.S. and going abroad. The risk-off cash position is due to the Fed. The rest is a symptom of a red-hot U.S. stock market that got too expensive for its own good, and right at a time when interest rates are rising and tight labor markets have peaked. If the Fed goes dovish next year, investors expect a lot of that cash to go into emerging markets.

It continues: “Net inflows since November 1 for all emerging market equity funds are $8.34 billion as of December 5, according to EPFR Global, a Cambridge, Massachusetts-based fund-tracking firm. Even China, which suffers from negative sentiment, saw net equity inflows of $3.49 billion over that period while flows into U.S. equity funds saw outflows of $2.9 billion.”

No surprise they pointed out that China’s stock market for 2019 is cheap because of the ‘trade war’ fears, as well as South Korea, Russia, Turkey and Argentina.

Buy emerging stock markets or U.S. stocks for 2019

We were triggered by this quote in the Forbes article to look into the relative strength of emerging stock markets vs U.S. stocks.

Big investors have been unwinding the so-called “QE trade” since 2017. The S&P and the German DAX have been the most resilient. As the year ends, everyone is seeing that trend change even as U.S. companies still look in good shape. “I think the forces of gravity move back to emerging markets in 2019.”

This is an interesting viewpoint.

So we extend this with an exercise of comparing emerging stock markets to U.S. stock markets with the ultimate goal to have an understanding if the intermarket dynamics suggest to buy emerging stock markets for 2019.

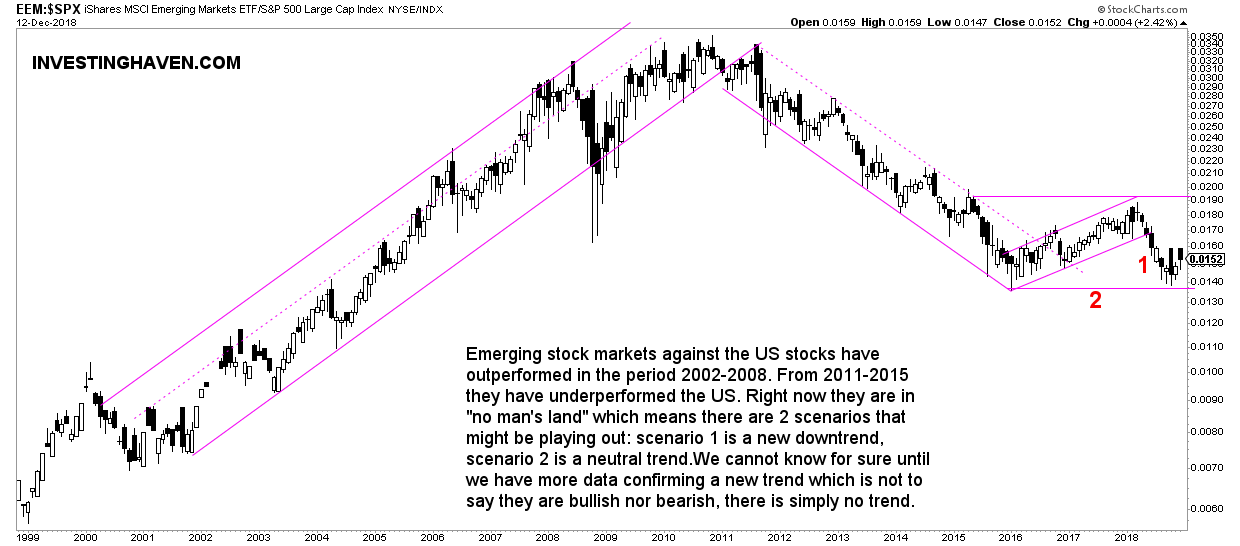

Below is the long term chart of emerging stock markets to U.S. stock markets, in particular the EEM ETF to the SPX index.

It is clear that we can identify a couple of periods over the last 20 years.

First, emerging stock markets against the US stocks have outperformed in the period 2002-2008. It was a better idea to hold top performing emerging markets in that time period even if US stock were going up.

Next, from 2011-2015 they have underperformed the US. It was a better idea to hold US stocks.

Right now, however, emerging markets compared to US stocks are in “no man’s land” which means there is no clear winner. Mathematically, there are 2 scenarios that might be playing out: scenario 1 is a new downtrend, scenario 2 is a neutral trend.

We cannot know for sure until we have more data confirming a new trend which is not to say they are bullish nor bearish, there is simply no trend.

So it is interesting that the relative viewpoint of emerging markets to US stocks is confirming the conclusions we started off with in the introduction of this article. Emerging markets are at a make-or-break level, it is sufficient to watch EEM ETF at 40 points, especially monthly closes.