In our China stock market outlook 2019 published 6 months ago (!) we stated that the odds favor a rebound in China’s stock market (SSEC). That was at a time when ‘trade war’ was the most popular term. Our data points per our proprietary method suggested China would become bullish as of early 2019. Right now, China has one of the most gorgeous stock market chart setups in the world, even more attractive than several of the 5 top stocks in the U.S., India’s market outlook (NIFTY)and several other emerging markets (EEM). We have tipped China as a potential candidate for one of the TOP 3 investing opportunities this year.

In our China stock market outlook for 2019 we forecasted this:

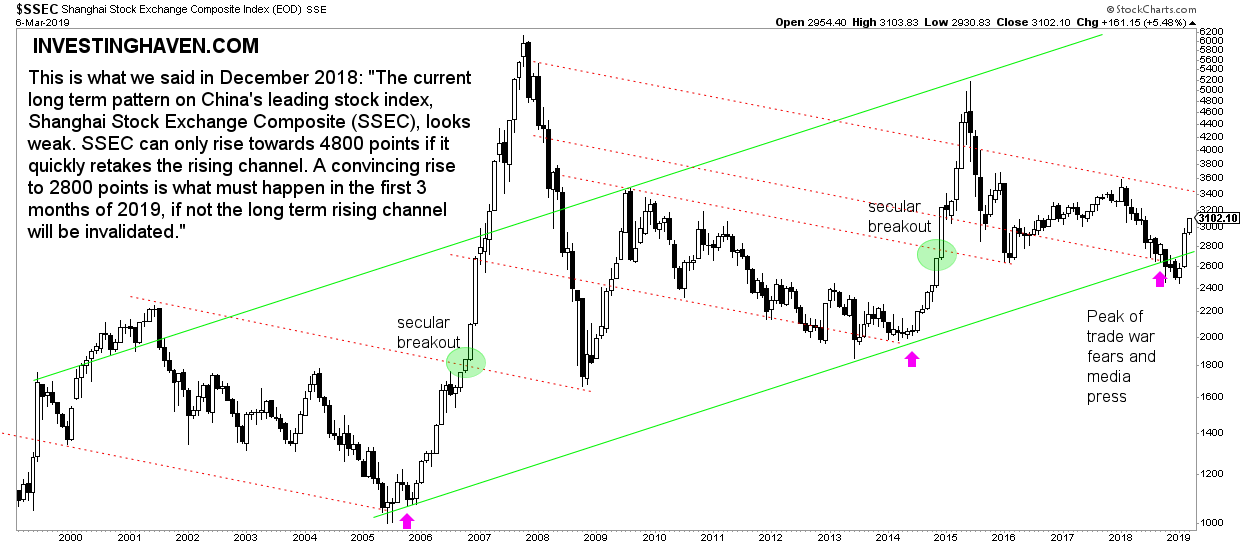

We conclude that the Euro, leading indicator, will be a catalyst for China’s stock market and that bad press as a lagging indicator has probably peaked. This implies that hardly anyone believes that China’s stock market can go higher, a great environment for the bull to resume. That said, with the SSEC chart setup, we are on record with our China stock market outlook of 4800 points in the SSEC for 2019 or 2020, a 73% rise against current levels.

Back then, that was 6 months ago, the SSEC, China’s leading stock market index, was trading at 2,670 points.

Since then the SSEC went somehow lower, only to stop its decline and stabilize.

China Stocks: 10 Pct Rally Coming Before Becoming Wildly Bullish

Since January of this year, exactly as forecasted by InvestingHaven’s research team, China is sharply higher.

Trade talk or not, trade wars or not, the only thing that matters is the chart. Investors with a focus on fundamentals based on the endless flow of news, like this China news update, will continue in a rollercoaster ride.

The whole world believes that China was declining because of trade wars. InvestingHaven is on record stating that China declined until it reached the maximum support level.

May sound somehow similar, but it’s a world of a difference for investors and their portfolios.

Where do we go from here, and is it time to buy China stocks?

We believe China will rise another 10 pct before it hits resistance (see dotted red line on the chart, our annotations) which is at 3,400 points. The chart structure will have major support in the 2,800 to 3,400 area. We expect some consolidation in this area towards this summer, only to see the SSEC break above 3,400 points later in 2019.

If and when this happens, we would say ‘the sky is the limit’ for China’s stock market! An easy ride to 4,800 to 5,200 points will be next. Ultimately, in the next few years, the SSEC may rise to 8,000 points, and we expec this to happen before 2022.

Talking about a great long term investment!