Today is D-Day in Canada when it comes to their cannabis legalization. It’s the first day that Canada allows, legally, to consume recreational marihuana. As per our Cannabis Stocks in Canada Forecast for 2019 the sector would get a serious boost in 2019, with one favorite cannabis stock we featured in our Emerald Health Therapeutics Stock Forecast for 2019 (EMH.V). This very first day, however, was a small disaster for Canadian cannabis stocks. They started to sell-off yesterday, and it continued today. Reason to be concerned or buy the dip opportunity for cannabis in Canada?

The news headlines are full of ‘Canada legalizes cannabis‘ excitement.

This live feed shows the cannabis legalization rush across Canada. It really is fair to say this is a frenziness going on, with even conservative leaders talking and thinking big about what prosperity the cannabis industry may bring to its country, economically.

BBC also looks at the exciting impressions of the first day, and adds to the conversation what the health benefits are that cannabis may bring.

NYTimes even take it from the emotional angle with statements from individuals explaining how proud they are being Canadian with this legalization. They also believe that this is a tipping point for the country, not only economically but also socially and culturally.

Cannabis stocks in Canada

As expected, there is also some discussion on Canadian cannabis stocks. CNN looks at the bullish and bearish picture. In the bearish camp they feature viewpoints from cannabis companies. Needless to say they are uber-bullish. The bullish camp has some investors that believe the sector is overhyped, and compare it with the tech boom in the late 90ies, right before the crash, saying most stocks will go sour at a certain point in time.

At InvestingHaven, we remain focused on value by applying our 1/99 formula. We believe this is a classic buy the dip opportunity based on our guiding investing principles combined with the chart.

First, per our 1/99 Investing Principles, 1% of stocks in a bullish sector is worth buying. In other words, as per our principles, a handful of cannabis stocks in Canada are worth investing in. Finding out which ones is the trick of course, and we gave many tips in our Canadian cannabis forecast for 2019 mentioned in the intro. But, more importantly, avoiding the wrong stocks, and staying disciplined on this, even if their prices go ballistic at a certain point, is the key thing. That’s because strongly rising prices touch emotions of investors, and they forget value. That’s also what happened with the crypto frenziness last year, and many continue to struggle with their crypto holdings as they are tempted to push the ‘sell’ button right at a bottom as they can’t stand the emotional and mental pain of their crashing account value.

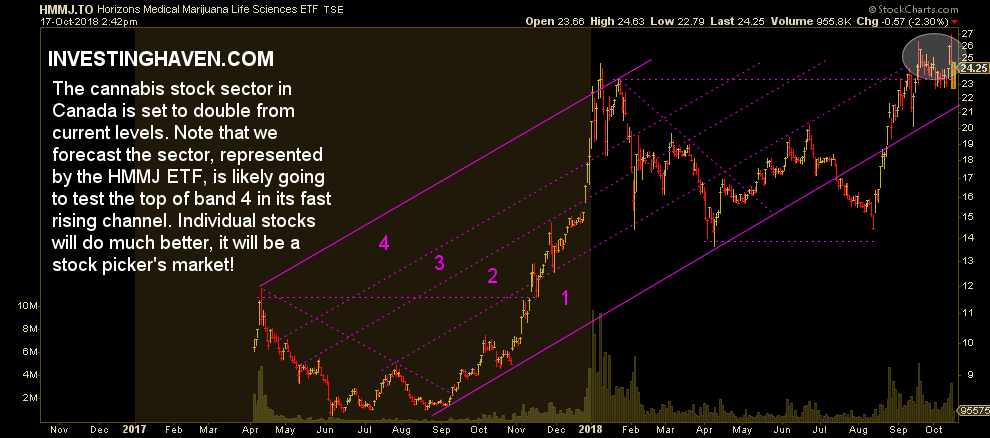

Next, the chart of cannabis stocks cleary shows the state of the sector. The last 2 days may have seen a big sell-off, with some stocks falling +20 pct in 2 trading days. Still, on the chart, it is clear what is happening. The HMMJ ETF representing cannabis stocks in North America shows a consolidation at a breakout point (January 2018 highs). This is a very normal process, and comes close to a breakout test according to us.

We believe that this offers a classic buy-the-dip opportunity unless, of course, prices fall below support. For HMMJ ETF support sits at $21.50. We do not expect this sector to fall below support. On the contrary, everything suggests a sustained breakout.

The chart below makes our point. Look at the circle that we highlighted. This is a classic breakout consolidation, nothing wrong with it, we have seen times and over again.

For now, InvestingHaven sits in the bullish camp. Only a sustained break below $21.50 would make us reconsider our thoughts.